Top-shelf municipal bonds ended stronger on Wednesday, according to traders, who foresee the week closing out on a quiet note. Traders expect prices to remain nearly unchanged and supply almost non-existent for the rest of the year.

Secondary Market

The 10-year benchmark muni general obligation yield fell three basis points to 2.36% on Wednesday from 2.39% on Tuesday, while the yield on the 30-year GO dropped three basis points to 3.08% from 3.11%, according to the final read of Municipal Market Data's triple-A scale.

U.S. Treasuries were narrowly mixed on Wednesday. The yield on the two-year Treasury rose to 1.26% from 1.23% on Tuesday, while the 10-year Treasury yield fell to 2.51% from 2.57%, and the yield on the 30-year Treasury bond decreased to 3.09% from 3.15%.

The 10-year muni to Treasury ratio was calculated at 94.1% on Wednesday, compared with 93.1% on Tuesday, while the 30-year muni to Treasury ratio stood at 99.8%, versus 99.0%, according to MMD.

MSRB: Previous Session's Activity

The Municipal Securities Rulemaking Board reported 40,638 trades on Tuesday on volume of $8.95 billion.

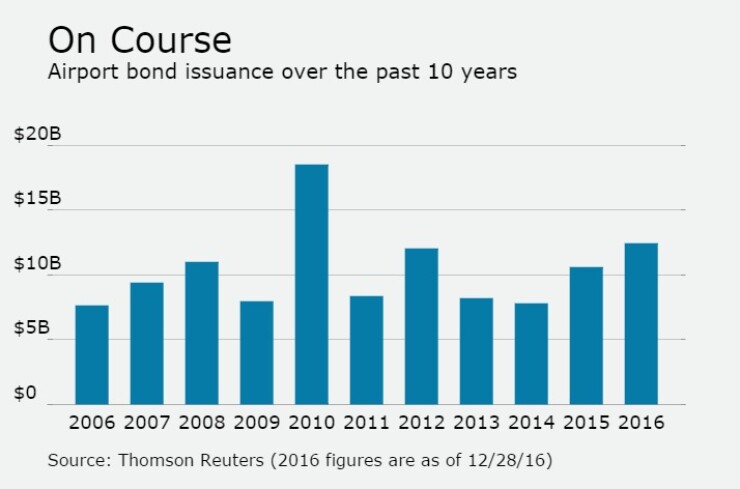

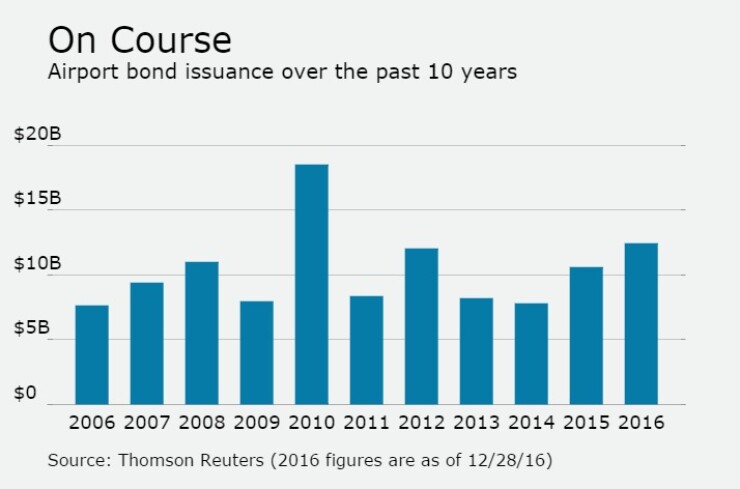

Airport Issuance on Course in '16

Municipal bond issuance for airports topped $12.45 billion this year, marking the second biggest year of issuance in the past 10 years.

Airport issuance was 10.9% of the overall market share in 2016, with 71 issues pricing during the year.

This year nudged out 2012 when $12.09 billion of airport deals priced in 99 issues for a market share of 10.6%.

However, 2016 ranked behind 2010 when 153 issues priced totaling $18.54 billion with a market share of 16.2%

The least amount of airport debt issued in the past 10 years was in 2006 when $7.64 billion of offerings came to market in 103 issues for a market share of 6.7%.

Some of the biggest deals of the year were from the New York Transportation Development Corp., which issued $2.41 billion of bonds for LaGuardia Gateway Partners and $844.21 million of bonds for the American Airlines John F. Kennedy International Airport project. Both offerings were priced by Citigroup.

Also coming to market this year were two deals for the city of Chicago's O'Hare International Airport. Bank of America Merrill Lynch priced the airports $1.01 billion of bonds while Morgan Stanley priced the airport's $1.12 billion of bonds.

Additionally, Goldman Sachs priced the city and county of San Francisco, Calif.'s $887.92 million of bonds for its international airport while BAML priced a $744.38 million deal for Miami-Dade County, Fla.'s international airport.

Primary Market

Volume for the week is only about $2 million, and that's comprised of one competitive bond sale of $2 million and no negotiated deals.

Issuers have pretty much packed it in for 2016 and new supply is not expected to reach more normal levels again until the second week of 2017.

"In January 2016, total supply was $24 billion versus $27 billion in January 2015 and an average of $6 billion per week versus the 2016 average of $8.0 billion," MMD Senior Market Analyst Randy Smolik wrote in a Wednesday market comment. "The first week of January always tends to be the lightest of the month. The first week in 2016 totaled $3.5 billion and this coming week in the new year may not be much different. The second week typically presents a supply challenge. In 2016, the second week totaled $9.3 billion."

The municipal bond market currently has a good tone, according to Nuveen Asset Management, which is expected to continue for the next few weeks.

"Supply will likely remain thin until mid-January. Demand should remain solid, as the outsized Jan. 1 coupon reinvestment money must be deployed," John V. Miller, Nuveen co-head of fixed income, wrote in a Wednesday market comment. "Dealers should become more amenable to stocking bonds in inventory as they begin the new year. Municipal-to-Treasury yield ratios remain relatively attractive, which should attract crossover activity."