Top-rated municipal bonds finished stronger on Wednesday, according to traders, as issuers in Indiana and Florida pumped in some supply.

Secondary market

The yield on the 10-year benchmark muni general obligation fell two basis points to 1.88% from 1.90% on Tuesday, while the 30-year GO yield dropped two basis points to 2.73% from 2.75%, according to the final read of Municipal Market Data's triple-A scale.

Treasuries were stronger on Wednesday. The yield on the two-year Treasury dipped to 1.31% from 1.32% on Tuesday, the 10-year Treasury yield declined to 2.17% from 2.21% and the yield on the 30-year Treasury bond decreased to 2.75% from 2.79%.

The 10-year muni-to-Treasury ratio was calculated at 86.5% on Wednesday, compared with 85.9% on Tuesday, while the 30-year muni-to-Treasury ratio stood at 99.2% versus 98.6%, according to MMD.

MSRB: Previous session's activity

The Municipal Securities Rulemaking Board reported 38,779 trades on Tuesday on volume of $11.54 billion.

Primary Market

In the competitive arena, the Florida Board of Education sold $261.64 million of Series 2017B full faith and credit public education capital outlay refunding bonds.

Citigroup won the bonds with a true interest cost of 2.82%.

The issue was priced to yield from 0.76% with a 5% coupon in 2018 to 3.20% with a 3.50% coupon in 2038.

The deal is rated Aa1 by Moody’s Investors Service and AAA by S&P Global Ratings and Fitch Ratings.

Goldman Sachs priced and repriced the Indiana Finance Authority’s $178.5 million of Series 2017A highway revenue refunding bonds.

The bond issue was repriced to yield from 0.85% with a 4% coupon in 2018 to 2.74% with a 5% coupon in 2037.

The deal is rated Aa1 by Moody’s and AA-plus by S&P and Fitch.

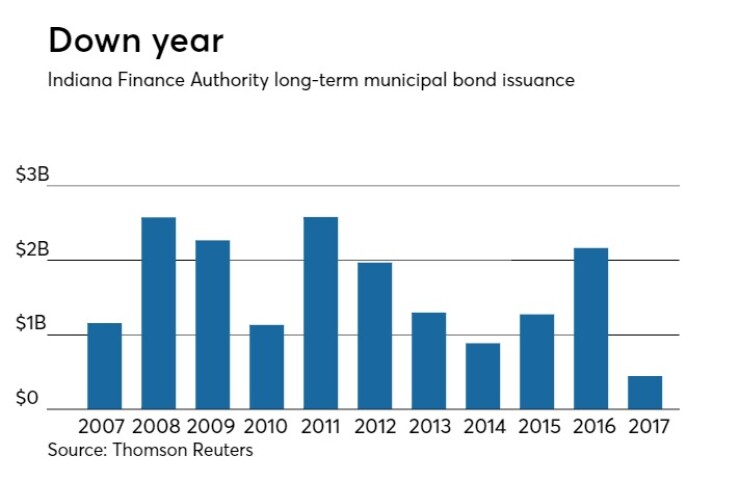

Since 2007, the IFA has sold $17.76 billion of securities, with the most issuance occurring in 2011 when it sold $2.58 billion. Prior to this year, the authority sold the least amount in 2014 when it offered $887 million.

Bank of America Merrill Lynch priced and repriced the Tampa-Hillsborough County Expressway Authority’s $158.44 million of revenue bonds.

The issue was repriced as 5s to yield 3.15% in a 2047 bullet maturity.

The deal is rated A2 by Moody’s and A-plus by S&P.

Morgan Stanley priced and repriced the Oregon Transportation Department’s $132.64 million of highway user tax revenue refunding senior lien bonds.

The issue was repriced to yield from 0.79% with a 5% coupon in 2018 to 1.83% with a 5% coupon in 2026.

The deal is rated Aa1 by Moody’s, triple-A by S&P and AA-plus by Fitch.

Roosevelt & Cross priced and repriced the Erie County Fiscal Stability Authority, N.Y.’s $154.96 million of sales tax and state aid secured bonds and refunding bonds

The $62.86 million of Series C refunding bonds were repriced to yield from 0.75% with a 3% coupon in 2018 to 3.12% with a 3% coupon in 2034.

The $92.1 million of Series D bonds were repriced to yield from 0.75% with a 3% coupon in 2018 to 2.81% with a 5% coupon in 2039.

The deal is rated Aa1 by Moody’s and AAA by Fitch.

Moody’s: VRDB, CP transactions steady in Q2

In the second quarter of 2017, banks committed over $11 billion of credit and liquidity support for variable-rate demand bonds and commercial paper transactions, according to a report issued Wednesday by Moody’s Investors Service.

The data are based on securities which are rated by Moody’s.

“New issuance and substitutions of existing facilities accounted for 37% of the overall dollar volume of banks’ commitments in the second quarter of 2017, up from 28% in the first quarter, while same-bank extensions of credit and liquidity facilities made up the remaining 63%, down from 72% in the first quarter,” Moody’s said.

Almost 83% of new bank facilities issued in the second quarter were related to commercial paper programs.

“The lower amount of same-bank extensions in the second quarter reflects a low volume of facility expirations and substitutions during the quarter, in part due to an increase in the issuance of facilities with longer maturities during the last two years,” Moody’s said.

Three-years and longer were the most popular commitments in the second quarter, based on the aggregate amount pledged, Moody’s said, adding that the issuance volume of new-rated tender option bond trusts was notably higher than in the first quarter.