Top-rated municipal bonds ended mixed on Tuesday, according to traders, as the first of the week’s big deals came to market, led by the Bay Area Toll Authority of Calif.’s $1.4 billion deal.

Primary market

Action kicked off with pricing of BATA’s revenue bond offering for the San Francisco Bay Area Toll Bridge.

Bank of America Merrill Lynch priced and repriced the offering, which consisted of $552.09 million of senior bonds made up of Series 2017- E, G, and H term-rates and $852.02 million of Series 2017-I index-rates and Series 2017 S-7 fixed-rated subordinate bonds.

The subordinate bonds were repriced to yield from 0.85% with a 5% coupon in 2019 to 3.40% with a 4% coupon in 2038. A term bond in 2042 was priced to yield 3.48% with a 4% coupon. A term bond in 2047 was repriced to yield 3.54% with a 4% coupon and 3.62% with a 3.5% coupon in a split maturity. A term bond in 2049 was repriced to yield 3.57% with a 4% coupon. This portion of the deal is rated A1 by Moody’s Investors Service and AA-minus by S&P Global Ratings.

The $209.36 million of 2017 Series E senior term-rates was repriced at par to yield 1.375% in 2053 with a put date of April 1, 2020. The $153.975 million of 2017 Series G term-rates was repriced at par to yield 2% in 2053 with a put date of April 1, 2024. The $188.75 million of 2017 Series H term-rate bond was repriced at par to yield 2.125% in 2053 with a put date of April 1, 2025. This part of the deal is rated Aa3 by Moody’s and AA by S&P and Fitch Ratings.

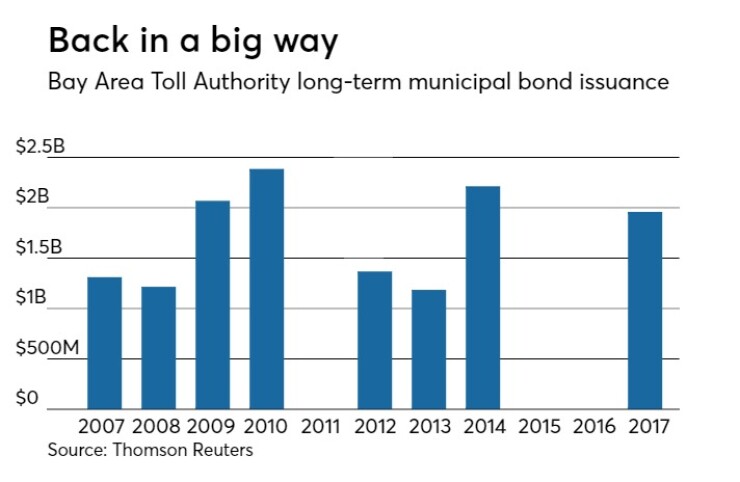

Since 2007, BATA has issued $13.70 billion of securities, with the most issuance occurring in 2010 when it sold $2.38 billion. The authority did not come to market in 2011 or 2015 or 2016. Tuesday’s sales put it at nearly $2 billion of issuance for the year, the fourth time the authority has issued that much in a year going back a decade.

"The senior lien deal was tightened 12 basis points and the deal was upsized [from $1.1 billion] due to demand," said Brian Mayhew, BATA's CFO. "As far as we know, this is the largest 4% coupon deal done."

JPMorgan Securities priced and repriced the California Department of Water Resources’ $149.25 million of Series AT index floating rate revenue bonds as a remarketing.

The issue was repriced at par to yield about 37 basis points over the comparable SIFMA rate in 2035; the bonds have a mandatory tender date in 2022.

The deal is rated AA1 by Moody’s and AAA by S&P.

Wells Fargo Securities priced and repriced the Washington Metropolitan Area Transit Authority’s $496.5 million of Series 2017B gross revenue transit bonds.

The bonds were priced to as 5s yield from 0.97% in 2019 to 2.86% in 2037 and 2.93% in 2042.

The deal is rated AA-minus by S&P and Fitch.

Goldman Sachs priced and repriced Austin, Texas’ $311.37 million of Series 2017 water and wastewater system revenue refunding bonds.

The bonds were repriced to yield from 1.08% with a 5% coupon in 2020 to 2.82% with a 5% coupon in 2037. A 2042 term bond was priced as 5s to yield 2.93% and a 2046 term was priced as 5s to yield 2.98%.

The deal is rated Aa2 by Moody’s, AA by S&P and AA-minus by Fitch.

Piper Jaffray priced the city of San Antonio, Texas’ $181.17 million of general improvement bonds and combination tax and revenue certificates of obligations and tax notes on Tuesday.

The $88.195 million of general improvement bonds were priced at par to yield 5.00% in 2019 to yield 3.10% with a 4% coupon in 2037. The 2019 maturity was offered as a sealed bid.

The $74.24 million of combination tax and revenue COO’s were priced at par to yield 3.00% in 2019 to yield 3.10% with a 4% coupon in 2037. The 2018 maturity was offered as a sealed bid.

The $18.73 million of tax notes were priced at par to yield 5% in 2019 and to yield 1.11% with a 5% coupon in 2020. The 2018 maturity was offered as a sealed bid.

The deal is rated triple-A by Moody’s, S&P and Fitch.

“[In both the BATA and San Antonio deals] there seemed to be more interest from various accounts out longer for the 4% coupons,” said one New York trader. “What we’ve seen is that spreads throughout the curve have tightened in and there has been more interest in 4% coupons.”

In the competitive arena on Tuesday, the Regional Transportation Authority of Illinois sold $188.38 million of Series 2017A general obligation refunding bonds.

BAML won the bonds with a true interest cost of 2.76%.

The bonds were priced to yield from 1.09% with a 5% coupon in 2019 to 2.71% with a 5% coupon in 2029. The bonds were also priced to yield from 3.20% with a 5% coupon in 2031 to 3.25% with a 3% coupon in 2032 and to yield from 3.40% with a 4% coupon in 2034 to 3.43% with a 4% coupon in 2035.

The deal is rated AA by S&P and Fitch.

Oakland, Calif., competitively sold $116.09 million of bonds in two separate offerings.

Fidelity Capital Markets won the $59.93 million of Series 2017A-1 Measure KK tax-exempt GOs with a TIC of 3.59% while Raymond James won the $56.16 million of Series 2017A-2 Measure KK taxable GOs with a TIC of 3.15%.

The deals are rated Aa2 by Moody’s and AA by S&P.

Secondary market

The yield on the 10-year benchmark muni general obligation was unchanged from 1.95% on Monday, while the 30-year GO yield was flat from 2.74%, according to the final read of Municipal Market Data's triple-A scale. Yields on intermediate bonds turned lower.

Treasuries were stronger on Tuesday. The yield on the two-year Treasury dipped to 1.34% from 1.35% on Monday, the 10-year Treasury yield declined to 2.26% from 2.29% and the yield on the 30-year Treasury bond decreased to 2.87% from 2.89%.

The 10-year muni to Treasury ratio was calculated at 86.6% on Tuesday, compared with 85.2% on Monday, while the 30-year muni to Treasury ratio stood at 96.1% versus 94.6%, according to MMD.

MSRB: Previous session's activity

The Municipal Securities Rulemaking Board reported 32,051 trades on Monday on volume of $5.75 billion.