As the year winds down and markets await an interest rate decision from the Federal Open Market Committee, the municipal market seems likely to close out the year in a positive manner, but concern remains about what 2019 will bring.

“We believe that the municipal bond market is now poised for a positive year-end finish, following a generally difficult 2018,” said Michael Cohick, senior ETF product manager at VanEck. “A look at the fundamentals going into December help make the case for investors to consider both reengaging the tax-exempt bond market and positioning in the intermediate part of the investment-grade yield curve”

Michael Pietronico, chief executive officer at Miller Tabak Asset Management said lots of investors ran for the cover of floating rate notes in the past few months.

“This is fine for individual investors but professional money managers are about to get smacked hard in terms of relative performance — the lesson remains true when the Fed raises rates, you need to extend duration,” he said.

Secondary market

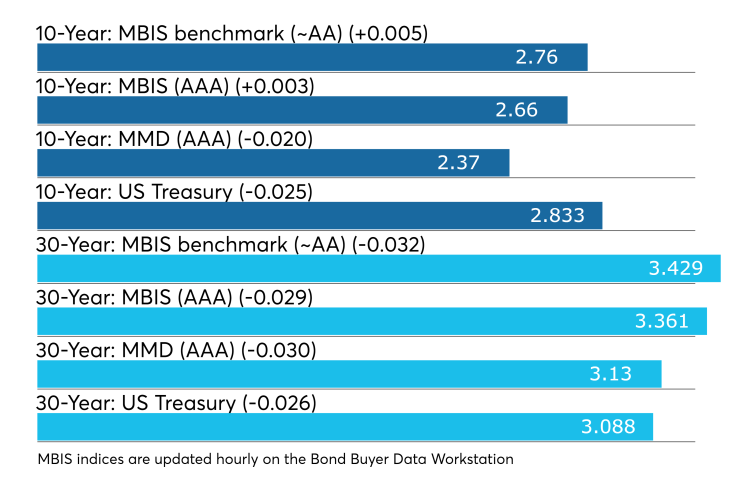

Municipal bonds were stronger on Tuesday, according to a midday read of the MBIS benchmark scale. Benchmark muni yields dropped as much as three basis points in the one- to 9-year and 12- to -30 year maturities. The two remaining maturities rose less than a basis point.

High-grade munis were also stronger, with yields calculated on MBIS' AAA scale decreasing no more than four basis points in the one- to 21- and the 23- to 30-year maturities. The lone remaining maturity saw its yield higher by no more than one basis point.

Municipals were stronger on Municipal Market Data’s AAA benchmark scale, which showed the yield on the 10-year muni general obligation lower by as many as two basis points, while the 30-year muni maturity decreased between one and three basis points.

On Monday, the 10-year muni-to-Treasury ratio was calculated at 83.6% while the 30-year muni-to-Treasury ratio stood at 101.4%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

Primary market

Raymond James & Associates priced the San Juan Unified School District, Sacramento County, Calif.’s $230 million of general obligation bonds on Tuesday. The deal is rated Aa2 by Moody’s Investors Service and AAA by Fitch Ratings.

Tuesday’s bond sales

Previous session's activity

The Municipal Securities Rulemaking Board reported 45,378 trades on Monday on volume of $11.487 billion.

California, New York and Texas were the municipalities with the most trades, with the Golden State taking 17.061% of the market, the Empire State taking 10.999% and the Lone Star State taking 10.695%.

Treasury to sell $40B 4-week bills

The Treasury Department said it will sell $40 billion of four-week discount bills Thursday. There are currently $30.001 billion of four-week bills outstanding.

Treasury also said it will sell $30 billion of eight-week bills Thursday.

Gary E. Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.