The action in the municipal market won't slow down yet, as bond-hungry money managers will get a third week in a row of issuance greater than $11 billion.

The muni market is projected to see $11.77 billion of new paper for the week of Nov. 18, compared with the revised total of $9.78 billion in the past week. The calendar consists of $10.22 billion of negotiated deals and $1.55 billion of competitive sales. The estimated volume is above the year's weekly average of $8.96 billion.

Coming off a blowout week, in which nearly all deals were heavily oversubscribed, investors are not close to be full on muni bonds.

“Munis outperformed Treasuries and performed wonderfully this past week,” said Dan Heckman, senior fixed-income strategist at U.S. Bank Wealth Management. “The market is going to preform very well this coming week as well, as there is still lots of demand for the product.”

The upcoming schedule provides a nice variety and blend of different states and sectors, which will come in handy as in some states, it is hard to find measurable supply.

“The phenomenal market dynamics and performance will continue to year-end,” Heckman said. “I am trying to think of something that will change what we are seeing and I can’t come up with anything. I wouldn’t be surprised if this uptick in issuance ran through the first quarter of next year at this rate, with so much money in the market.”

Heckman, who said anything and everything is selling, would advise investors and other money managers to move up in the credit quality ladder, as opposed to moving down.

“The issuers are having their way right now and they are able to name their terms to some degree,” he said. “If they can get away with less protection, then they will do it.”

Heckman added that he continues to be amazed by the current state of the muni market.

“For the first time in a long time, the market is being very resilient as not a whole lot that is unnerving it, like the trade war for example,” Heckman said. “No matter what happens globally or domestically, the cash flows remain constant and consistent. There haven’t been a whole lot of changes or volatility and I don’t see what will change the market at this point in time.”

Primary market

There are 39 scheduled deals of $100 million or larger, with three of those coming competitively. Twelve of those $100-million-or-larger scheduled deals are either partially or completely taxable.

Bank of America Securities is expected to price Port Authority of New York and New Jersey’s (Aa3/AA-/AA-) $1.1 billion of consolidated bonds on Tuesday.

BofAS is also scheduled to price Dormitory Authority of the State of New York’s (Aa3/ /A+) $520.33 million of facility revenue federally taxable bonds on Thursday.

JP Morgan is slated to price North Carolina Turnpike Authority’s $510.04 million of triangle expressway system senior lien revenue (NR/BBB/BBB) and system appropriation capital appreciation bonds (Aa1/AA+/AA+) on Wednesday.

Morgan Stanley is presumably pricing California Institute of Technology’s (Aa3/AA-/ ) $500 million of taxable corporate CUSIP century bond on Thursday.

Raymond James is set to price California Health Facilities Authority's (Aa3/AA-/AA-) $500 million of senior revenue federally taxable bonds on Tuesday.

There is also a second century bond deal scheduled, as Barclays is expected to price University of Pittsburgh’s (Aa1/AA+/ ) $350 million commonwealth system of higher education bonds, with a 2119 maturity.

The largest competitive deal will come from the State of Nevada (Aa1/AA+/AA+) when it sells $155.29 million of general obligation limited tax capital improvement and refunding bonds on Tuesday.

Lipper sees sixth consecutive billion-dollar inflow

For 45 weeks in a row investors have poured cash into municipal bond funds, according to the latest data released by Refinitiv Lipper on Thursday.

Tax-exempt mutual funds that report weekly received $1.275 billion of inflows in the week ended Nov. 13 after inflows of $1.103 billion in the previous week. This marks the sixth week in a row and eighth time in the past 12 weeks inflows have exceeded $1 billion.

Exchange-traded muni funds reported inflows of $176.045 million after inflows of $152.249 million in the previous week. Ex-ETFs, muni funds saw inflows of $1.099 billion after inflows of $951.394 million in the previous week.

The four-week moving average remained positive at $1.242 million, after being in the green at $1.224 billion in the previous week.

Long-term muni bond funds had inflows of $826.817 billion in the latest week after inflows of $738.369 million in the previous week. Intermediate-term funds had inflows of $262.672 million after inflows of $218.007 million in the prior week.

National funds had inflows of $1.177 billion after inflows of $977.543 million in the previous week. High-yield muni funds reported inflows of $249.308 million in the latest week, after inflows of $84.106 million the previous week.

Secondary market

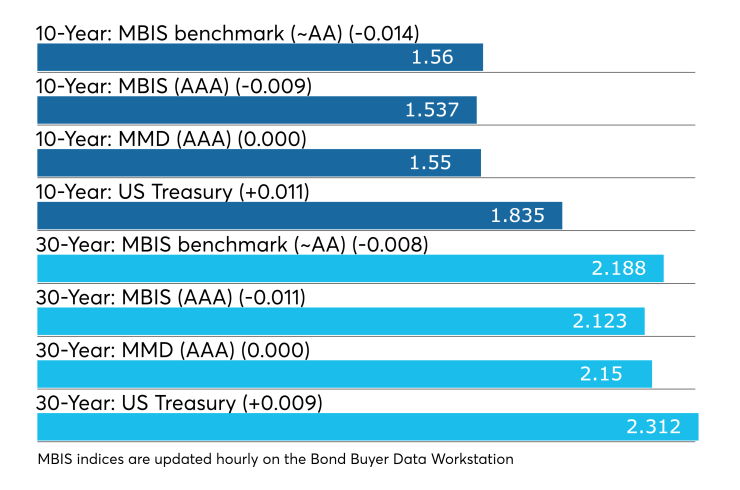

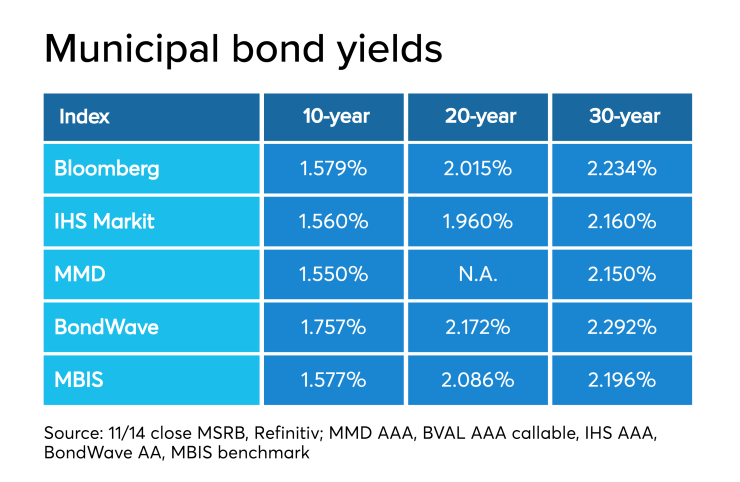

Munis were stronger on the MBIS benchmark scale, with yields falling by one basis point in the 10-year and by less than one basis point in the 30-year maturity. High-grades were also stronger, with yields on MBIS AAA scale decreasing by less than a basis point in the 10-year and by a basis point in the 30-year maturity.

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on both the 10- year and the 30-year GO were unchanged from 1.55% and 2.15%, respectively.

The 10-year muni-to-Treasury ratio was calculated at 84.5% while the 30-year muni-to-Treasury ratio stood at 93.0%, according to MMD.

Treasuries were mostly higher and stocks were all in the green, as The Dow was up 0.63%, The S&P 500 up 0.58% and The Nasdaq up 0.51%. The Treasury three-month was down and yielding 1.566%, the two-year was up and yielding 1.618%, the five-year was up and yielding 1.652%, the 10-year was up and yielding 1.835% and the 30-year was up and yielding 2.312%.

Week's actively traded issues

Some of the most actively traded munis by type in the week ended Nov. 15 were from Connecticut, New Jersey and Massachusetts issuers, according to

In the GO bond sector, the New Haven, Conn., 5s of 2039 traded 13 times. In the revenue bond sector, the New Jersey Economic Development Authority, 4s of 2049 traded 57 times. In the taxable bond sector, the Massachusetts School Building Authority, 3.395s of 2040 traded 67 times.

Week's actively quoted issues

Puerto Rico, Georgia and Florida bonds were among the most actively quoted in the week ended Nov. 15, according to IHS Markit.

On the bid side, the Puerto Rico Sales Tax Financing Corp., revenue 4.75s of 2053 were quoted by 26 unique dealers. On the ask side, the Fulton County, Georgia revenue, 3s of 2044 were quoted by 175 dealers. Among two-sided quotes, the Florida Hurricane Catastrophe Fund Finance Cor., taxable revenue 2.995s of 2020 were quoted by 18 dealers.

Previous session's activity

The MSRB reported 36,789 trades Thursday on volume of $17.83 billion. The 30-day average trade summary showed on a par amount basis of $10.34 million that customers bought $5.79 million, customers sold $2.72 million and interdealer trades totaled $1.83 million.

California, New York and Texas were most traded, with the Golden State taking 12.686% of the market, the Empire State taking 10.544% and the Lone Star State taking 9.49%.

The most actively traded securities were Texas Transportation Commission taxable refunding, 3.211s of 2044 traded 14 times on volume of $45.815 million.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.