The municipal bond market will continue to see a swarm of mid-sized deals that will be taken down with ease, continuing the good times that have been fueled by 27 straight weeks of fund inflows.

The muni market is estimated to see 16 deals scheduled in the $100 million or larger size, with the expectation is that deals will be well received, according to Alan Schankel, managing director at Janney Montgomery Scott.

"I see no indication that the strong first half fund inflows will diminish anytime soon, although the seasonal bump in reinvestment flows will slow after Aug. 1," Schankel said. "After the holiday slowdown, July is off to a reasonable supply start with a decent-sized calendar this past week and more than $7 billion scheduled for next week."

He added that next week’s primary calendar should be well received given the variety of issue types and strong overall demand illustrated by fund inflows.

The calendar is led by a $915 million offering from Children’s Healthcare of Atlanta and a $679 million North Texas Tollway Authority refunding deal.

Barclays will price the NTTA's (A1/A+/ ) $678.905 million of system revenue bonds on Tuesday.

"The toll road sector has been particularly solid post-recession," he said. "NTTA benefits from the economic and demographic strength of the growing Dallas area: Foothills/Eastern in California was upgraded by Moody’s last month; and S&P recently improved the outlook for Delaware River Joint Toll Bridge Commission, which has an issue for refunding and new money scheduled for next week."

With trading subdued and unchanged on Friday, municipal managers cast their views into next week when at least three large deals will dominate the primary market, according to Miller Tabak Asset Management.

“Next week's supply does not present a challenge to the market as July 15th coupon and maturing bonds will likely keep the pressure on portfolio managers to put cash to work,” Michael Pietronico, chief executive officer at Miller Tabak Asset Management, said on Friday afternoon.

Also on tap next week is a $478.3 million offering from Colorado Health Facilities Authority (Aa2/AA/AA), which is scheduled to be priced by JPMorgan on Thursday.

Besides the appeal of fresh supply, market technicals will boost demand next week, Pietronico said.

“Assisting demand for municipal bonds is a Federal Reserve that is likely to be lowering interest rates in the coming weeks, and a stock market trading at record highs,” he said. “Our sense is as stocks move higher more portfolio managers will trim their allocations to equities and look to park those proceeds on the short end of the municipal yield curve.”

Demand and deal flow this week were brisk so others believe money will continue to flow into municipal bond funds next week as well.

“Treasuries are slightly weaker but munis are firm and steady and have outperformed Treasuries all week,” a New York trader said Friday.

He called the upcoming calendar manageable at a little more than $7 billion next week, debuting some well-known issuers like the NTTA and the Sacramento Municipal Utility District.

“Deals should continue to get strong support,” he said, also pointing to the Georgia deal as an eye catching offering in a supply-starved market.

Bill Walsh, president of Hennion & Walsh agreed that a firm tone was evident on Friday and strong demand will continue to support munis in the foreseeable future.

“There is not much in the way of activity this morning,” he said Friday. “Bid wanted lists are smaller today and we haven’t seen too many blocks trading,” Walsh added.

Like Pietronico, he said reinvestment season is driving demand as well as scarcity.

“With the relative lack of supply, we expect investor demand to remain high as bonds are called or mature,” he said.

Lipper: More inflows into muni funds

For the 27th straight week, investors remained bullish on municipal bond funds, according to data from Refinitiv Lipper.

Those tax-exempt mutual funds which report flows weekly saw $1.009 billion of inflows in the week ended July 10 after inflows of $1.220 billion in the previous week.

Exchange-traded muni funds reported inflows of $124.122 million after inflows of $103.292 million in the previous week. Ex-ETFs, muni funds saw inflows of $884.860 million after inflows of $1.117 billion in the previous week.

The four-week moving average remained positive at $1.193 billion, after being in the green at $1.136 billion in the previous week.

Long-term muni bond funds had inflows of $801.608 million in the latest week after inflows of $781.308 million in the previous week. Intermediate-term funds had inflows of $146.174 million after inflows of $293.122 million in the prior week.

National funds had inflows of $922.178 million after inflows of $1.051 billion in the previous week. High-yield muni funds reported inflows of $345.109 million in the latest week, after inflows of $317.217 million the previous week.

On Wednesday, the Investment Company Institute reported long-term municipal bond funds and exchange-traded funds saw a combined inflow of $1.626 billion in the week ended July 2, while long-term muni funds alone saw an inflow of $1.456 billion and ETF muni funds saw an inflow of $170 million.

Secondary market

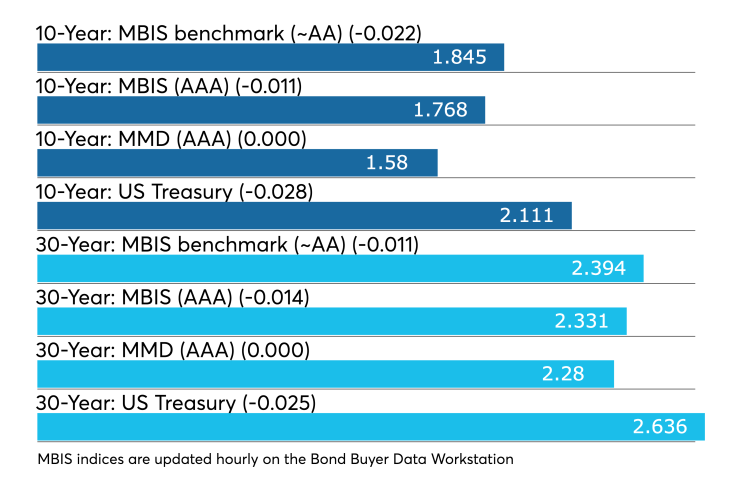

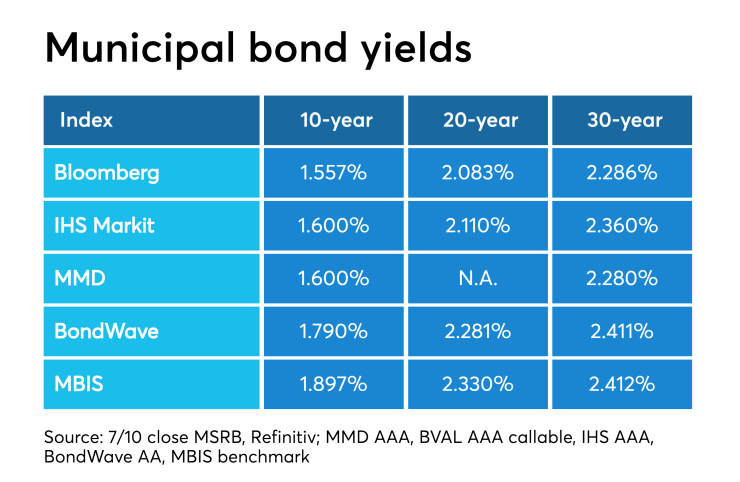

Munis were stronger in late trading on the MBIS benchmark scale, with yields falling by two basis points in the 10-year and by one basis point in the 30-year. High-grades were also stronger, with MBIS’ AAA scale showing yields dropping by one basis point in both the 10-year and 30-year.

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on both the 10-year and 30-year GO yields were unchanged.

The 10-year muni-to-Treasury ratio was calculated at 75.0% while the 30-year muni-to-Treasury ratio stood at 86.6%, according to MMD.

Treasuries were weaker as stocks traded higher. The Treasury three-month was yielding 2.148%, the two-year was yielding 1.837%, the five-year was yielding 1.863%, the 10-year was yielding 2.111% and the 30-year was yielding 2.636%.

Previous session's activity

The MSRB reported 37,992 trades Thursday on volume of $15.03 billion. The 30-day average trade summary showed on a par amount basis of $11.88 million that customers bought $6.28 million, customers sold $3.60 million and interdealer trades totaled $2.00 million.

California, New York and Texas were most traded, with the Golden State taking 16.436% of the market, the Empire State taking 11.194% and the Lone Star State taking 10.394%.

The most actively traded security was the Illinois Series 2017D GO 5s of 2025, which traded 11 times on volume of $55 million.

Week's actively traded issues

Some of the most actively traded munis by type in the week ended July 12 were from California, New York and Puerto Rico issuers, according to IHS Markit.

In the GO bond sector, the San Diego Unified School District, Calif., 5s of 2020 traded 49 times. In the revenue bond sector, the New York City Municipal Water Finance Authority 4s of 2049 traded 45 times. In the taxable bond sector, the Puerto Rico GDB Recovery Authority 7.5s of 2040 traded 29 times.

Week's actively quoted issues

Puerto Rico and California names were among the most actively quoted bonds in the week ended July 12, according to IHS Markit.

On the bid side, the Puerto Rico Sales Tax Financing Corp. revenue 5s of 2058 were quoted by 43 unique dealers. On the ask side, the California taxable 7.55s of 2039 were quoted by 68 dealers. Among two-sided quotes, the California taxable 7.5s of 2034 were quoted by 16 dealers.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.