Municipals finished stronger on the long end Monday, with yields on the AAA muni scales falling as much as two basis points 10-years and longer while various factors outside the control of the municipal market were coalescing to put it on edge.

Supply and demand, technical performance and the uncertain outcome of negotiations in Washington on a new stimulus package are keeping municipals in a holding pattern.

Congress is debating provisions that will impact the muni market, such as aid to states and localities, help for hospitals and higher education, and money for infrastructure and transportation.

Meanwhile, in the primary, the oversubscriptions for new issues are persistent while secondary activity was very quiet for the beginning of the week.

"Deals are oversubscribed and getting bumped and allotments are thin,” a New York trader said. “People are getting less than they are putting in for, and most deals are trading up in secondary once they are free."

Compared to the previous week’s large calendar, this week’s is more manageable, according to the trader.

“The market seems to be doing very well with the deals,” he said. “The market is doing fine, but the supply imbalance continues because there is too much money and not enough issuance.”

He noted that municipals are trading relatively cheap compared to other fixed income products, despite outside distractions beyond the market.

The upcoming presidential election, COVID-19 impacts, and the status of the economy are among the key cross-currents outside of munis.

“There are some concerns surrounding some credits, obviously, especially if we continue to not be able to open up states and cities, he added.

But the market seems to be taking that in stride, according to the trader.

“For the time being, the market is taking a wait-and-see approach and doesn't seem like there’s much concern out there right,” he said.

Meanwhile, taxable munis are having their moment, up 1.23% in volume so far this month with no let-up in sight for supply, according to Kim Olsan, senior vice president at FHN Financial.

“When Federal Reserve Flow of Funds are reported for Q2 it will be interesting to see whether some of the distribution has been to foreign-based buyers, where at the end of Q1 they held $107 billion in munis,” Olsan said.

“A more moderate supply total of about $6 billion is in play this week for tax-exempts,” Olsan said. “Most issues can be expected to draw on heavy interest in sub-5% structures where a coupon crush is in place with ongoing spread compression.”

Indeed, trading out long saw Celina, Texas ISD's, 3s of 2040 traded at 1.65%-1.55% in large blocks. Cypress-Fairfield, Texas ISD, 3s of 2045 traded at 1.82% while trading at 1.87% on Thursday.

“Strong technicals along with favorable seasonal rollovers continue to present a negative net supply that drives the tax-exempt market richer,” Peter Delahunt, managing director of municipals at Raymond James & Associates said on Friday afternoon.

Meanwhile, fundamentals are being temporarily overlooked, as investors wait for Congress to potentially pass another trillion-dollar relief package for state and local governments, Delahunt said.

“The net result is an oversubscription of orders on most all new issues that free up in the after-market,” he said.

Primary market

On Tuesday, King County, Wash., (Aa1/AA+//) is competitively selling $366 million of bonds.

The deals consists of $186.605 million of Series 2020B taxable sewer refunding revenue bonds and $179.02 million of Series 2020A sewer improvement and refunding revenue bonds.

Piper Sandler is the bond counsel; Pacifica Law Group is the bond counsel.

Proceeds from the 2020B taxables will be used to defease and advance refund certain sewer system revenue bonds. Proceeds from the Series 2020A exempts will be used for improvements to the sewer system and to defease and refund on a current basis certain system revenue bonds.

Jefferies is expected to price the Port of Houston Authority of Harris County, Texas’ (Aaa/AAA/NR/NR) $225 million of Series 2020A unlimited tax refunding bonds on Tuesday.

Also Tuesday, Ramirez & Co. will price the New York State Housing Finance Agency’s (Aa2///) $164 million of affordable housing revenue climate bond certified sustainability bonds.

And Wells Fargo Securities will price the agency’s (Aaa/NR/NR/NR) $78.5 million of 15 Hudson Yards housing revenue green bonds with Fannie Mae Direct Pay credit enhancement.

On Wednesday, Maryland (Aaa/AAA/AAA/) is coming to market with four competitive sales totaling over $1 billion.

The state and local facilities loan of 2020 deals consist of $345.76 million of taxable general obligation refunding bonds Second Series C; $290.08 million of tax-exempt Bidding Group 1 Second Series A GOs; $249.92 million of exempt Bidding Group 2 Second Series A GOs; and $117.34 million of exempt Second Series B refunding GOs.

JPMorgan Securities will price on Wednesday Auburn University in Alabama’s $300 million of taxable general fee revenue bonds.

HilltopSecurities is expected on Wednesday to price the West Covina Public Financing Authority, Calif.’s $204.1 million of taxable lease revenue bonds.

Goldman Sachs is expected to price the Andrew W. Mellon Foundation’s (Aaa/AAA//) $300 million of taxable social bonds on Wednesday. Morgan Stanley is set to price the Doris Duke Charitable Foundation Inc.’s (Aaa///) $100 million of taxable social bonds on Wednesday.

Secondary market

Some other noteable trades on Monday:

Montgomery County, Maryland GOs, 5s of 2021, traded at 0.15%. Thursday they were at 0.18%. Washington Suburban Sanitation District 5s of 2022 at 0.16%-0.13%. Texas transportation 5s of 2024 traded at 0.26%-0.24%.

Collin County, Texas, community college 5s of 2030, traded at 0.88%. Fairfax County, VA GOs, 5s of 2039 at 1.20%.

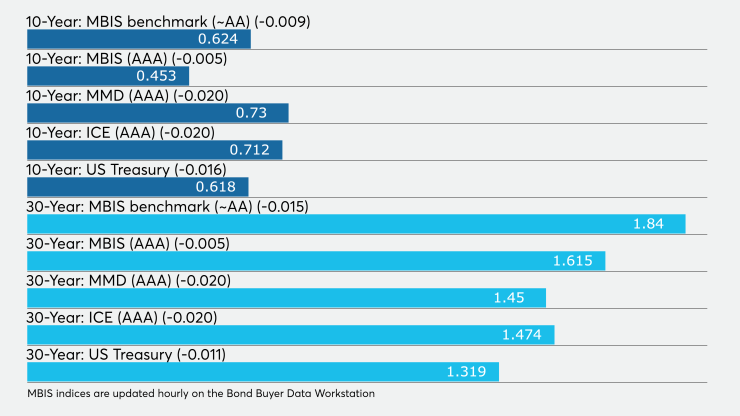

Municipals were steady to stronger Monday, according to readings on Refinitiv MMD’s AAA benchmark scale.

MMD reported yields on the 2021 and 2023 GO munis were unchanged at 0.15% and 0.17%, respectively. The yield on the 10-year GO muni fell two basis points t0 0.73% while the 30-year yield dropped two basis points to 1.45%.

The 10-year muni-to-Treasury ratio was calculated at 117.7% while the 30-year muni-to-Treasury ratio stood at 110.0%, according to MMD.

The ICE AAA municipal yield curve showed short yields remaining unchanged at 0.140% in 2021 and 0.158% in 2022. The 10-year maturity was off two basis points to 0.712% and the 30-year was down two basis point sto 1.474%.

ICE reported the 10-year muni-to-Treasury ratio stood at 122% while the 30-year ratio was at 109%.

The IHS Markit municipal analytics AAA curve showed the 2021 maturity yielding 0.13% and the 2022 maturity at 0.16% while the 10-year muni was at 0.72% and the 30-year stood at 1.45%.

The BVAL AAA curve showed the 2021 maturity unchanged at 0.13% and the 2022 maturity lower by one basis point to 0.16% while the 10-year muni was at 0.72% a basis point lowerand the 30-year fell two basis points to 1.48%.

Munis were little changed on the MBIS benchmark and AAA scales.

Treasuries were stronger as stock prices traded higher.

The three-month Treasury note was yielding 0.115%, the 10-year Treasury was yielding 0.618% and the 30-year Treasury was yielding 1.319%.

The Dow rose 0.09%, the S&P 500 increased 0.70% and the Nasdaq gained 2.13%.

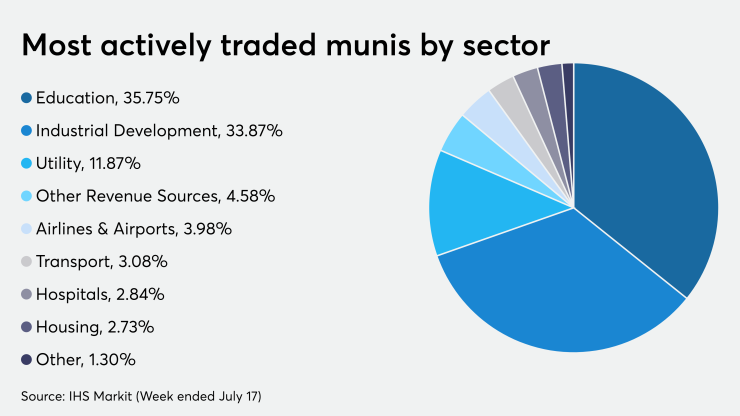

Last week, the most traded muni sector was education bonds, followed by industrial development and utilities.

D.C. preps CARES package

Another round of fiscal aid to alleviate the economic effects of COVID-19 is being talked about in D.C. this week, Morgan Stanley said in a research report.

Lawmakers are considering the reinstatement of the Build America Bonds program, the revival of advanced refundings and the removal of the SALT cap.

“In our base case, 'CARES 2' will extend aid to states, locals, hospitals, and bring back advance refundings, keeping the market on track for continued excess returns,” Morgan Stanley said in the report released Monday.

In its “Bull Case,” they see munis getting a boost.

“Our bull case adds aid provisions for higher education and transit authorities on top of the aid and advance refunding clauses extended in our base case,” Morgan Stanley said. “The bull-case scenario likely coincides with a larger overall size of CARES 2, boosting the potential for a V-shaped economic recovery. Combined, this may quicken the pace of muni spread compression, providing an opportunity in high yield.”

In its "Bear Case,” they see a failure on CARES leading to a bumpy path for munis.

“Our bear case reflects a reality in which no bipartisan consensus exists and CARES 2 legislation fails. We would move to a high-grade bias on an expectation of choppy demand,” Morgan Stanley said. “However, we'd expect any underperformance to be less severe than in the spring, given a better starting point for valuations and Fed support through the municipal liquidity facility, which limits jump-to-default risk in states and locals.”