Municipal bonds finished mixed in secondary trading on Thursday as a spate of new transportation deals hit traders' screens.

Secondary market

The yield on the 10-year benchmark muni general obligation fell one basis point to 1.92% from 1.93% on Wednesday, while the 30-year GO yield was unchanged from 2.69%, according to the final read of Municipal Market Data's triple-A scale.

U.S. Treasuries were stronger on Thursday. The yield on the two-year Treasury was unchanged from 1.56%, the 10-year Treasury yield declined to 2.32% from 2.34% and yield on the 30-year Treasury bond decreased to 2.83% from 2.85%.

On Thursday, the 10-year muni-to-Treasury ratio was calculated at 82.7% compared with 82.5% on Wednesday, while the 30-year muni-to-Treasury ratio stood at 95.1% versus 94.4%, according to MMD.

AP-MBIS 10-year muni at 2.254%, 30-year at 2.815%

The Associated Press-MBIS 10-year municipal benchmark 5% general obligation was at 2.254% late on Thursday, compared to the final read of 2.276% on Wednesday, according to

The AP-MBIS index is a yield curve built on market data aggregated from MBIS member firms and is updated hourly on the

MSRB: Previous session's activity

The Municipal Securities Rulemaking Board reported 37,567 trades on Wednesday on volume of $13.20 billion.

Primary market

The calendar dwindled to its last major issues on Thursday, all of which were in the transportation sector and up for bid in the competitive arena.

The New York Metropolitan Transportation Authority sold $1 billion of notes in two competitive deals on Thursday.

Four groups won the $500 million of Subseries 2017C-1 transportation revenue bond anticipation notes:

- JPMorgan Securities won $250 million with a bid of 4% and a $9,565,000 premium, an effective rate of 1.04233%;

- Goldman Sachs won $100 million with a bid of 4% and a $3,826,000 premium, an effective rate of 1.04233%;

- Morgan Stanley won $75 million with a bid of 4% and a $2,865,000 premium, an effective rate of 1.04685%; and

- Citigroup won $75 million, taking $50 million with a bid of 4% and a premium of $1,915,000, an effective rate of 1.03932% and $25 million with a bid of 4% and a premium of $963,750, an effective rate of 1.02048%.

Seven groups won the $500 million of Subseries 2017C-2 transportation revenue BANs:

- JPMorgan Securities won $250 million with a bid of 4% and a $11,267,500 premium, an effective rate of 1.07029%;

- Morgan Stanley won $75 million with a bid of 4% and a $3,381,750 premium, an effective rate of 1.06902%;

- Citigroup won $50 million with a bid of 4% and a $2,257,000 premium, an effective rate of 1.06587%;

- Bank of America Merrill Lynch won $50 million with a bid of 4% and a $2,252,000 premium, an effective rate of 1.07218%;

- UBS Financial Services won $25 million with a bid of 4% and a $1,127,000 premium, an effective rate of 1.06965%;

- Goldman Sachs won $25 million with a bid of 4% and a $1,126,750 premium, an effective rate of 1.07029; and

- RBC Capital Markets won $25 million with a bid of 4% and a $1,126,500 premium, an effective rate of 1.07092%.

The deals were rated MIG1 by Moody’s Investors Service, SP1-plus by S&P Global Ratings and F1-plus by Fitch Ratings.

The San Francisco County Transportation Authority sold $248.54 million of Series 2017 limited tax senior sales tax revenue bonds.

Bank of America Merrill Lynch won the bonds with a true interest cost of 2.3963%.

The issue was priced to yield from 0.90% with a 3% coupon in 2020 to 2.95% with a 3% coupon in 2034.

The deal is rated AA-plus by S&P Global Ratings and AAA by Fitch Ratings.

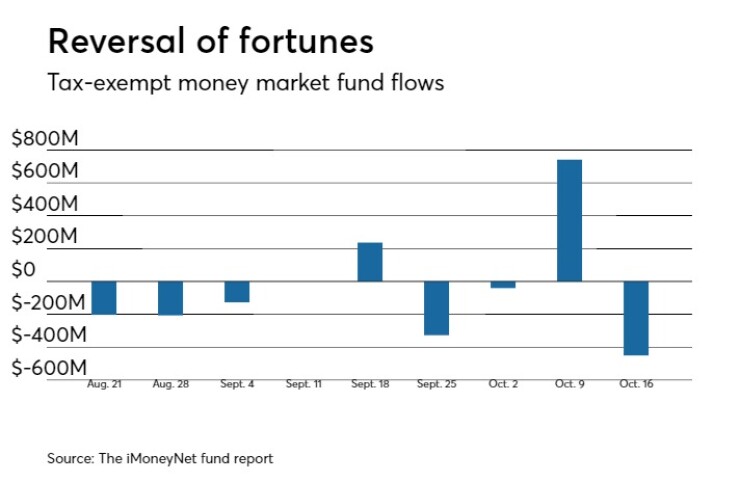

Tax-exempt money market funds see outflows

Tax-exempt money market funds experienced outflows of $450.3 million, dropping total net assets to $128.16 billion in the week ended Oct. 16, according to The Money Fund Report, a service of iMoneyNet.com.

This followed an inflow of $741.4 million to $128.61 billion in the previous week.

The average, seven-day simple yield for the 218 weekly reporting tax-exempt funds slid to 0.44% from 0.45% the previous week.

The total net assets of the 830 weekly reporting taxable money funds increased $12.79 billion to $2.586 trillion in the week ended Oct. 17, after an outflow of $11.30 billion to $2.573 trillion the week before.

The average, seven-day simple yield for the taxable money funds was steady at 0.69% from the prior week.

Overall, the combined total net assets of the 1,048 weekly reporting money funds increased $12.34 billion to $2.714 trillion in the week ended Oct. 17, after outflows of $10.55 million to $2.702 trillion in the prior week.

Data appearing in this article from Municipal Bond Information Services, including the AP-MBIS municipal bond index, is available on the Bond Buyer Data Workstation.