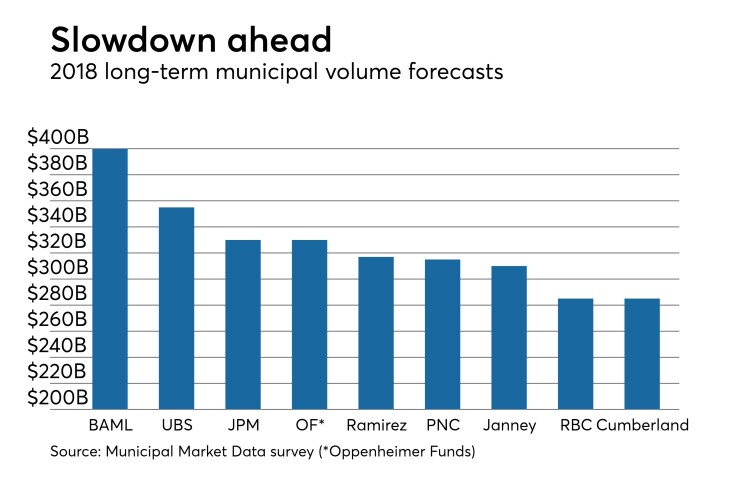

Wall Street firms agree that municipal bond volume will drop in 2018. The only question is by how much.

Analysts in a survey by Municipal Market Data predict declines from 2017 that range from 8% to 34%. Issuers sold $434.76 billion in 2017, after setting yearly issuance record of $451.65 billion the year before.

Bank of America Merrill Lynch is one of the most bullish on muni supply in 2018, projecting a $400 billion year, while UBS is also quite optimistic with $355 billion. JPMorgan Securities and Oppenheimer both see the muni market getting $330 billion, while Ramirez & Co. sees $317 billion, PNC Capital Markets projects $315 billion and Janney is estimates $310 billion. The most bearish predictions come from RBC Capital Markets and Cumberland Advisors, which each forecast a $285 billion year.

Reasons for lower volume stem from the tax bill taking effect this year. Under the legislation, municipal issuers will no longer be able to come to market with advance refundings — a popular cost-saving tool that allowed issuers to take advantage of falling interest rates.

Also accounting for low volume estimates is the

“Our 2018 gross supply forecast [for 2018] is $317 billion, or down 23% year over year,” Ramirez wrote in its weekly market report released late Tuesday. “The steep projected decline in gross supply of about $93 billion in 2018 vs. 2017 is driven by recent tax reform curbs on tax-exempt advance refundings, higher short-end rates, and a continued uncertain political environment, all of which could impact the pace and scale of new projects/new money.”

Ramirez said its total estimate for 2018 consists of $185 billion of new money, or58% of the total and $132 billion of refundings.

"Lower refunding issuance is likely to be driven by the relatively smaller universe of currently refundable bonds in 2018 (down 16%, or $17 billion, year over year) against higher taxable issuance for advance refunding purposes of about $43 billion,” Ramirez wrote, adding that “total taxable issuance is estimated to be up 100% to $73 billion (23% of total gross issuance), comprised of new money ($30 billion) and advance refundings ($43 billion).”

This week’s supply calendar totals about $757 million, including $713 million of negotiated deals and $44 million of competitive sales.

RBC Capital Markets is expected to price the New Jersey Economic Development Authority’s $381.195 million of state lease revenue bonds for state government buildings on Thursday.

The offering is comprised of $197.275 million bonds for the Health Department and Taxation Division office project; $19.225 million taxable bonds for the Health Department office project; and $164.695 million of bonds for the Juvenile Justice Commission Facilities project.

Proceeds of the sale will be used to fund construction of Health Department and Taxation Division office buildings in Trenton and to finance building juvenile justice commission facilities in Ewing and Winslow townships.

The deal is rated Baa1 by Moody’s Investors Service, BBB-plus by S&P Global Ratings and A-minus by Fitch Ratings.

RBC is also expected to price the Socorro Independent School District, Texas’ $173.54 million of Series 2018 unlimited tax school building bonds on Thursday.

The deal, which is backed by the Permanent School Fund guarantee program, is rated triple-A by Moody’s and Fitch.

Stifel is set to price the Anaheim Successor Agency to the Redevelopment Agency, Calif.’s $110 million of Series 2018A tax allocation refunding bonds on Thursday.

The deal is rated AA-minus by S&P.

The competitive arena remains particularly quiet this week.

Quincy, Mass., is selling notes and of bonds on Thursday. The separate deals consist of $42.39 million of general obligation bond anticipation notes and $10 million of GO district improvement bonds.

The BANs are rated SP-1-plus by S&P and the bonds are rated AA-plus by S&P.

Bond Buyer 30-day visible supply at $5.19B

The Bond Buyer's 30-day visible supply calendar increased $855.6 million to $5.19 billion on Thursday. The total is comprised of $2.40 billion of competitive sales and $2.79 billion of negotiated deals.

Secondary market

The MBIS municipal non-callable 5% GO benchmark scale was stronger in late trading.

The 10-year muni benchmark yield dipped to 2.263% on Wednesday from the final read of 2.280% on Tuesday, according to

The MBIS benchmark index is updated hourly on the

Top-rated municipal bonds finished mixed on Wednesday. The yield on the 10-year [2028] benchmark muni general obligation was unchanged from 1.98% on Tuesday, while the 30-year [2038] GO yield fell one basis point to 2.54% from 2.55% according to the final read of MMD’s triple-A scale.

U.S. Treasuries were mixed on Wednesday. The yield on the two-year Treasury rose to 1.94% from 1.92% on Tuesday, the 10-year Treasury yield fell to 2.45% from 2.46% and the yield on the 30-year Treasury decreased to 2.79% from 2.81%.

On Wednesday, the 10-year muni-to-Treasury ratio was calculated at 81.0% compared with 80.3% on Tuesday, while the 30-year muni-to-Treasury ratio stood at 91.2% versus 90.7%, according to MMD.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.