As the municipal market and its investors prepare for what should be a busy week with big name issues coming to market, industry analysts are already looking to what 2019 might have in store.

The research team at Morgan Stanley said they will start 2019 with a preference for munis, but expect a tricky second half on Federal Reserve and GDP uncertainty.

“We enter the year with a credit barbell and an overweight to hospitals, but expect to reduce credit and add duration risk over the course of the year if our macro forecast plays out,” wrote Michael Zezas, municipal strategist at Morgan Stanley, in a report that came out Monday. “Based on the historical lag between good economic conditions and muni capital spending, we forecast gross supply of $358 billion, including new money issuance of $261 billion — which would be a post-crisis record.”

He added, risks to this outlook are skewed to the upside given "mega-deals" under consideration.

“Still, we think these levels will be manageable for the market in 2019,” he said. “We expect a tricky second half, with a Q3 growth slowdown, pause in Fed hikes and a surprisingly early end to balance sheet normalization (all of which we expect) creates uncertainty. Around this time, muni excess returns could show weakness, as rates volatility biases ratios higher & growth concerns bias spreads wider.”

Rising rates in the Morgan Stanley team’s bear case, he wrote, would present complications to munis.

“For example, a 100bp rise across the curve brings 20% of the market into de minimis. If this is closer to your base case, we'd recommend a barbell with money markets to capture the steepness of the ratio curve,” said Zezas. “Don't fall into the "intermediates" trap - they don't offer much protection from rising rates, in our view.”

Secondary market

Municipal bonds were weaker on Monday, according to a midday read of the MBIS benchmark scale. Benchmark muni yields rose as much as one basis point in the one- to 30-year maturities.

High-grade munis were mixed, with yields calculated on MBIS' AAA scale decreasing as much as one basis point in the one- to six-year and the nine- to -15-year maturities. Yields were either flat or increasing by less than one basis point in the other 18 maturities.

Municipals were steady on Municipal Market Data’s AAA benchmark scale, which showed the yield on both the 10-year muni general obligation and the yield on 30-year muni maturity remaining unchanged.

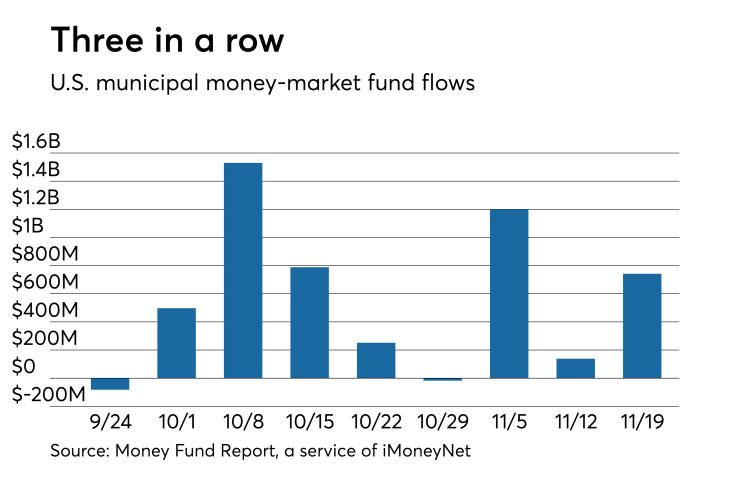

Muni money market funds see inflows

Tax-free municipal money market fund assets increased $741.9 million, raising their total net assets to $136.15 billion in the week ended Nov. 19, according to the Money Fund Report, a service of iMoneyNet.com.

The average seven-day simple yield for the 190 tax-free and municipal money-market funds rose to 1.23% from 1.18% last week.

Taxable money-fund assets decreased $25.62 billion in the week ended Nov. 20, bringing total net assets to $2.762 trillion.

The average, seven-day simple yield for the 816 taxable reporting funds crawled up to 1.85% from 1.83% last week.

Overall, the combined total net assets of the 1,006 reporting money funds gained $26.36 billion to $2.898 trillion in the week ended Nov. 20.

Primary market

Topping the new issue calendar are $1.2 billion of general obligation bonds coming out of New York City.

Bank of America Merrill Lynch is set to price the city’s $856 million of tax-exempt fixed-rate bonds, consisting of Fiscal 2019 Series D Subseries D-1 and Fiscal 2008 Series J Subseries J-1 and J-11 as a reoffering. The deal is expected to have a two-day retail order period starting on Tuesday and be priced for institutions on Thursday, Nov. 29.

Also on Thursday, the city is competitively selling $350 million of taxable fixed-rate GOs in two sales consisting of $223.79 million of Fiscal 2019 Series D Subseries D-2 GOs and $126.21 million of Fiscal 2019 Series D Subseries D-3 GOs.

Proceeds will be used for capital projects, with the exception of some of the tax-exempt fixed-rate bond proceeds, which will be used to convert $175 million of outstanding floating-rate bonds into fixed-rates, the city said.

The deals are rated Aa2 by Moody’s Investors Service and AA by S&P Global Ratings and Fitch Ratings.

Also on tap, the Chicago Board of Education will be coming to market with negotiated and competitive deals totaling more than $1 billion.

JPMorgan Securities is expected to price the BOE’s $763.305 million of dedicated revenues Series 2018C unlimited tax GO refunding bonds and Series 2018D unlimited tax GOs on Wednesday and the school’s $86 million of Series 2018 dedicated capital improvement tax bonds on Tuesday.

On Thursday, the BOE will competitively sell $200 million of Series 2018B tax anticipation notes. The TANs are unrated and bids are capped at 5%.

The GOs are rated junk by two rating agencies and low investment grade by a third. Ahead of the deal, Fitch affirmed the district’s BB-minus rating and positive outlook and S&P affirmed its B-plus rating and stable outlook. Kroll Bond Rating Agency assigns a rating of BBB with a positive outlook. The CIT bonds are rated between BBB and the single-A category.

Previous session's activity

The Municipal Securities Rulemaking Board reported 9,531 trades on Friday on volume of $3.078 billion.

California, New York and Texas were the municipalities with the most trades, with the Golden State taking 16.581% of the market, the Empire State taking 13.541% and the Lone Star State taking 9.553%.

Treasury auctions two-years

The Treasury Department Monday auctioned $39 billion of two-year notes with a 2 3/4% coupon at a 2.836% yield, a price of 99.833929.

The bid-to-cover ratio was 2.65.

Tenders at the high yield were allotted 2.49%.

The median yield was 2.816%. The low yield was 2.720%.

Treasury auctions discount rate bills

Tender rates for the Treasury's latest 91-day and 182-day discount bills were higher, as the $39 billion of three-months incurred a 2.370% high rate, up from 2.345% the prior week, and the $36 billion of six-months incurred a 2.475% high rate, up from 2.455% the week before.

Coupon equivalents were 2.417% and 2.541%, respectively. The price for the 91s was 99.400917 and that for the 182s was 98.748750.

The median bid on the 91s was 2.350%. The low bid was 2.325%.

Tenders at the high rate were allotted 0.24%. The bid-to-cover ratio was 3.74.

The median bid for the 182s was 2.455%. The low bid was 2.440%.

Tenders at the high rate were allotted 48.21%. The bid-to-cover ratio was 3.61.

Treasury to sell $50B 4-week bills

The Treasury Department said it will sell $50 billion of four-week discount bills Tuesday. There are currently $25 billion of four-week bills outstanding.

Treasury also said it will sell $30 billion of eight-week bills Tuesday.

Gary E. Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.