Municipal bonds saw an August that marked the third consecutive month with issuance greater than $40 billion in 2020.

Long-term muni bond volume was 4.1% higher year-over-year at $41.29 billion via 1,056 transactions in August, more than the $39.52 billion spanning 982 transactions the market saw in August of 2019.

“Although August volume slowed from the previous two months, let’s consider the context. Both June and July saw outsized issuance with June being the busiest month year-to-date,” said Jeffrey Lipton, head of municipal credit and market strategy and municipal capital markets at Oppenheimer & Co. “During these two months, oversubscriptions and upsizing were the norm with summer reinvestment needs framing rather compelling market technicals. Since June and July volume numbers reflected a meaningful degree of supply backlog given earlier market uncertainty, it comes as no surprise that by the time August came around, much of the backlog had already been accounted for with less sidelined issuers.”

Lipton added that unlike July, which exhibited a firmer tone with advancing prices, August saw some volatility with a back-up in yields that began mid-month, thus giving some issuers pause.

“We also point out that August failed to deliver the next round of [Federal] fiscal relief that the market had been anticipating and so this added to a more discerning climate as credit concerns grew more visible,” he said. "Against this backdrop, August was still a strong issuance month as it surpassed $40 billion and was modestly higher year-over-year”

It comes as no surprise that taxable munis were the driving force, as they were up 60.5% year-over-year to $12.66 billion.

“Once again, taxable supply was a significant contributor to overall August issuance at about 30%, and continues to be supported by low interest rates and accommodating spread and relative value relationships,” Lipton said. “This backdrop combines with more liberalized use of proceeds capabilities when marketing taxable debt to produce fertile taxable entry for many issuers. We would also note that the investor audience, with noted foreign buyer participation, has expanded into the taxable muni space. Many institutional buyers have shown interest in taxable munis given their relative cheapness versus corporates.”

New-money issuance was up 9% to $25.39 billion and refunding volume was down 14.4% to $11.61 billion.

“The noted drop in refunding activity in August, is likely due to the backup in rates last month, which can make the refunding math less compelling or entirely obsolete,” Lipton said. “We suspect that if rates held steady or declined during August, taxable volume would have been significantly higher year-over-year as advance refunding issuance comes in taxable form since the Tax Cuts and Jobs Act eliminates the ability to advance refund outstanding tax-exempt debt with new tax-exempt bonds.”

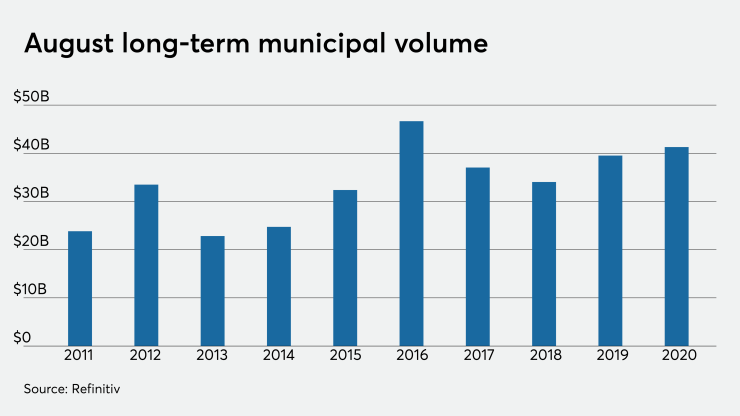

Tom Kozlik, head of municipal strategy and credit at Hilltop Securities said the $40 billion for August is “still a strong moth compared to the last 10 years."

"And if you do look at August issuance over the past 10 years, you will find that 2020 brought us the second highest total for the month in the past decade, with the highest coming in 2016 when the market saw $46.66 billion," Kozlik said.

For most of the year, the taxable muni volume has been mostly made up of refunding deals but that was not the case this month.

“This could just be a month-to-month irregularity,” Kozlik said. “But going forward, I am going to watch closely to see if behaviors are dictating by potential uncertainty related to the election.”

Issuance of revenue bonds was 8.3% lower to $21.74 billion, while general obligation bond sales rose to $19.54 billion from $15.81 billion.

Negotiated deal volume increased 17.8% to $32.88 billion. Competitive sales declined 16.3% to $8.26 billion

Deals wrapped by bond insurance in August rose 55.9% to $3.55 billion in 209 deals from $2.27 billion in 154 transactions the same month last year.

Six sectors were in the green year-over-year for the month. Education elevated to $11.22 billion from $8.47 billion, general purpose bonds ballooned to $12.55 billion from $9.36 billion, housing deals moved higher to $2.11 billion from $1.83 billion, public facilities jumped to $738.2 million from $421.9 million, electric power improved to $870.6 million from $353 million and development deals edged higher to $1.15 billion from $1.05 billion. The other four sectors saw a decline of at least 5.8%.

“Fiscal policy solutions have not been near enough for higher education institutions to withstand the COVID-19 storm,” Kozlik said. “The Coronavirus Aid, Relief, and Economic Stabilization Act did include a $31 billion Education Stabilization Fund, $14 billion of the allocation was available to higher-ed entities via the Higher Education Emergency Relief Fund, but restrictions on the use of the money have kept it underutilized. Fiscal policy solutions provided a buffer for some but eligibility was only open to schools with less than 500 employees.”

Four types of issuers increased levels from a year ago, while issuance by the rest of the others declined at least 3.4%. Issuance from state governments rose 70.7% to $4.94 billion from $2.89 billion, colleges and universities saw a 105.7% increase to $1.60 billion from $780.3 million, districts’ increased 31.7% to $9.99 billion from $7.59 billion and local authorities gained 52.5% to $9.93 billion from $6.51 billion.

California leads all states in terms of long-term muni bonds sold so far this year. All issuers in the Golden State have accounted for $43.65 billion. Texas is second with $39.73 billion, New York is third with $33.27 billion, Ohio is fourth with $14.05 billion and Pennsylvania rounds out the top five with $11.96 billion.

The rest of the top 10 are: Massachusetts with $10.45 billion, Florida is next with $10.35 billion, followed by Illinois at $7.69 billion, then Michigan with $7.44 billion and last but not least, Maryland with $7.35 billion.

So will September bring the muni market a fourth consecutive of $40-plus-billion volume?

“If rates continue to back up, September volume can very well come in lower month-over-month,” Lipton said.

While Kozlik noted that September is “not usually” a $40-plus-billion month, this year could be different.

“We could see some issuers rushing calendars in order to get things completed before the election,” he said.