Municipal bonds were mixed at midday as new supply surged into the market, led by issuers from New York and Massachusetts.

Primary market

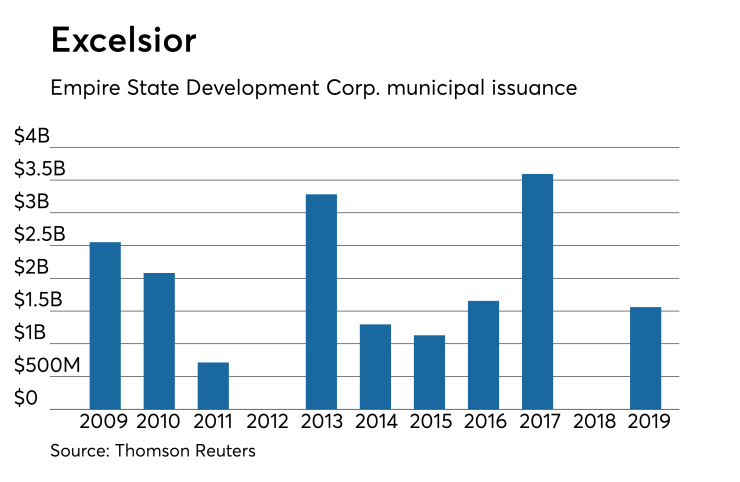

In the competitive arena on Tuesday, New York’s Empire State Development sold about $1.3 billion of Urban Development Corp. state personal income tax revenue bonds in five sales.

Bank of America Merrill Lynch won the $396.38 million of Series 2019A Bidding Group 1 general purpose bonds with a true interest cost of 3.8004%.

Citigroup won the $345.555 million of Series 2019A Bidding Group 2 general purpose bonds with a TIC of 3.9574% and the $190.695 million of Series 2019B Bidding Group 2 taxable general purpose bonds with a TIC of 3.4709%.

JPMorgan Securities won the $259.985 million of Series 2019B Bidding Group 1 taxable general purpose bonds with a TIC of 3.1724%.

Morgan Stanley won the $353.265 million of Series 2019B Bidding Group 3 taxable general purpose bonds with a TIC of 3.9394%.

The bonds are rated Aa1 by Moody’s Investors Service and AA-plus by Fitch.

Since 2009, the ESDC has sold about $17.5 billion of bonds, with the most issuance occurring in 2017 when is issued around $3.59 billion of debt. It did not come to market in in 2012 or 2018.

Bank of America Merrill Lynch priced Massachusetts’ $918.49 million of tax-exempt general obligation bonds after holding a two-day retail order period.

The bonds are rated Aa1 by Moody’s, AA by S&P Global Ratings and AA-plus by Fitch.

Morgan Stanley priced the Board of Regents of the Texas A&M University System’s $223.745 million of taxable Series 2019A revenue financing system bonds.

The deal is rated triple-A by Moody’s, S&P and Fitch.

On Wednesday, Wells Fargo Securities is expected to price the New Jersey Transportation Trust Fund Authority’s $500 million of transportation program bonds. The deal is rated A-minus by Fitch and Kroll Bond Rating Agency,

On Thursday, JPMorgan Securities expected to price the San Francisco Airport Commission’s $1.78 billion of tax-exempt and taxable revenue and revenue refunding bonds. The deal, which consists of bonds subject to the alternative minimum tax and non-AMT bonds, is rated A1 by Moody’s and A-plus by S&P and Fitch.

Bond sales

New York

Texas

Massachusetts

Bond Buyer 30-day visible supply at $11.16B

The Bond Buyer's 30-day visible supply calendar increased $627.7 million to $11.16 billion for Tuesday. The total is comprised of $4.50 billion of competitive sales and $6.66 billion of negotiated deals.

Secondary market

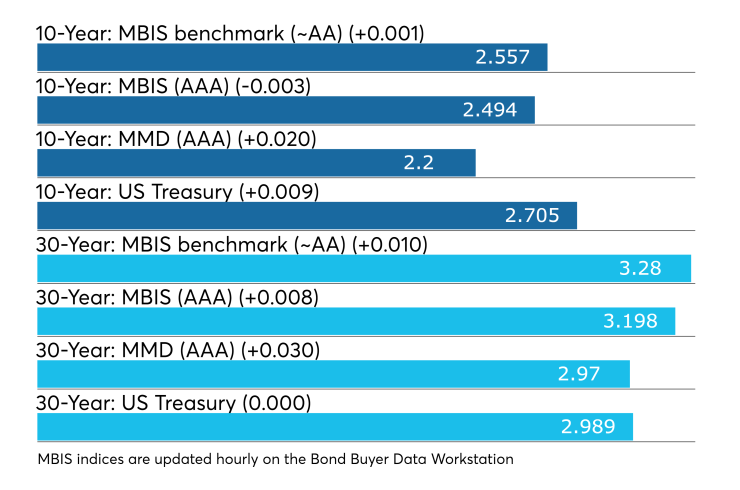

Municipal bonds were mixed on Tuesday, according to a midday read of the MBIS benchmark scale. Benchmark muni yields fell three basis points in the one-year maturity, four basis points in the two-year maturity, three basis points in the three-year maturity and as much as one basis point in the four- to nine-year maturities while yields rose as much as one basis point in the 10- to 30-year maturities.

High-grade munis were also mixed, with yields calculated on MBIS' AAA scale falling as much as four basis points in the one-year maturity, five basis points in the two-year maturity, four basis points in the three-year maturity and as much as two basis points in the four- to 10-year maturities maturities while rising less than a basis point in the 12- to 30-year maturities and remaining unchanged in the 11-year maturity.

Municipals were weaker on Municipal Market Data’s AAA benchmark scale, which showed the yield on the 10-year muni general obligation rising as much as two basis points as the yield on the 30-year muni maturity gained one to three basis points.

Treasury bonds were mixed amid continuing stock market volatility. The Treasury 30-year was yielding 2.989%, the 10-year yield stood at 2.705%, the five-year was at 2.558%, the two-year was at 2.565% while the Treasury three-month bill stood at 2.448%.

On Monday, the 10-year muni-to-Treasury ratio was calculated at 82.4% while the 30-year muni-to-Treasury ratio stood at 99.9%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

Previous session's activity

The Municipal Securities Rulemaking Board reported 41,498 trades on Monday on volume of $9.05 billion.

California, New York and Texas were the municipalities with the most trades, with the Golden State taking 15.335% of the market, the Empire State taking 11.976% and the Lone Star State taking 10.422%.

Treasury to sell $40B 4-week bills

The Treasury Department said it will sell $40 billion of four-week discount bills Thursday. There are currently $30.001 billion of four-week bills outstanding.

Treasury also said it will sell $30 billion of eight-week bills Thursday.

Gary E. Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.