Municipal bonds strengthened in early activity, traders said, after the March employment report came in weaker than expected.

Secondary Market

The Labor Department reported that the March non-farm payrolls rose 98,000, less than the 180,000 gain forecast by economists surveyed by IFR Markets. The unemployment rate fell to 4.5%, lower than the 4.7% rate expected by economists polled by IFR.

The yield on the 10-year benchmark muni general obligation fell two to four basis points from 2.19% on Thursday, while the 30-year GO yield dropped two to four basis points from 2.99%, according to a read of Municipal Market Data's triple-A scale.

U.S. Treasuries were narrowly mixed on Friday. The yield on the two-year Treasury was unchanged from 1.24% on Thursday, while the 10-year Treasury yield dropped to 2.32% from 2.34%, and the yield on the 30-year Treasury bond decreased to 2.96% from 2.99%.

On Thursday, the 10-year muni to Treasury ratio was calculated at 93.5% compared to 93.6% on Wednesday, while the 30-year muni to Treasury ratio stood at 100.0%, versus 99.9%, according to MMD.

MSRB: Previous Session's Activity

The Municipal Securities Rulemaking Board reported 42,309 trades on Thursday on volume of $12.14 billion.

Week’s Primary Market

Citigroup priced Massachusetts’ $767.97 million general obligation bonds, consisting of $400 million of Series A consolidated loan of 2017 GOs, $100 million of Series B consolidated loan of 2017 green bond GOs and $267.97 million of Series C consolidated loan of 2017 refunding GOs.

The deal is rated Aa1 by Moody’s Investors Service and AA-plus by S&P Global Ratings and Fitch Ratings.

Bank of America priced the California State Public Works Board’s $534.995 million of Series 2017 B&C various capital lease revenue refunding bonds. The deal is rated A1 by Moody’s and A-plus by S&P and Fitch.

BAML priced the New Jersey Health Care Facilities Financing Authority’s $589.65 million of Series 2017A revenue and refunding bonds for the Meridian Health Obligated Group. The deal is rated A-plus by S&P and AA-minus by Fitch.

Jefferies priced the New York State Environmental Facilities Corp.’s $336.33 million of Series 2017B taxable state clean water and drinking water revolving funds revenue bonds for New York City Municipal Water Authority projects, second resolution bonds. The deal is rated triple-A by Moody’s, S&P and Fitch.

Goldman Sachs priced San Antonio, Texas’ $308.94 million of New Series 2017 electric and gas systems revenue and refunding bonds. The deal is rated Aa1 by Moody’s, AA by S&P and AA-plus by Fitch.

BAML priced the Massachusetts Clean Water Trust’s $303.63 million of state revolving fund Series 20 green bonds and Series 2017 refunding bonds. The deal is rated triple-A by Moody’s, S&P and Fitch.

Goldman Sachs priced Philadelphia, Pa.’s $280.94 million of Series 2017A water and wastewater revenue bonds. The deal is rated A1 by Moody’s and A-plus by S&P and Fitch.

BAML priced the Maryland Department of Housing and Community Development’s $263.06 million of Series 2017 taxable residential revenue bonds. The deal is rated Aa2 by Moody’s and AA by Fitch

RBC Capital Markets priced the San Joaquin County Transportation Authority, Calif.’s $209.08 million of Series 2017 Measure K limited tax sales tax revenue refunding bonds. The deal is rated AA by S&P and Fitch.

Citigroup priced the New Jersey Housing and Mortgage Finance Agency’s $150.27 million of multi-family revenue bonds. The bonds are rated AA-minus by S&P.

Wells Fargo Securities priced the California Municipal Finance Authority’s $126.82 million of revenue bonds for the University of La Verne. The deal is rated A3 by Moody’s and A-minus by Fitch.

RBC priced the Desert Community College District, Calif.’s $125.31 million of Series 2017 crossover refunding GO refunding bonds. The deal is rated Aa2 by Moody’s and AA by S&P.

Bond Buyer Visible Supply

The Bond Buyer's 30-day visible supply calendar decreased $62.2 million to $10.75 billion on Friday. The total is comprised of $5.13 billion of competitive sales and $5.62 billion of negotiated deals.

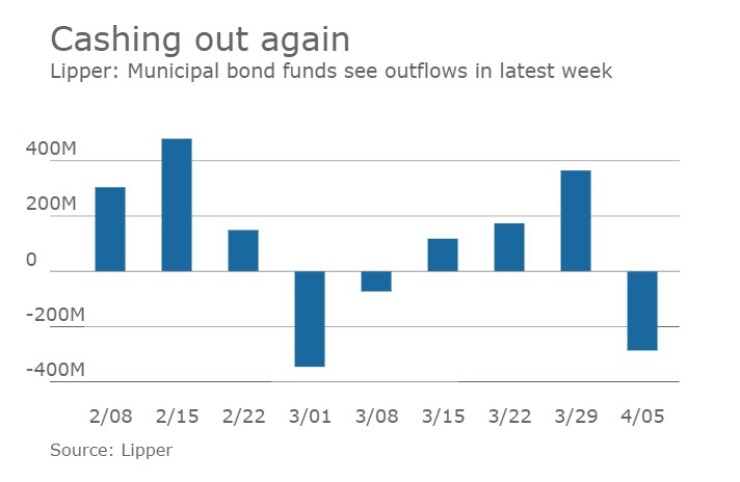

Lipper: Muni Bond Funds Report Outflows

Investors in municipal bond funds reversed course and pulled cash out of the funds in the latest week, according to Lipper data released late Thursday.

The weekly reporters saw $287.201 million of outflows in the week ended April 5, after inflows of $265.041 million in the previous week.

The four-week moving average was still in the green at positive $8.313 million, after being positive at $61.827 million in the previous week. A moving average is an analytical tool used to smooth out price changes by filtering out fluctuations.

Long-term muni bond funds also had outflows, losing $166.361 million in the latest week after rising $271.561 million in the previous week. Intermediate-term funds had outflows of $79.763 million after outflows of $15.992 million in the prior week.

National funds had outflows of $135.789 million after inflows of $358.965 million in the previous week. High-yield muni funds reported inflows of $68.334 million in the latest reporting week, after inflows of $277.761 million the previous week.

Exchange traded funds saw inflows of $81.089 million, after inflows of $141.468 million in the previous week.