Municipal bonds finished stronger on Monday as the Hudson Yards deal was offered to retail buyers for a second day.

Traders spent the rest of the day waiting for this week’s $7.02 billion new issue calendar to get underway, which will start to hit the market in earnest on Tuesday.

Primary market

Goldman Sachs took retail orders for a second day on the Hudson Yards Infrastructure Corp., N.Y.’s $2.15 billion of tax-exempt Fiscal 2017 Series A second indenture revenue bonds. The deal will be priced for institutions on Tuesday.

On Monday, the HYIC bonds were priced for retail to yield from 1.31% with 3% and 5% coupons in a split 2022 maturity to approximately 3.568% with a 3.50% coupon in 2038; a 2042 maturity was priced as 5s to yield 3.19% while a 2045 maturity was priced as 4s to yield 3.53%.

No retail orders were taken in the 2031, 2033-2035, 2039, 2041, 2044 or 2047 maturities.

On Tuesday, the HYIC’s $33.36 billion of taxable Fiscal 2017 Series B bonds will go out for competitive bid.

Last week, Moody's Investors Service upgraded the HYIC’s Fiscal 2012 Series A senior revenue bonds to Aa3 from A2 and assigned Aa3 ratings to this week’s sales.

The second indenture bonds are being issued to current and advance refund most of HYIC's $3 billion of outstanding Fiscal 2007 Series A and Fiscal 2012 Series A debt. After closing, about $609 million of the Fiscal 2012 Series A first indenture bonds will remain outstanding and the first indenture will be closed.

“The bonds were issued to finance expansion of the Number 7 subway to Hudson Yards to spur economic growth there and for other infrastructure improvements. The original bonds were issued with a 40-year final maturity and no principal amortization. With the refunding, bonds under both indentures will begin to amortize with a level debt service structure and a 2047 final maturity,” Moody’s said. “The bonds are paid primarily by payments in lieu of taxes (PILOTs) collected by HYIC from commercial properties in the Hudson Yards area and tax equivalency payments (TEPs) from residential properties and hotels collected by the city and appropriated to HYIC."

New York City, whose GOs are rated Aa2 by Moody's, has pledged to cover interest, subject to appropriation, for the life of the bonds if those revenues are insufficient. The new ratings, Moody’s said are derived from the city's credit quality.

“The Aa3 rating on both liens is one notch lower than the city's general obligation rating. The one notch distinction reflects our determination of the essential nature of the transportation and other infrastructure projects financed by the bonds, the strong legal structure that obligates the mayor to include the TEPs and an amount sufficient to cover interest in the annual budget, the need for appropriation of those amounts, and potential real estate market volatility that could affect assessed values in the district," Moody's said. "The ratings also reflect closure of the first indenture and the relatively small amount of debt left outstanding under it.”

Also last week, S&P Global Ratings said it upgraded its rating on the HYIC's outstanding Fiscal 2012 Series A first-indenture senior revenue bonds by two notches to AA-minus from A. At the same time, S&P assigned A-plus ratings to this week's sales.

Additionally, Fitch upgraded HYIC’s outstanding Fiscal 2007 Series A and 2012 Series A revenue bonds to AA-minus from A in anticipation of the closing of the lien under which the bonds were issued, which will occur upon the refunding of all of the Fiscal 2007 Series A bonds and part of the Fiscal 2012 Series A bonds with proceeds of this week's Series 2017 bonds. Fitch also assigned A-plus ratings to this week’s sales.

And Fitch Ratings said its A-plus rating on the new bonds, which is two notches below the city's issuer default rating [IDR], “is based on the support provided by New York City's obligation to pay interest on the bonds if project revenues are insufficient for this purpose, subject to appropriation. The two notch distinction from the IDR, wider than the standard one notch for appropriation-supported obligations, is based on the limitation of the city's support to interest payments only.”

On Tuesday, Ziegler is set to price the Tarrant County Cultural Education Facilities Finance Corp., Texas’ $238.38 million of Series 2017A, B1-B3 and C retirement facilities revenue bonds for Buckner Senior Living’s Ventana project.

Bank of America Merrill Lynch is set to price the California Municipal Finance Authority’s $236.38 million of Series 2017A revenue refunding bonds for the Eisenhower Medical Center on Tuesday.

The deal is rated Baa2 by Moody’s and BBB by Fitch.

Raymond James is expected to price the Metropolitan Government of Nashville and Davidson County, Tenn.’s $174.51 million of electric system revenue and refunding bonds on Tuesday.

The deal is rated AA-plus by S&P and Fitch.

Wells Fargo Securities is set to price Clark County, Nev.’s $150 million of Series 2017 indexed fuel tax and subordinate motor vehicle fuel tax highway revenue bonds on Tuesday.

The deal is rated Aa3 by Moody’s and AA-minus by S&P.

In the competitive arena on Tuesday, Fort Worth, Texas, is selling $111.67 million of Series 2017 water and sewer system revenue refunding and improvement bonds.

The deal is rated Aa1 by Moody’s, AA-plus by S&P and AA by Fitch.

Secondary market

The yield on the 10-year benchmark muni general obligation dropped two basis points to 1.99% from 2.01% on Friday, while the 30-year GO yield declined two basis points to 2.85% from 2.87%, according to the final read of Municipal Market Data's triple-A scale.

U.S. Treasuries were mixed on Monday. The yield on the two-year Treasury was unchanged from 1.27% on Friday as the 10-year Treasury yield rose to 2.25% from 2.24% while the yield on the 30-year Treasury bond was steady from 2.91%.

The 10-year muni to Treasury ratio was calculated at 88.3% on Monday, compared with 89.6% on Friday, while the 30-year muni to Treasury ratio stood at 97.8%, versus 98.8%, according to MMD.

MSRB: Previous session's activity

The Municipal Securities Rulemaking Board reported 34,083 trades on Friday on volume of $8.23 billion.

Prior week's actively traded issues

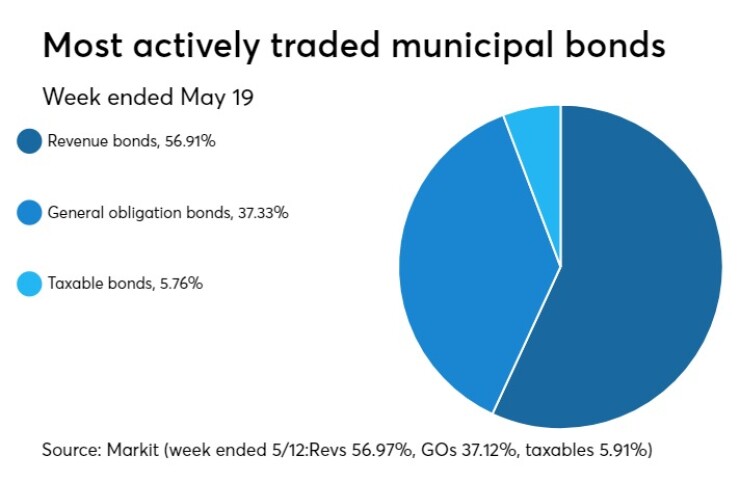

Revenue bonds comprised 56.91% of new issuance in the week ended May 19, down from 56.97% in the previous week, according to

Some of the most actively traded bonds by type were from California, Louisiana and New York issuers.

In the GO bond sector, the Los Angeles Unified School District, Calif., 5s of 2027 were traded 58 times. In the revenue bond sector, the New Orleans Aviation Board, La., 5s of 2048 were traded 68 times. And in the taxable bond sector, the New York State Dormitory Authority 3.998s of 2039 were traded 32 times.

Previous week's top underwriters

The top negotiated and competitive underwriters of last week included Morgan Stanley, Citigroup, Bank of America Merrill Lynch, JPMorgan Securities, and RBC Capital Markets, according to Thomson Reuters data.

In the week of May 14 to May 20, Morgan Stanley underwrote $1.29 billion, Citi $1.23 billion, BAML $1.14 billion, JPMorgan $1.05 billion and RBC $661.4 million.