Municipal market participants are ready for the flood of pricings expected on Tuesday, on what should be the busiest day of the biggest volume week the market has seen since June.

Secondary market

U.S. Treasuries were weaker on Tuesday morning. The yield on the two-year Treasury was up to 1.44% from 1.42%, the 10-year Treasury yield increased to 2.23% from 2.21% and the yield on the 30-year Treasury bond rose to 2.77% from 2.76%.

The yield on the 10-year benchmark muni general obligation was flat at the close Monday at 1.92% from Friday, while the 30-year GO yield was unchanged from 2.78%, according to a read of Municipal Market Data's triple-A scale.

On Monday, the 10-year muni-to-Treasury ratio was calculated at 86.6% compared with 85.0% on Friday, while the 30-year muni-to-Treasury ratio stood at 100.7% versus 99.5%, according to MMD.

MSRB: Previous session's activity

The Municipal Securities Rulemaking Board reported 33,574 trades on Monday on volume of $5.778 billion.

Bond Buyer reports 30-day visible supply

The Bond Buyer's 30-day visible supply calendar increased $3.032 billion to $16.24 billion on Tuesday. The total is comprised of $5.95 billion of competitive sales and $10.29 billion of negotiated deals.

Primary market

There was little action on Monday, as one deal priced for retail and Morgan Stanley circulated pricing guidance for the biggest deal of the week — Texas Water Development Board’s $1.04 billion of State Water Implementation Revenue Fund for Texas bonds that are expected to price on Tuesday.

In the guidance, the bonds are priced to yield from 0.91% with a 5% coupon in 2019 to 3.11% with a 4% coupon in 2038. A term bond in 2042 was listed to yield 3.21% and 2.91% with 4% and 5% coupons in a split maturity. A term bond in 2047 was listed to yield 3.28% and 2.98% with 4% and 5% coupons in a split maturity. A term bond in 2052 was listed to yield 3.38% and 3.08% with 4% and 5% coupons in a split maturity. The 2018 maturity was offered as a sealed bid. The deal is the largest in the board’s history and carries ratings of triple-A from S&P and Fitch.

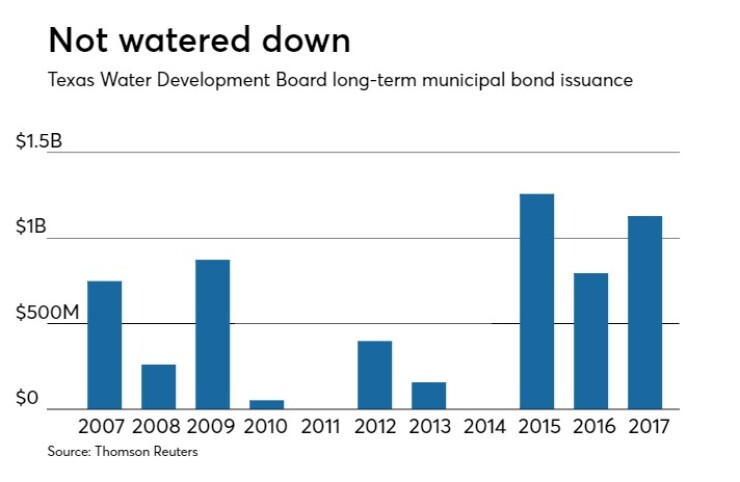

Since 2007, the TWDB has sold about $5.76 billion of securities, with the most issuance in 2015 when it sold $1.26 billion. The board did not come to market at all in 2011 or 2014.

Raymond James priced the New York City Municipal Water Finance Authority’s $383.975 million of water and sewer system second general resolution revenue bonds for retail investors on Monday, ahead of institutional pricing on Tuesday.

The $217.315 million of fiscal 2018 series BB, subseries BB-1 bonds were priced for retail to yield 3.45% and 3.00% with 3.375% and a 5% coupons in a split maturity. The 2037 and 2046 maturities were not available for retail.

The $166.660 million of subseries BB-2 bonds were priced for retail to yield 2.19% with a 5% coupon in 2028 and 2.82% and 2.39% with 2.75% and 5% coupons in a split 2030 maturity. No retail was available in the 2029, 2031 and 2032 maturities. The deal is rated Aa1 by Moody’s Investors Service and AA-plus by S&P Global Ratings and Fitch Ratings.

Tuesday should be the busiest day of the week as Bank of America Merrill Lynch is expected to price New Jersey Turnpike Authority’s $579 million of revenue SIFMA LIBOR indexed bonds. The deal is rated A2 by Moody’s, A-plus by S&P and A by Fitch.

Bank of America Merrill Lynch is slated to price Oregon’s $578 million tax anticipation notes for institutions on Tuesday. The TANs are rated MIG 1 by Moody’s, SP-1-plus by S&P and F1-plus by Fitch.

On the competitive side, Washington State is set to sell a total of $528.81 million through three separate sales — including the largest individual competitive sale of $435.025 million on Tuesday. The general obligation various purpose motor vehicle fuel tax and refunding bonds are rated Aa1 by Moody’s and AA-plus by S&P and Fitch.