The municipal bond market priced the last of the week’s big new issues on Thursday ahead of the holiday-shortened trading week.

Primary market

In the competitive arena, the Florida Department of Transportation sold $240.695 million of Series 2019A right-of-way acquisition and bridge construction refunding bonds.

JPMorgan Securities won the bonds with a true interest cost of 2.78%.

Proceeds will be used to refund all or a portion of the outstanding DOT Series 2009A&B right-of-way acquisition and bridge construction and refunding bonds.

The Florida Division of Bond Finance is the financial advisor; bond counsel is Greenberg Traurig. The deal is rated triple-A by Moody’s Investors Service, S&P Global Ratings and Fitch Ratings.

Newark, New Jersey, competitively sold $51.27 million of taxable qualified general obligation bonds for the ECIA Property Acquisition. The bonds are qualified under the Municipal Qualified Bonds Act of 1976.

Morgan Stanley won the bonds with a TIC of 3.9614%.

Proceeds will be used to defease the authority’s $42.185 million of Series 2010A lease revenue bonds for the city and $30.255 million Series 2010B lease revenue bonds for the city. The financial advisor is NW Financial Group; the bond counsel is DeCotiis FitzPatrick.

The 2019-2021 maturities are rated Baa1 by Moody’s; the 2022-2030 maturities are insured by Assured Guaranty Municipal and rated A2 by Moody’s and AA by S&P.

Barclays Capital priced the Missouri Health and Educational Facilities Authority’s $144.09 million of Series 2019 educational facilities revenue bonds for St. Louis University. The deal is rated A1 by Moody’s and AA-minus by S&P.

Morgan Stanley priced the Public Energy Authority of Kentucky’s $380.87 million of gas supply revenue bonds consisting of Series 2019 A-1 fixed-rates and Series 2019 A-2 LIBOR-index rate bonds. The deal is rated A3 by Moody’s and A by Fitch.

JPMorgan Securities priced are repriced Main Street Natural Gas Inc.’s $702.91 million of Series 2019A gas supply revenue bonds. The deal is rated A3 by Moody’s and A-minis by Fitch.

RBC Capital Markets priced the New Jersey Housing and Mortgage Finance Agency’s $256.925 million of single family housing revenue bonds, Series 2019C not subject to the alternative minimum tax and the Series 2019 D AMT bonds. The deal is rated Aa3 by Moody’s and AA by Fitch.

Goldman Sachs priced the Regents of The University of Michigan’s $148.585 million of Series 2019A tax-exempt general revenue bonds and $16.755 million of Series 2019B taxable. The deal is rated triple-A by Moody’s and S&P.

Bank of America Merrill Lynch priced the Texas Transportation Commission’s $251.644 million of state highway 249 system first tier toll revenue bonds. The deal is rated Baa3 by Moody’s

BAML received the official award on the District of Columbia’s $937.775 million of Series 2019A general obligation bonds. The bonds are rated Aaa by Moody’s and AA-plus by S&P and Fitch.

Citigroup received the written award on Oregon’s $466.355 million of GOs, consisting of Series 2019A tax-exempts and Series 2019D tax-exempts and $59.765 million of various series GOs. The deal is rated Aa1 by Moody’s and AA-plus by S&P and Fitch.

RBC received the official award on the Iowa Finance Authority’s $215.99 million of Series 2019A state revolving fund revenue green bonds and $42.015 million of Series 2019B taxable state revolving fund revenue green bonds. The deal is rated triple-A by Moody’s, S&P and Fitch.

Thursday’s bond sales

Florida

New Jersey

Washington, D.C.

Oregon

Iowa

Kentucky

Tennessee

Missouri

Texas

Michigan

Bond Buyer 30-day visible supply at $5.39B

The Bond Buyer's 30-day visible supply calendar decreased $2.099 billion to $5.39 billion for Thursday. The total is comprised of $2.39 billion of competitive sales and $2.995 billion of negotiated deals.

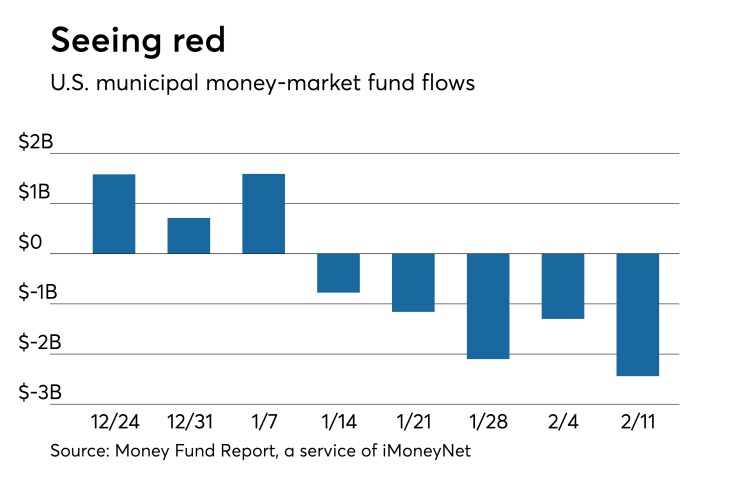

Muni money market funds in the red again

Tax-free municipal money market fund assets decreased $2.44 billion, lowering their total net assets to $138.75 billion in the week ended Feb. 11, according to the Money Fund Report, a service of iMoneyNet.com.

The average seven-day simple yield for the 190 tax-free and municipal money-market funds rose to 1.10% from 1.04% last week.

Taxable money-fund assets gained $23.82 billion in the week ended Feb. 12, bringing total net assets to $2.902 trillion.

The average, seven-day simple yield for the 804 taxable reporting funds dipped to 2.04% from 2.06% last week.

Overall, the combined total net assets of the 994 reporting money funds increased $21.38 billion to $3.040 trillion in the week ended Feb. 12. It marks the sixth consecutive week total money-fund assets have exceeded $3 trillion.

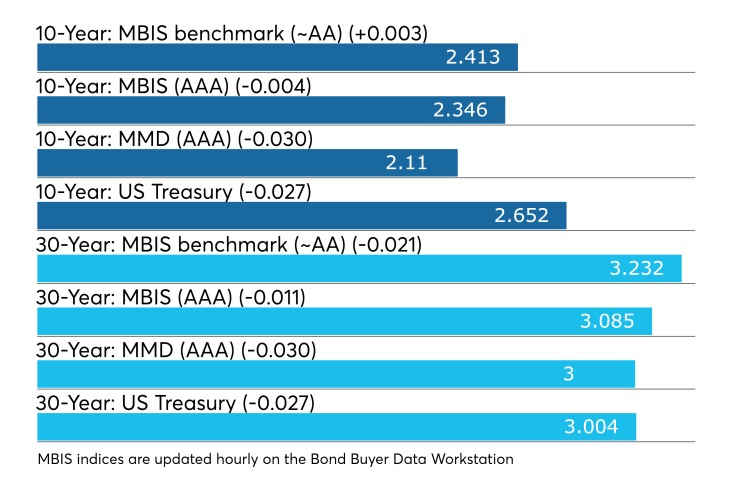

Secondary market

Municipal bonds were stronger Thursday, according to a late read of the MBIS benchmark scale. Benchmark muni yields fell as much as two basis point in the one- to right-year and 11- to 30-year maturities and rose less than a basis point in the nine- and 10-year maturities.

High-grade munis were also stronger with muni yields falling as much as two basis point in the five- to 30-year maturities, rising as much as one basis point in the one- to three-year maturities and remaining unchanged in the four-year maturity.

Municipals were stronger on Municipal Market Data’s AAA benchmark scale, which showed the yield on both the 10-year muni general obligation and the yield on the 30-year muni maturity falling one to three basis points.

"The broader muni curve is yielding two basis points less from 2027 and longer," ICE Data Services said in a Thursday market comment. "The high-yield market it mixed with no direction as yet, and tobaccos are unchanged as well."

Treasury bonds were stronger as stock prices traded mixed.

On Thursday, the 10-year muni-to-Treasury ratio was calculated at 79.5% while the 30-year muni-to-Treasury ratio stood at 99.9%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

Previous session's activity

The Municipal Securities Rulemaking Board reported 42,376 trades on Wednesday on volume of $15.56 billion.

California, New York and Texas were the municipalities with the most trades, the Golden State taking 15.45% of the market, the Empire State taking 12.415% and the Lone Star State taking 11.223%.

Treasury auctions announced

The Treasury Department announced these auctions:

· $8 billion of 30-year TIPs selling on Feb. 21;

· $18 billion of one-year 11-month floating rate notes selling on Feb. 20;

· $39 billion of 182-day bills selling on Feb. 19; and

· $45 billion of 91-day bills selling on Feb. 19.

Treasury sells bills

The Treasury Department Thursday auctioned $50 billion of four-week bills at a 2.395% high yield, a price of 99.813722.

The coupon equivalent was 2.433%. The bid-to-cover ratio was 2.85. Tenders at the high rate were allotted 68.33%. The median rate was 2.370%. The low rate was 2.330%.

Treasury also auctioned $35 billion of eight-week bills at a 2.400% high yield, a price of 99.626667.

The coupon equivalent was 2.442%. The bid-to-cover ratio was 2.95. Tenders at the high rate were allotted 0.91%. The median rate was 2.380%. The low rate was 2.350%.

Gary E. Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.