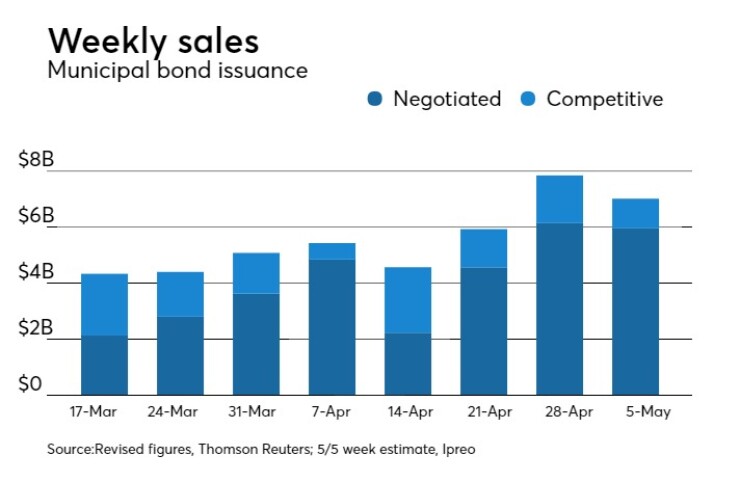

Municipal bond traders returning to work on Monday will face a moderate new issue calendar of $7.02 billion, made up of $5.96 billion of negotiated deals and $1.06 billion of competitive sales.

Ipreo estimates volume will decrease to $7.02 billion, from a revised total of $7.87 billion in the past week, according to updated figures from Thomson Reuters. The calendar for the week ahead is composed of $5.96 billion of negotiated deals and $1.06 billion of competitive sales.

“Now that we are past tax season, hopefully we could see more money being put to work in the market,” said Dan Heckman, senior fixed income strategist at U.S. Bank Wealth Management. “We think that right now, values are somewhat rich here and frankly we think issuers should take advantage of the current market conditions.”

Heckman said that it continues to be a period where the calendar has been thin, and munis have been very attractive.

“Rates are down and spreads are tight, as we go through May and through the summer months, volume could pick up here and accelerate through the fall as long as nothing happens to upset the market,” he said. “The market needs supply and we are optimistic that new issuance will pick up.”

Jefferies LLC is expected to price the University of California Regents’ $1.13 billion of a variety of bonds on Thursday following a day one-day retail order period and indications of interest. The sale is scheduled to be separated into $447.83 million of Series AV tax-exempt bonds, $186.225 million of Series AW taxable bonds and $500 million of Series AX taxable fixed rate notes. The deal is rated Aa2 by Moody’s Investors Service and AA by S&P Global Ratings and Fitch Ratings.

Pension funding continues to plague the market, and it looks as if the Cal U regents are the latest victim. Earlier this week the California State Auditor release a report highlighting lavish compensation and benefits at UC’s President’s Office, part of a system wide issue, according to Marc Joffe, director of Policy Research, California Policy Center.

“UC currently has about 50 retirees receiving annual pensions in excess of $250,000. Faculty who work 40 years can retire at 100% of final salary, and sometimes have the opportunity to draw additional salary,” Joffe said. “According to the most recent actuarial report, UC’s pension system is only 78% funded (based on market value of assets) and has unfunded liabilities of over $15 billion.”

Joffe also said that the university is making pension fund contributions of close to $3 billion annually and that it also has a $21 billion OPEB liability, according to the most recent retiree health system actuarial report.

“The State Auditor’s report appears to be part of a legislative agenda to reduce the university’s independence: it is not really facing a financial crisis," Joffe said. "If the state were to freeze or reduce subsidies to UC, the system could pursue the option of taking more out of state and foreign students. UC Berkeley, UCLA and UCSF especially are very strong franchises that could be more aggressively monetized if push came to shove.”

The state of Wisconsin will be coming to market with a combined total of $688.31 million in two sales. The $403.105 million of general fund annual appropriation refunding taxable bonds will be priced by Wells Fargo on Tuesday and is expected to mature serially from 2018 through 2027. This deal is rated Aa3 by Moody’s and AA-minus by S&P and Fitch.

The $285.205 million of transportation revenue bonds will be priced by JP Morgan also on Tuesday. This deal is rated Aa2 by Moody’s, AA-plus by S&P and Fitch and triple-A by Kroll Bond Rating Agency.

Bank of America Merrill Lynch is slated to price the Kentucky Economic Development Finance Authority’s $495 million of revenue refunding bonds for Owensboro Health, Inc. – Hospital on Tuesday. The deal is rated Baa3 by Moody’s and triple-B by Fitch.

The largest single competitive sale on the calendar for next week will come from Milwaukee, Wisc. The city will sell $132.225 of general obligation Promissory Notes Series and general obligation corporate purpose bonds on Thursday.

Secondary Market

Top-shelf municipal bonds were weaker on Friday, as the yield on the 10-year benchmark muni general obligation rose one basis point to 2.14% from 2.13% on Thursday, while the 30-year GO yield increased one basis point to 3.02% from 3.01%, according to a final read of Municipal Market Data's triple-A scale.

U.S. Treasuries were mixed on Friday at the market close. The yield on the two-year Treasury rose to 1.27% from 1.25% on Thursday, while the 10-year Treasury yield dipped to 2.28% from 2.29%, and the yield on the 30-year Treasury bond was flat at 2.96%.

On Thursday, the 10-year muni to Treasury ratio was calculated at 93.9%, compared with 92.8% on Wednesday, while the 30-year muni to Treasury ratio stood at 102.3%, versus 101.4%, according to MMD.

On Friday, the 10-year muni to Treasury ratio was calculated at 93.9%, compared with 92.8% on Thursday, while the 30-year muni to Treasury ratio stood at 102.3%, versus 101.4%, according to MMD.

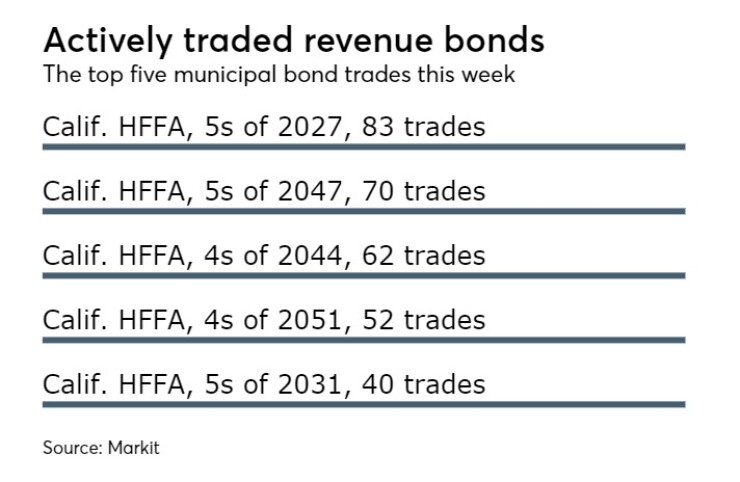

Week's actively traded issues

Some of the most actively traded issues by type in the week ended April 28 were from Puerto Rico and California and Pennsylvania, according to

In the GO bond sector, the Puerto Rico Commonwealth 8s of 2035 were traded 31 times. In the revenue bond sector, the California Health Facilities Financing Authority 5s of 2027 were traded 83 times. And in the taxable bond sector, the California 2.367s of 2022 were traded 117 times.

Week's actively quoted issues

Puerto Rico, Illinois and California names were among the most actively quoted bonds in the week ended April 28, according to Markit.

On the bid side, the Puerto Rico Commonwealth GO 5s of 2041 were quoted by 49 unique dealers. On the ask side, the Illinois 6.63s of 2035 were quoted by 113 unique dealers. And among two-sided quotes, the California taxable 7.55s of 2039 were quoted by 22 unique dealers.

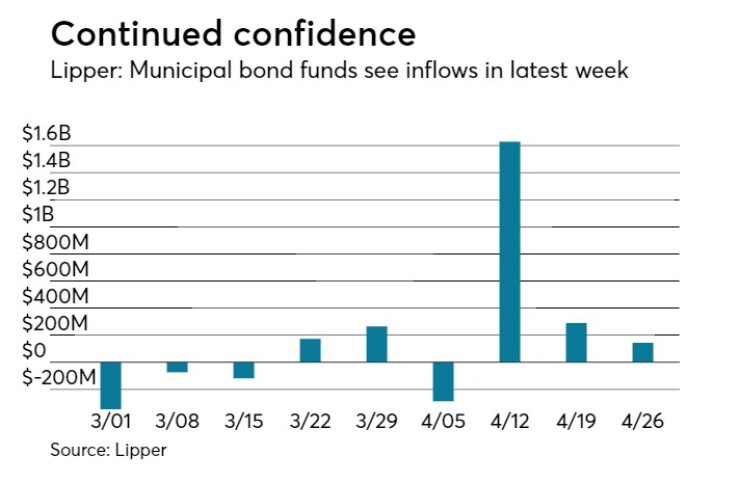

Lipper: Muni bond funds see inflows

Investors in municipal bond funds continued to put cash back into the funds in the latest week, according to Lipper data released late on Thursday.

The weekly reporters saw $144.519 million of inflows in the week ended April 26, after inflows of $290.227 million in the previous week.

The four-week moving average was still in the green at positive $443.814 million, after being positive at $473.945 million in the previous week. A moving average is an analytical tool used to smooth out price changes by filtering out fluctuations.

Long-term muni bond funds also had inflows, gaining $291.183 million in the latest week after rising $382.696 million in the previous week. Intermediate-term funds had outflows of $2.015 million after inflows of $129.744 million in the prior week.

National funds had inflows of $195.710 million after inflows of $317.247 million in the previous week. High-yield muni funds reported outflows of $129.979 million in the latest reporting week, after inflows of $227.034 million the previous week.

Exchange traded funds saw outflows of $72.246 million, after inflows of $96.644 million in the previous week.