The municipal bond market is getting a smaller-than-average taste of supply this week, even though the calendar is filled with a variety of new issues that are expected to receive a warm reception. Volume is estimated at $4.76 billion, comprised of $3.12 billion of negotiated deals and $1.64 billion of competitive sales.

The week got off to a quiet start, a New York trader said.

With a backdrop of stronger Treasury and equity markets dictating the course of financial markets — and investors holding their breath for higher rates — there wasn’t much activity to speak of as February wound down.

“I’m not seeing the retail participation yet,” the trader said Monday morning, adding the muni market needs guidance on where rates are headed.

And it didn’t get any livelier as the day wore on.

A Florida trader described the market as quiet on Monday afternoon, with few bid wanted lists circulating paper inside five years.

“We have had success bidding some odd lot positions,” he said.

This week institutional investors will be eyeing the large New York State Thruway Authority deal, as well as the pair of airport deals from Houston and Los Angeles.

Despite the sluggish retail demand, the municipal market was “hanging in there," the New York trader said. “There’s a better Treasury market, the percentages seem to be improving, and we don’t have that much supply pressure.”

BAML: YTD issuance down 41% from ‘17

Issuance for the year as of Feb. 22 was $32.5 billion, down 40.6% from the same period last year, Bank of America Merrill Lynch said in a report released on Monday.

Month-to-date issuance fell 34.6% from a year earlier to $12.2 billion, according to BAML.

The report said that 20.6% of the total issuance for the year has been related to total refundings, compared with 51% during the same period last year.

The report also looked at municipal performance compared to other fized-income investments.

The ICE BAML U.S. Municipal Securities Index returned -1.516% for the year to date, outperforming both the ICE BAML U.S. Treasury and Agency Index and the ICE BAML U.S. Corporate Index, which had total returns of -2.430% and -2.672%, respectively.

The best performance in munis so far this year has been in the one- year to three-year maturities and the BBB-rated sector, BAML said.

Primary Market

Baltimore County, Md., will competitively sell about $837 million of bonds and notes in four offerings this week. On Wednesday, the county will sell $225 million of general obligation metropolitan district bonds, 80th issue, and $121 million of 2018 GO consolidated public improvement bonds. On Thursday, the county will sell $246 million of Series 2018 consolidated public improvement general obligation bond anticipation notes and $245 million of Series 2018 metropolitan district general bond anticipation notes.

In the negotiated sector, Goldman Sachs will price Alabama’s Black Belt Energy Gas District’s $653 million of gas prepay revenue bonds for Project No. 3.

Also on tap, RBC Capital Markets will price the New York State Thruway Authority’s $600 million of Series L general revenue refunding bonds.

And two airports deals will be hitting the screens.

Bank of America Merrill Lynch is set to price Houston, Texas’ $417 million of airport system subordinate lien revenue and refunding bonds consisting of Series 2918A bonds subject to the alternative minimum tax and Series 2018B non-AMT bonds.

Barclays Capital is set to price the Los Angeles Department of Airports $376 million of Series 2018 AMT subordinate revenue bonds for Los Angeles International Airport.

Bond Buyer 30-day visible supply at $10.48B

The Bond Buyer's 30-day visible supply calendar increased $2.23 billion to $10.48 billion on Tuesday. The total is comprised of $3.61 billion of competitive sales and $6.86 billion of negotiated deals.

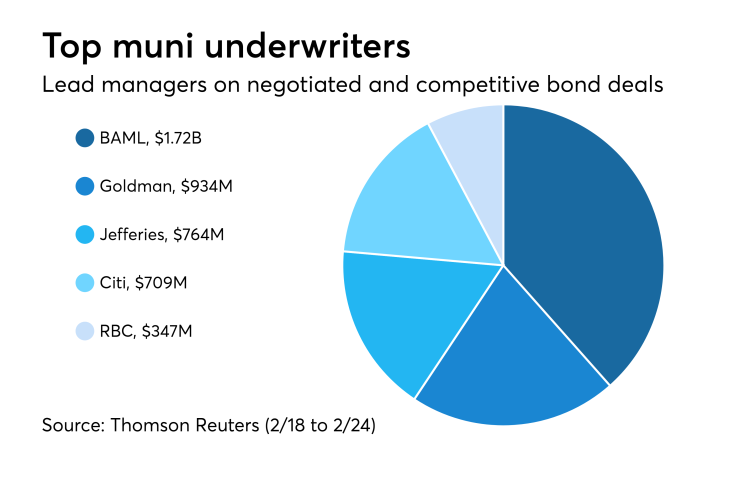

Previous week's top underwriters

The top municipal bond underwriters of last week included Bank of America Merrill Lynch, Goldman Sachs, Jefferies, Citigroup and RBC Capital Markets, according to Thomson Reuters data.

In the week of Feb. 18 to Feb. 24, BAML underwrote $1.72 billion, Goldman $934.3 million, Jefferies $763.5 million, Citi $709.3 million and RBC $347.4 million.

Previous session's activity

The Municipal Securities Rulemaking Board reported 42,324 trades on Friday on volume of $12.28 billion.

California, Texas and New York were the states with the most trades, with the Golden State taking 18.591% of the market, the Empire State taking 10.744% and the Lone Star State taking 9.43%.

Treasury auction, announcement

The Treasury Department said it will sell $60 billion of four-week discount bills Tuesday. There are currently $101.002 billion of four-week bills outstanding.

Tender rates for the Treasury's latest 91-day and 182-day discount bills were higher, as the three-months incurred a 1.645% high rate, up from 1.630% the prior week, and the six-months incurred a 1.830% high rate, up from 1.820% the week before. Coupon equivalents were 1.675% and 1.873%, respectively. The price for the 91s was 99.584181 and that for the 182s was 99.074833.

The median bid on the 91s was 1.615%. The low bid was 1.590%. Tenders at the high rate were allotted 19.08%. The bid-to-cover ratio was 2.84. The median bid for the 182s was 1.800%. The low bid was 1.770%. Tenders at the high rate were allotted 46.34%. The bid-to-cover ratio was 3.08.

Gary Siegel contributed to this report.

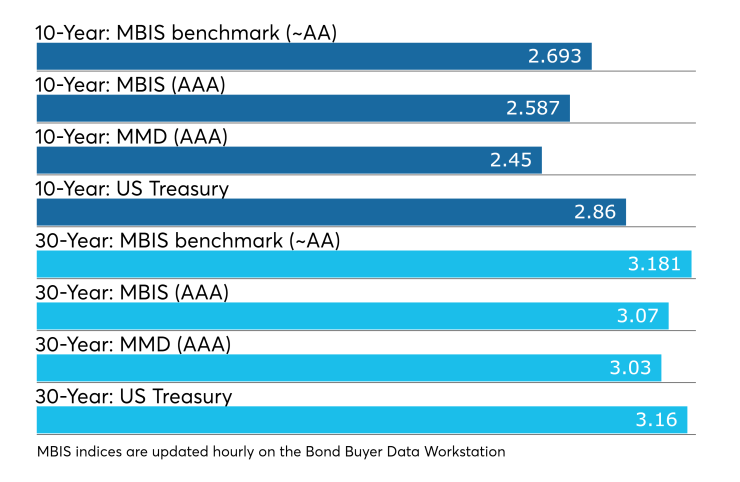

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.