Municipal bond supply takes a big leap forward during next week’s holiday-shortened trading since markets are closed on Monday for Veterans Day.

Ipreo forecasts weekly bond volume will increase to $7.3 billion from a revised total of $2.3 billion in the prior week, according to updated data from Thomson Reuters. The calendar is composed of $5.8 billion of negotiated deals and $1.5 billion of competitive sales.

Primary market

Bank of America Merrill Lynch is expected to price the Michigan Strategic Fund’s $595 million of limited obligation revenue bonds for the I-75 improvement project on Wednesday.

The deal is rated Baa2 by Moody’s Investors Service and BBB by Kroll Bond Rating Agency.

Wells Fargo Securities is set to price South Carolina Jobs and Economic Development’s $587 million of hospital revenue bonds for the Prisma Health Obligated Group on Wednesday.

The deal is rated A2 by Moody’s and A by S&P Global Ratings.

RBC Capital Markets is expected to price the Los Angeles Department of Water and Power’s $426 million of water system revenue bonds on Thursday after a one-day retail order period.

The deal is rated Aa2 by Moody’s, AA-plus by S&P and AA by Fitch Ratings.

BAML is set to price the New Jersey Economic Development Authority’s $401 million of school facilities construction and refunding bonds on Thursday.

The deal is rated Baa1 by Moody’s, BBB-plus by S&P and A-plus by Fitch.

In the competitive arena, the Wentzville R-IV School District, Mo., is selling $159.82 million of Series 2018 general obligation refunding and improvement bonds under the Missouri Direct Deposit program. Proceeds will be used to finance various school improvements and to current refund some outstanding debt.

The financial advisor is Stifel while the bond counsel is Thompson Coburn.

Bond Buyer 30-day visible supply at $9.01B

The Bond Buyer's 30-day visible supply calendar increased $2.06 billion to $9.01 billion for Friday. The total is comprised of $2.23 billion of competitive sales and $6.78 billion of negotiated deals.

Secondary market

Municipal bonds were stronger on Friday, according to a midday read of the MBIS benchmark scale. Benchmark muni yields dipped as much as two basis point in the two- to 30-year maturities while rising less than one basis point in the one-year maturity.

High-grade munis were stronger, with yields calculated on MBIS' AAA scale decreasing as much as two basis points across the curve.

Municipals were stronger on Municipal Market Data’s AAA benchmark scale, which showed the yield on both the 10-year muni general obligation and the yield on 30-year muni maturity falling one to three basis points.

Treasury bonds were stronger as stocks traded mixed. The Treasury 10-year stood at 3.181% while the Treasury 3-month bill was at 2.355%.

On Thursday, the 10-year muni-to-Treasury ratio was calculated at 85.7% while the 30-year muni-to-Treasury ratio stood at 100.6%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

Previous session's activity

The Municipal Securities Rulemaking Board reported 43,263 trades on Thursday on volume of $13.36 billion.

California, New York and Texas were the municipalities with the most trades, with the Golden State taking 18.265% of the market, the Empire State taking 14.512% and the Lone Star State taking 8.625%.

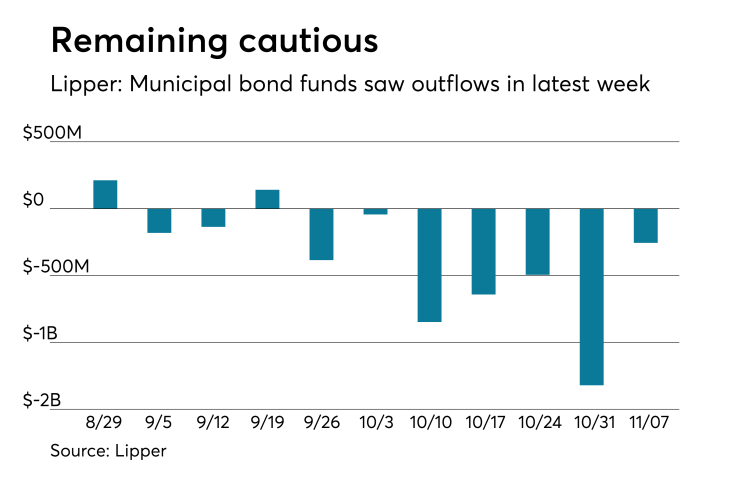

Lipper: Muni bond funds saw outflows

Investors in municipal bond funds remained cautious and again pulled cash out of the funds during the latest reporting week, according to Lipper data released on Thursday.

The weekly reporters saw $255.812 million of outflows in the week ended Nov. 7 after outflows of $1.321 billion in the previous week.

Exchange traded funds reported outflows of $89.409 million, after inflows of $105.897 million in the previous week. Ex-ETFs, muni funds saw $166.403 million of outflows, after outflows of $1.427 billion in the previous week.

The four-week moving average remained negative at -$678.357 million, after being in the red at -$826.368 million in the previous week. A moving average is an analytical tool used to smooth out price changes by filtering out fluctuations.

Long-term muni bond funds had outflows of $286.728 million in the latest week after outflows of $657.629 million in the previous week. Intermediate-term funds had outflows of $39.001 million after outflows of $500.907 million in the prior week.

National funds had outflows of $87.939 million after outflows of $1.009 billion in the previous week. High-yield muni funds reported outflows of $161.205 million in the latest week, after outflows of $511.540 million the previous week.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.