Municipal market volume is set to rise to a nine week high, as issuers tap into growing demand for the securities.

Ipreo estimates volume will surge to $9.36 billion, from a revised total of $4.88 billion in the past week, according to updated figures from Thomson Reuters. The calendar for the week ahead is composed of $7.82 billion of negotiated deals and $1.54 billion of competitive sales.

The last time estimated volume was higher was for the week ended March 10, where it was estimated at $10.2 billion.

“The spike in volume should be readily absorbed by a municipal market that is entering a technically stronger period of the next few months, as portfolios will be seeing high levels of cash returned from maturing bonds and coupon interest,” said Michael Pietronico, CEO of Miller Tabak Asset Management. “Demand should remain fairly steady as the economy is far from booming, and that keeps money coming into bonds on the margin.”

Bank of America Merrill Lynch is expected to run the books on the two largest deals of the week.

The first is for the County of Cuyahoga, Ohio’s $915 million of revenue bonds for the Metrohealth System Hospital. The deal is scheduled to price on Wednesday after a one-day retail order period and is rated Baa3 by Moody’s Investors Service and BBB-minus by S&P Global Ratings and Fitch Ratings.

Moody’s recently downgraded Cuyahoga citing "an unexpected and material increase in leverage relative to modest operating performance, while the system is executing new strategies and faces uncertainty regarding Medicaid funding. The rating is also constrained by significant competition in a consolidated market, high exposure to government payers, and construction risk associated with a large project.”

The second BAML deal is the State of Hawaii’s $856 million of general obligation bonds, which will also be priced on Wednesday following a one-day retail order period. This deal is rated Aa1 by Moody’s, AA-plus by S&P and AA by Fitch.

Citi is slated to price the Houston Independent School District’s $838 million of limited tax schoolhouse and refunding bonds. The deal is rated triple-A by Moody’s, S&P and Fitch.

The largest competitive sale is set to take place Wednesday, as the Southern California Metropolitan Water Department will sell 245.165 million of subordinate water revenue refunding bonds.

One other thing to take note of when looking over the calendar for the upcoming week is the green bonds that are sprouting up.

The New York MTA is expected to come with $300 million of climate bond certified green bonds, the city of Los Angeles will be coming with plus $300 million of green bonds, the city and county of Denver are expected to come with $173 million of green bonds and a portion of the upcoming San Francisco Bay Area Rapid Transit’s $388 million will be of the green bond variety.

Secondary market

Top rated municipal bonds ended flat on Friday after the release of a strong U.S. employment report for April. Non-farm payrolls rose 211,000 last month, higher than the 185,000 gain predicted in a survey of economists done by IFR Markets. The unemployment rate in April fell to 4.4%, the lowest since May 2001, and lower than the 4.5% rate predicted in IFR's survey.

The yield on the 10-year benchmark muni general obligation was steady from 2.17% on Thursday, while the 30-year GO yield was unchanged from 3.03%, according to the final read of Municipal Market Data's triple-A scale.

U.S. Treasuries were little changed on Friday. The yield on the two-year Treasury was unchanged from 1.31% on Thursday, while the 10-year Treasury yield was flat from 2.35%, and the yield on the 30-year Treasury bond decreased to 2.99% from 3.00%.

The 10-year muni to Treasury ratio was calculated at 92.3% on Friday, compared with 92.3% on Thursday, while the 30-year muni to Treasury ratio stood at 101.4%, versus 101.1%, according to MMD.

Week's actively traded issues

Some of the most actively traded issues by type in the week ended May 5 were from Georgia, Kentucky and Wisconsin, according to

In the GO bond sector, the Fulton County, Ga., 2s of 2017 were traded 19 times. In the revenue bond sector, the Kentucky Economic Development Finance Authority 4s of 2045 were traded 46 times. And in the taxable bond sector, the Wisconsin 3.154s of 2027 were traded 72 times.

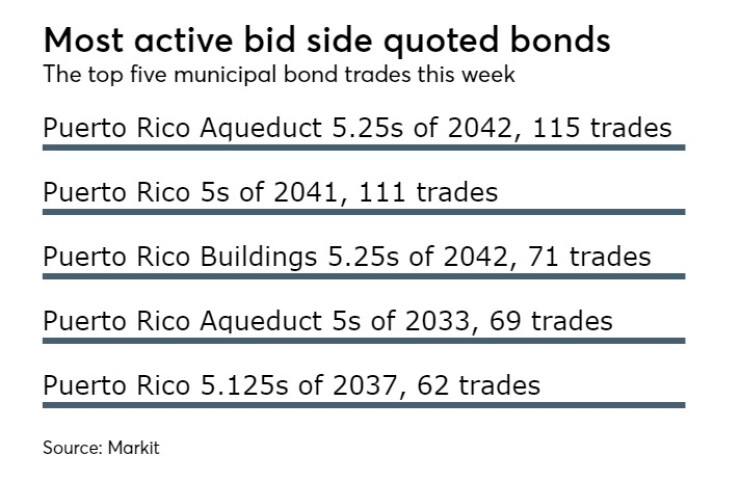

Week's actively quoted issues

Puerto Rico, Connecticut and New York & New Jersey names were among the most actively quoted bonds in the week ended May 5, according to Markit.

On the bid side, the Puerto Rico Aqueduct and Sewer Authority revenue 5.25s of 2042 were quoted by 115 unique dealers. On the ask side, Connecticut taxable 5.459s of 2030 were quoted by 76 unique dealers. And among two-sided quotes, the Port Authority of New York & New Jersey taxable 5s of 2039 were quoted by 22 unique dealers.

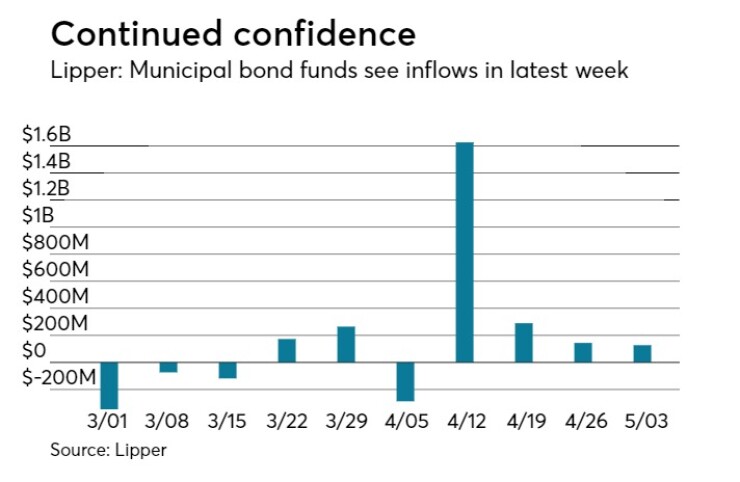

Lipper: Muni bond funds see inflows

Investors in municipal bond funds continued to put cash back into the funds in the latest week, according to Lipper data released late on Thursday.

The weekly reporters saw $127.783 million of inflows in the week ended April 26, after inflows of $144.519 million in the previous week.

The four-week moving average was still in the green at positive $547.560 million, after being positive at $443.814 million in the previous week. A moving average is an analytical tool used to smooth out price changes by filtering out fluctuations.

Long-term muni bond funds also had inflows, gaining $21.355 million in the latest week after rising $291.183 million in the previous week. Intermediate-term funds had outflows of $20.400 million after outflows of $2.015 million in the prior week.

National funds had inflows of $205.904 million after inflows of $195.710 million in the previous week. High-yield muni funds reported inflows of $36.671 million in the latest reporting week, after outflows of $129.979 million the previous week.

Exchange traded funds saw outflows of $21.160 million, after outflows of $72.246 million in the previous week.