Long-term municipal bond volume declined in April for the eighth consecutive month, as a rise in new-money issuance could not make up for a steep drop in refundings.

Total monthly volume for April fell 21% to $32.48 billion in 1,050 transactions from $41.10 billion in 1,380 transactions last April, according to data from Thomson Reuters.

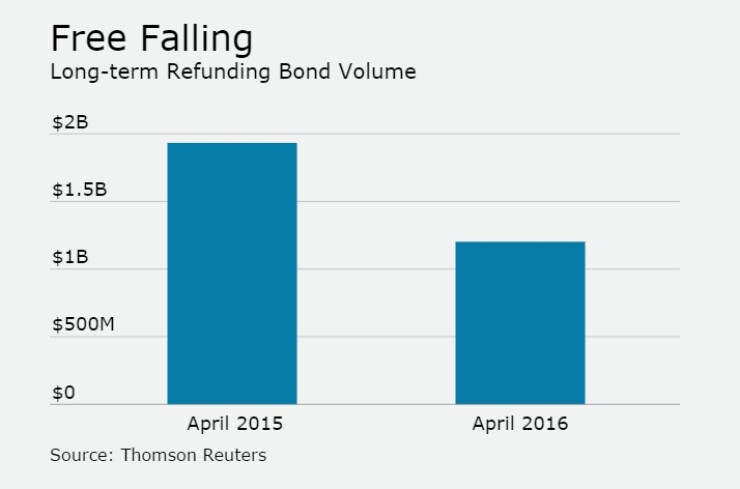

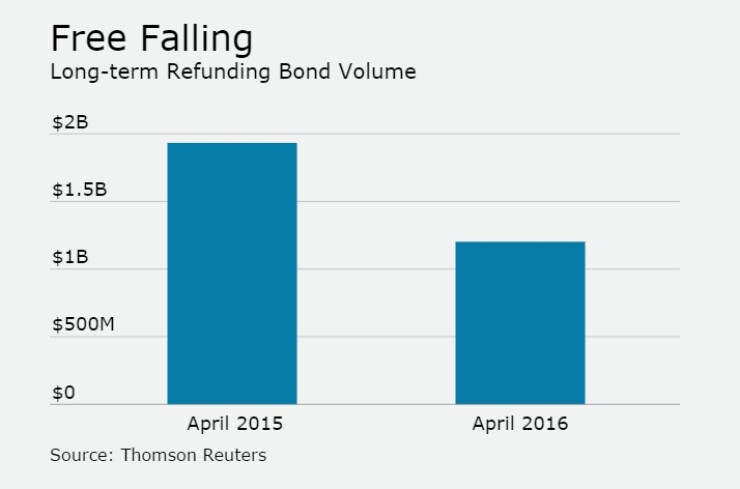

Refundings nose-dived 37.8% to $12.02 billion in 447 deals, down preciptiously from last April's $19.33 billion in 661 deals.

"The drop in refunding volume is most striking as we believe that the universe of outstanding bonds which is eligible for refundings is actually larger in 2016 versus 2015," said Vikram Rai, head of municipal strategy at Citi. "We examined the universe of outstanding bonds which is likely to be eligible for refunding in 2016 – and this depends on the longer dated bonds that were issued in 2006-07 – and by our estimates this number is about $252 billion. In contrast, by our estimates, this number was lower in 2015 at about $219 billion."

Rai said the year-over-year drop in refundings does not make sense. He said that typically a spike in long-dated rates leads to a drop in advance refundings as the savings decline dramatically when the curve steepens.

"We have seen that happen in the past, for instance in spring 2015. The drop is likely due to the volatility in the issuance calendar around Federal Open Market Committee meetings – owing to temporary knee-jerk reactions – which tends to have a cumulative effect of negatively impacting issuance," Rai said.

Jim Grabovac, managing director and senior portfolio manager at McDonnell Investment Management agreed with Rai.

"You would think that the overall conditions would be pretty ripe for refundings," said Grabovac. "If the Fed chooses to move forward in June, they should have conditions that are conducive for tightening."

Grabovac added that at this point in time, it's safe to say there will be 1-2 hikes this year but that, more importantly, he doesn't think it's going to be disruptive from a rates standpoint.

"Inflation is still below the Fed target and does not appear to be a problem to us. If they do act, it will impact mostly the short end and overall the curve will flatten," he said.

Rai said Citi still expects that refundings will pick-up because they expect the ultra-short rates to move up at a measured pace and high-grade yield curves should flatten as the 18- to 20-year part of the curve is likely to sell off less.

"This will alleviate the negative arbitrage associated with refundings as it will enhance the yield from the escrow account and thus provide some impetus to refunding deals," he said.

New-money deals rose 7.8% to $14.20 billion in 519 issues compared to $13.17 billion in 571 issues.

Combined new-money and refunding issuance dropped by 27.2 % to $6.26 billion from $8.59 billion.

Issuance of revenue bonds fell 26.2% to $18.33 billion, while general obligation bond sales declined 13% to $14.15 billion.

Negotiated deals were lower by 18.8% to $24.54 billion and competitive sales decreased by 19.9% to $7.58 billion.

Taxable bond volume was 44.3% lower at $1.89 billion, while tax-exempt issuance declined by 18.4% to $30.26 billion.

Bond insurance sunk 30% in April, as the volume of deals wrapped with insurance declined to $1.93 billion in 149 deals from $2.76 billion in 186 deals.

Variable-rate short put bonds dropped 32.8% to $374 million from $557 million. Variable-rate long or no put bonds shot up to $589 million from $74 million.

"Variable rate issuance short-put is down significantly and this is shows the continued decline of the VRDN market. On the other hand, issuance of long dated floating-rate notes is up significantly and this shows that issuers are tapping into the demand for FRNs – typically investor demand for FRNs rises with the fear of rising rates," said Rai.

All of the sectors posted declines year over year, with the exception of environmental facilities and healthcare, which posted modest gains to $410 million from $54 million and to $4.95 billion from $4.31 billion. All of the other sectors saw a drop of at least 13.6%, with the biggest decline coming in the electric power sector, which dropped to $423 million from $3.15 billion.

As far as the different entities that issue bonds, all saw negative year over year changes except colleges and universities, which posted a 72.4% improvement to $3.58 billion from $2.08 billion. The others saw a minimum loss of 11.8%, with the most notable drop coming from state agencies which fell 42.2% to $6.58 billion from $11.39 billion.

California remained the top issuer among states so far this year, followed by Texas, New York, Florida and Pennsylvania.

The Golden State so far this year has issued $21.14 billion, giving them a comfortable lead over the Lone Star State, which has issued $17.71 billion. The Empire State follows with $11.86 billion, followed by the Sunshine State with $7.02 billion. The Keystone State rounds out the top five with $4.22 billion.

Dawn Mangerson, managing director and senior portfolio manager at McDonnell added that it's nice to have the positive flows and that at least we are seeing demand for munis.

"Even though the total volume is as high as people we would like to be, we still have some nice-sized deals coming in as well as decent names," she said.