Municipal bond traders are taking a break on Friday as they get ready for the weekend and look ahead to next week's beefy new issue slate.

Secondary Market

U.S. Treasuries were weaker on Friday. The yield on the two-year Treasury rose to 0.73% from 0.71% on Thursday, the 10-year Treasury yield gained to 1.57% from 1.54% and the yield on the 30-year Treasury bond increased to 2.29% from 2.26%.

On Thursday, top rated municipals finished stronger. The yield on the 10-year benchmark muni general obligation fell one basis point to 1.40% from 1.41% on Wednesday, while the yield on the 30-year muni dropped one basis point to 2.12% from 2.13%, according to the final read of Municipal Market Data's triple-A scale.

The 10-year muni to Treasury ratio was calculated at 91.3% on Thursday compared to 90.7% on Wednesday, while the 30-year muni to Treasury ratio stood at 93.8% versus 94.0%, according to MMD.

MSRB: Previous Session's Activity

The Municipal Securities Rulemaking Board reported 35,266 trades on Thursday on volume of $14.72 billion.

Week's Most Actively Traded Issues

Some of the most actively traded issues by type in the week ended Aug. 19 were from Kentucky, New York and Illinois issuers, according to

In the GO bond sector, the Louisville and Jefferson County, Ky., Visitors and Convention Center 3 1/8s of 2041 were traded 22 times. In the revenue bond sector, the Brooklyn Arena Local Development Corp.'s Barclays Center 5s of 2042 were traded 129 times. And in the taxable bond sector, the Illinois 5.1s of 2033 were traded 66 times.

Week's Most Actively Quoted Issues

California, Pennsylvania and Illinois issues were among the most actively quoted names in the week ended Aug. 19, according to Markit.

On the bid side, the California taxable 7.55s of 2039 were quoted by 11 unique dealers. On the ask side, the Pennsylvania GO 3s of 2036 were quoted by 17 unique dealers. And among two-sided quotes, the Illinois taxable 5.1s of 2033 were quoted by 11 unique dealers.

Primary Market

The week's calendar didn't hit the year's weekly average, but wasn't too bad for a sleepy summer slate.

Goldman Sachs priced the Brooklyn Area Local Development Corp.'s $499 million deal for the Barclays Center, consisting of $483.45 million of Series 2016A tax-exempt and $15 million of Series 2016B taxable bonds backed by payments in lieu of taxes.

The bonds are rated Baa3 by Moody's Investors Service and BBB-minus by S&P Global Ratings, with the exceptions of the 2029, 2031 through 2036 and 2043 maturities, totaling $133.25 million, that are insured by Assured Guaranty Municipal.

Bank of America Merrill Lynch priced Honolulu City and County, Hawaii's $384.01 million of first bond resolution Senior Series 2016A wastewater system revenue bonds and Senior Series 2016B wastewater system revenue refunding bonds and $44.04 million of taxable Senior Series 2016C first bond resolution wastewater system revenue refunding and taxable Junior Series 2016A second bond resolution wastewater system revenue refunding bonds. The deal is rated Aa2 by Moody's and AA by Fitch Ratings.

Morgan Stanley priced the New Jersey Healthcare Facilities Financing Authority's $248.53 million of Series 2016 revenue bonds for the St. Joseph's Healthcare System Obligated Group. The deal is rated Baa3 by Moody's and BBB-minus by S&P.

Barclays Capital priced the Port of Tacoma, Wash.'s three series of bonds totaling $245.62 million, consisting of $35.97 million of Series 2016A revenue refunding bonds, not subject to the alternative minimum tax; $103.06 million of Series 2016B revenue and refunding AMT bonds; and $106.59 million of Series 2016A limited tax general obligation refunding non-AMT bonds.

The Series 2016A non-AMT and Series 2016B AMT bonds are rated Aa3 by Moody's and AA-minus by S&P. The Series 2016A non-AMT deal is rated Aa2 by Moody's and AA by S&P.

BAML priced the Boston Water and Sewer Commission's $146.05 million of Series 2016A&B senior series general revenue and refunding bonds. The deal is rated Aa1 by Moody's and AA-plus by S&P.

HilltopSecurities priced the Grapevine-Colleyville Independent School District, Texas $157.7 million of Series 2016 unlimited tax school building bonds. The deal, which is backed by the Permanent School Fund guarantee program, is rated triple-A by Moody's and S&P.

Goldman priced the Irvine Ranch Water District, Calif.'s $117.51 million of Series 2016 certificates of participation. The deal is rated triple-A by S&P and Fitch.

In the competitive arena, the Los Angeles Unified School District, Calif., sold $455.44 million of Series 2016B general obligation refunding, dedicated unlimited ad valorem property tax bonds. Morgan Stanley won the issue with a true interest cost of 2.29%. The deal is rated Aa2 by Moody's and AAA by Fitch.

In the competitive arena, the Louisville and Jefferson County Visitors and Convention Commission, Ky., sold $138.59 million of Series 2016 dedicated tax revenue bonds. BAML won the bonds with a TIC of 3.22%.

The deal is rated A2 by Moody's and A by S&P except for the $36.46 million of the 2046 maturity which is insured by Assured Guaranty Municipal and rated A2 by Moody's and AA by S&P.

Bond Buyer Visible Supply

The Bond Buyer's 30-day visible supply calendar increased $1.74 billion to $13.29 billion on Friday. The total is comprised of $4.37 billion of competitive sales and $8.92 billion of negotiated deals.

Lipper: Muni Bond Funds See Inflows

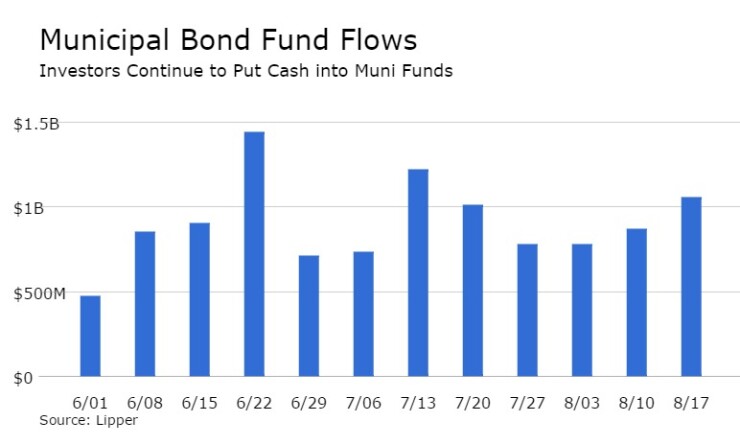

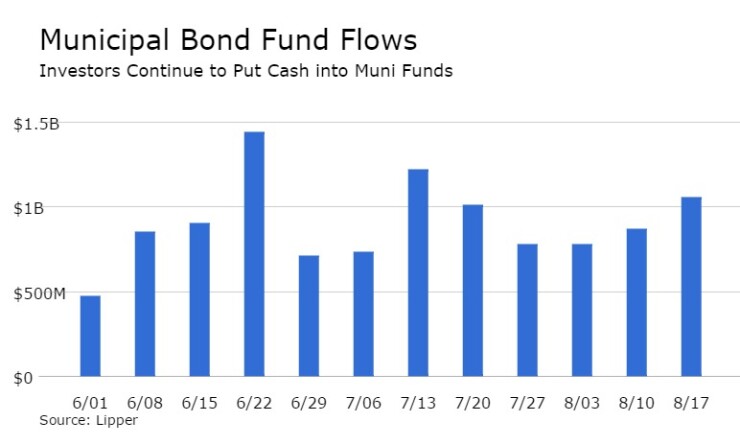

For the 46th straight week, municipal bond funds reported inflows, according to Lipper data released on Thursday.

The weekly reporters saw $1.059 billion of inflows in the week ended Aug. 17, after inflows of $871.013 million in the previous week, Lipper said.

The four-week moving average remained positive at $874.145 billion after being in the green at $862.893 million in the previous week. A moving average is an analytical tool used to smooth out price changes by filtering out fluctuations.

Long-term muni bond funds experienced inflows, gaining $650.811 million in the latest week after inflows of $582.341 million in the previous week. Intermediate-term funds had inflows of $147.707 million after inflows of $124.228 million in the prior week.

National funds had inflows of $879.368 million on top of inflows of $754.059 million in the previous week. High-yield muni funds reported inflows of $253.987 million in the latest reporting week, after inflows of $287.447 million the previous week.

Exchange traded funds saw inflows of $125.347 million, after inflows of $90.117 million in the previous week.