Municipal bond traders are set to see a more hefty new issue slate coming at them this week. Total volume is estimated at $7.49 billion in a calendar comprised of $6.13 billion of negotiated deals and $1.36 billion of competitive sales.

Secondary Market

U.S. Treasuries were stronger on Monday. The yield on the two-year Treasury declined to 1.17% from 1.21% on Thursday, while the 10-year Treasury dropped to 2.43% from 2.49%, and the yield on the 30-year Treasury bond decreased to 3.06% from 3.12%.

Top-rated municipal bonds were flat on Friday. The 10-year benchmark muni general obligation yield was unchanged from 2.33% on Thursday, while the yield on the 30-year GO was flat from 3.09%, according to the final read of Municipal Market Data's triple-A scale.

On Friday, the 10-year muni to Treasury ratio was calculated at 93.6% compared to 94.3% on Thursday, while the 30-year muni to Treasury ratio stood at 99.3%, versus 100.2%, according to MMD.

MSRB: Previous Session's Activity

The Municipal Securities Rulemaking Board reported 39,450 trades on Friday on volume of $9.49 billion.

Prior Week's Actively Traded Issues

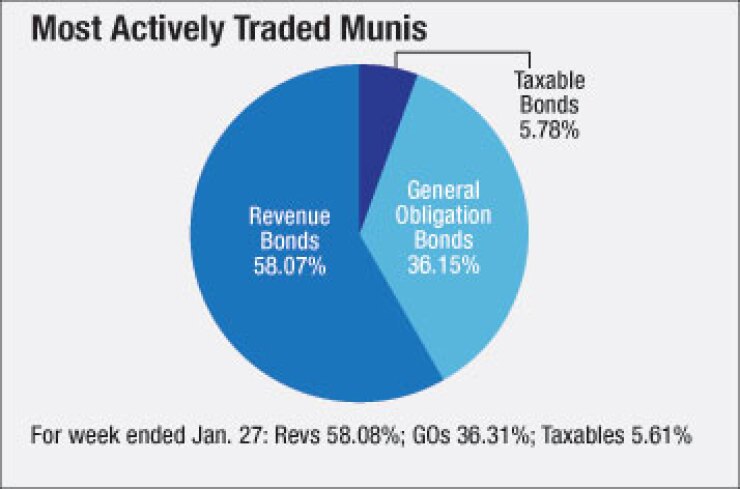

Revenue bonds comprised 58.07% of new issuance in the week ended Feb. 3, down from 58.08% in the previous week, according to

Some of the most actively traded issues by type in the week were from Illinois and New York.

In the GO bond sector, the Chicago, Ill., 6s of 2038 were traded 37 times. In the revenue bond sector, the New York City Municipal Water Finance Authority 5s of 2047 were traded 134 times. And in the taxable bond sector, the Westchester County, N.Y., 1.5s of 2017 were traded 31 times.

Previous Week's Top Underwriters

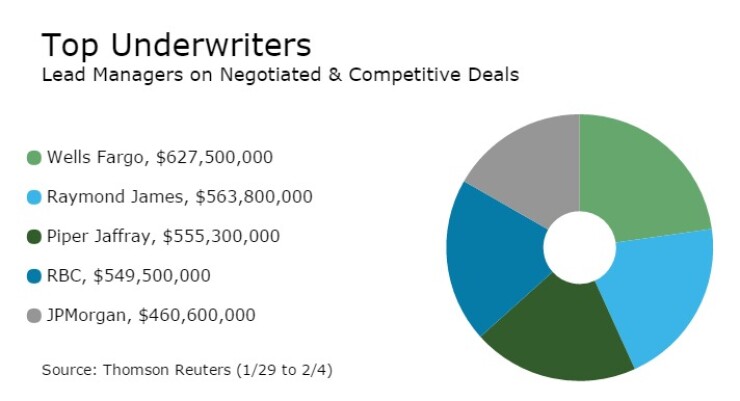

The top negotiated and competitive underwriters of last week included Wells Fargo Securities, Raymond James, Piper Jaffray, RBC Capital Markets and JPMorgan Securities, according to Thomson Reuters data.

In the week of Jan. 29 to Feb. 4, Wells Fargo underwrote $627.5 million, Raymond James $563.8 million, Piper $555.3 million, RBC $549.5 million and JPMorgan $460.6 million.

Primary Market

On Monday, Citigroup held the second day of a two-day retail order period for New York City's $800 million of Fiscal 2017 Series C and D general obligation bonds ahead of the institutional pricing on Tuesday.

The $780.89 million of Fiscal 2017 Series C bonds were priced on Monday for retail to yield from 1.29% with 3% and 5% coupons in a split 2019 maturity to 3% at par in 2029; a 2018 maturity was offered as a sealed bid.

The $19.18 million of Fiscal 2017 Series D bonds were priced for retail on Monday to yield from 1.29% with a 3% coupon in 2019 to 3% at par in 2029; the 2017 and 2018 maturities were offered as sealed bids.

The deal is rated Aa2 by Moody's and AA by S&P and Fitch.

Topping the week's slate is a $1.15 billion deal from the Trustees of California State University. Goldman Sachs is set to price the taxable and tax-exempt systemwide revenue bonds for institutions on Wednesday. The deal is rated Aa2 by Moody's Investors Service and AA-minus by S&P Global Ratings.

On Wednesday, Citi is expected to price the Salt Lake Department of Airports' $952 million of airport revenue bonds, consisting of Series 2017A bonds subject to the alternative minimum tax and Series 2017B non-AMT bonds. The deal is rated A2 by Moody's and A-plus by S&P.

Citi is also expected to price the state of Oregon's $491 million of tax-exempt and taxable GOs for state seismic and energy projects. The taxables are seen being priced on Tuesday while the tax-exempts are set for Wednesday. The deal is rated Aa1 by Moody's and AA-plus by S&P and Fitch.

In the competitive arena, the biggest bond sale is coming from the Fairfax County Water Authority, Va., which is selling $198.58 million of water revenue and refunding revenue bonds on Thursday. The deal is rated triple-A by Moody's, S&P and Fitch.

In the short-term competitive sector, the New York Metropolitan Transportation Authority is set to sell $700 million of notes in two separate sales on Wednesday. The offerings consist of $500 million of Series 2017 Subseries 2017A-1 transportation revenue bond anticipation notes and $200 million of Series 2017 Subseries 2017B-1 transportation revenue bond anticipation notes. The BANs are rated MIG1 by Moody's, SP1-plus by S&P and F1 by Fitch.

Bond Buyer Visible Supply

The Bond Buyer's 30-day visible supply calendar increased $79.2 million to $10.62 billion on Monday. The total is comprised of $2.02 billion of competitive sales and $8.60 billion of negotiated deals.