The municipal bond market returns to work on Tuesday, the first trading day of 2017. Traders are set to see a $3 billion new issue slate this week, with the calendar composed of $2.92 billion of negotiated deals and $84.2 million of competitive sales.

Secondary Market

U.S. Treasuries were weaker on Tuesday. The yield on the two-year Treasury rose to 1.24% from 1.19% on Friday, while the 10-year Treasury yield gained to 2.50% from 2.44%, and the yield on the 30-year Treasury bond increased to 3.11% from 3.06%.

Top-quality municipal bonds ended stronger on Friday. The 10-year benchmark muni general obligation yield fell two basis points at 2.31% from 2.33% on Thursday, while the yield on the 30-year GO fell one basis point to 3.04% from 3.05%, according to the final read of Municipal Market Data's triple-A scale.

On Friday, the 10-year muni to Treasury ratio was calculated at 94.6% compared with 94.1% on Thursday, while the 30-year muni to Treasury ratio stood at 99.3%, versus 99.0%, according to MMD.

MSRB: Previous Session's Activity

The Municipal Securities Rulemaking Board reported 21,702 trades on Friday on volume of $6.55 billion.

Prior Week's Actively Traded Issues

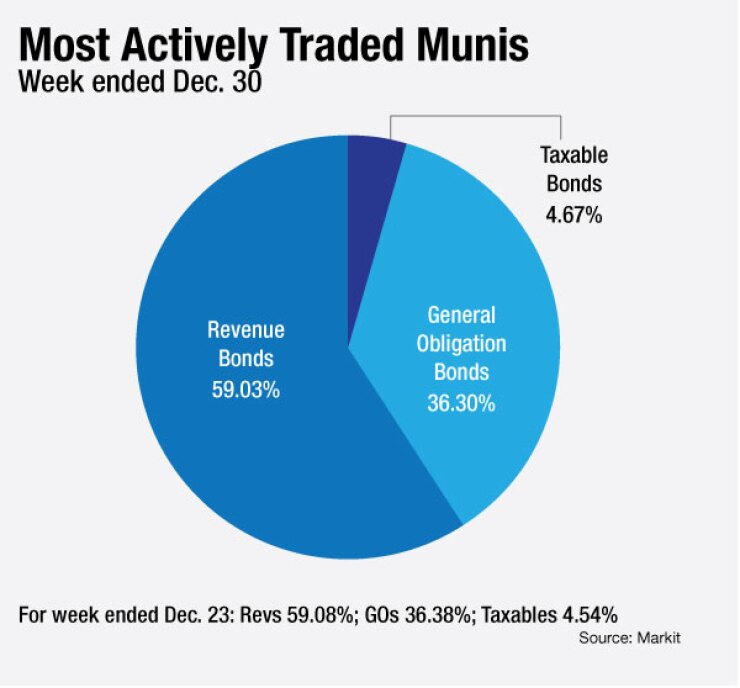

Revenue bonds comprised 59.03% of new issuance in the week ended Dec. 23, down from 59.08% in the previous week, according to

General obligation bonds comprised 36.30% of total issuance, down from 35.38%, while taxable bonds made up 4.67%, up from 4.54%.

Some of the most actively traded issues by type were from New York, California and Connecticut.

In the GO bond sector, the New York City zeroes of 2038 were traded 24 times. In the revenue bond sector, the California Municipal Finance Authority 0.65s of 2021 were traded 22 times. And in the taxable bond sector, the Connecticut 2.52s of 2025 were traded seven times.

Primary Market

Action will be subdued on Tuesday and Wednesday and really only get underway in earnest on Thursday.

Barclays Capital is set to price the Board of Regents of the Texas State University System's $570.83 million of Series 2017A revenue financing system revenue and refunding bonds on Thursday. The deal is rated Aa2 by Moody's Investors Service and AA by Fitch Ratings.

JPMorgan Securities is expected to price the Board of Regents of the University of North Texas' $214.92 million of Series 2017A revenue financing system refunding and improvement bonds on Thursday. The deal is rated Aa2 by Moody's and AA by Fitch.

Barclays is set to price the Board of Regents of the University of North Texas' $164.99 million of Series 2017B taxable revenue financing and improvement bonds on Thursday. The deal is rated Aa2 by Moody's and AA by Fitch.

Wells Fargo Securities is expected to price the University of Pittsburgh, Pa.'s $525 million of Series 2017A taxable university refunding bonds on Thursday. The deal is rated Aa1 by Moody's and AA-plus by S&P Global Ratings.

Wells Fargo is also set to price the District of Columbia's $311.52 million of Series 2017 refunding revenue bonds for Georgetown University on Thursday. The deal is rated A2 by Moody's and A by S&P.

Piper Jaffray is expected to price the El Paso Independent School District, Texas' $184.09 million of unlimited tax school building bonds on Thursday. The deal is rated Aaa by Moody's.

Piper is also set to price the Ysleta Independent School District, Texas' $171.38 million of unlimited tax school building general obligation bonds on Wednesday. The deal is rated triple-A by Moody's and S&P.

In the short-term competitive arena, Colorado is selling $375 million of Series 2016B education loan program tax and revenue anticipation notes next Thursday. The deal is rated MIG1 by Moody's and SP1-plus by S&P.

Bond Buyer Visible Supply

The Bond Buyer's 30-day visible supply calendar increased $202.4 million to $9.62 billion on Tuesday. The total is comprised of $1.77 billion of competitive sales and $7.86 billion of negotiated deals.