Municipal bond traders are set to see some of the largest deals of the week hit the screens on Wednesday, topped by a $1.5 billion sale for Harvard University.

Secondary Market

Treasuries were narrowly mixed on Wednesday. The yield on the two-year Treasury was unchanged from 0.82% on Tuesday, the 10-year Treasury yield gained to 1.69% from 1.68% and the yield on the 30-year Treasury bond increased to 2.42% from 2.40%.

Top-quality municipal bonds finished weaker on Tuesday. The yield on the 10-year benchmark muni general obligation rose three basis points to 1.55% from 1.52% on Monday, while the yield on the 30-year gained five basis points to 2.36% from 2.31%, according to the final read of Municipal Market Data's triple-A scale.

On Tuesday, the 10-year muni to Treasury ratio was calculated at 92.2% compared to 93.7% on Monday, while the 30-year muni to Treasury ratio stood at 98.2% versus 98.9%, according to MMD.

MSRB: Previous Session's Activity

The Municipal Securities Rulemaking Board reported 38,062 trades on Tuesday on volume of $10.62 billion.

Primary Market

On Wednesday, the biggest deal of the week will be coming from the Massachusetts Development Finance Agency.

Goldman Sachs is set to price the DFA's $1.54 billion of Series 2016A revenue bonds for Harvard University. The deal is rated triple-A by Moody's Investors Service and S&P Global Ratings.

Loop Capital Markets is set to price the California State Public Works Board's $527.54 million of Series 2016 C&D various projects lease revenue refunding bonds for institutions on Wednesday after a one-day retail order period.

For retail, the $313.2 million of Series 2016C bonds were priced as 5s to yield from 1.09% in 2020 to 2.49% in 2034. The $214.34 million of Series 2016D bonds were priced to yield from 0.86% with a 3% coupon in 2017 to 2.74% with a 4% coupon and at par with a 3% coupon in a split 2034 maturity.

The bonds are rated A1 by Moody's and A-plus by S&P and Fitch; the issue carries stable outlooks from all three agencies.

Also Wednesday, Morgan Stanley is expected to price the Tarrant County Cultural Education Facilities Finance Corp., Texas' $631.62 million of Series 2016A revenue bonds for the Texas Health Resources System.

Bank of America Merrill Lynch is set to price the Georgia Housing and Finance Authority's $117 million of Series 2016B-1 non-AMT and Series 2016B-2 single-family mortgage bonds. The deal is rated triple-A by S&P.

In the competitive arena on Wednesday, Wisconsin is selling about $325 million of Series 2016D general obligation bonds. The last time the state competitively sold comparable bonds was on July 12 when Morgan Stanley won $83.98 million of Series 2016B GOs with a true interest cost of 0.99%.

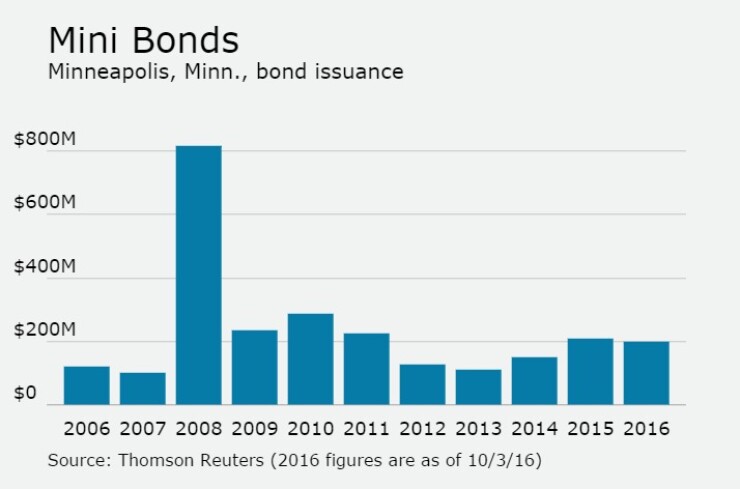

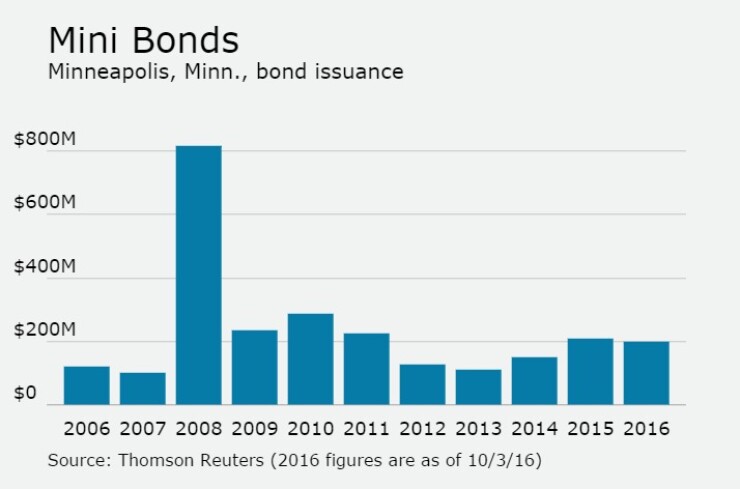

Also in the Midwest, Minneapolis, Minn., is competitively selling $120 million of Series 2016 GO improvement and various purpose bonds on Wednesday. The deal is rated Aa1 by Moody's and triple-A by S&P and Fitch. The last time the city competitively sold comparable bonds was on Nov. 18, 2014, when Citigroup won $37.4 million of Series 2014 GOs with a TIC of 0.52%.

Since 2006, Minneapolis has issued roughly $2.6 billion of bonds with the largest issuance occurring in 2008 when it sold $818 million of debt. During the same period, the City of Lakes sold the least amount of debt in 2007, when it issued $100.4 million of bonds.

Bond Buyer Visible Supply

The Bond Buyer's 30-day visible supply calendar increased $35.8 million to $21.58 billion on Wednesday. The total is comprised of $3.99 billion of competitive sales and $17.59 billion of negotiated deals.