The municipal bond market on Monday is prepared for the upcoming week's $8.5 billion new issue slate while it eyes the Federal Reserve, which will be gathering in Washington for its monetary policy meeting.

Secondary Market

Treasuries were little changed on Monday morning. The yield on the two-year Treasury dipped to 0.76% from 0.77% on Friday, the 10-year Treasury yield was unchanged from 1.70% and the yield on the 30-year Treasury bond was flat at 2.45%.

The Federal Open Market Committee is meeting on Tuesday and Wednesday to decide the course of monetary policy. Most market observers believe the Fed will do nothing to change the fed funds target rate at this meeting, but are divided as to whether the Fed will raise interest rates before the end of this year.

"The September and November meetings are unlikely to produce a rate hike, but the December meeting is still 50-50," said The Bond Buyer's Fed Watcher Gary Siegel. "It's really too early to tell about December. Too much can happen between now and then."

Top-quality municipal bonds ended unchanged on Friday, according to traders. The yield on the 10-year benchmark muni general obligation was steady from 1.57% on Thursday, while the yield on the 30-year was flat from 2.31%, according to the final read of Municipal Market Data's triple-A scale.

On Friday, the 10-year muni to Treasury ratio was calculated at 92.5% compared to 92.6% on Thursday, while the 30-year muni to Treasury ratio stood at 94.4% versus 93.6%, according to MMD.

MSRB: Previous Session's Activity

The Municipal Securities Rulemaking Board reported 31,350 trades on Friday on volume of $15.38 billion.

Prior Week's Actively Traded Issues

Revenue bonds comprised 53.97% of new issuance in the week ended Sept. 16, up from 51.47% in the previous week, according to

Some of the most actively traded issues by type in the week were from California and Michigan issuers.

In the GO bond sector, the Los Angeles, Calif. 2s of 2017 were traded 29 times. In the revenue bond sector, the Michigan Finance Authority 4s of 2046 were traded 52 times. And in the taxable bond sector, the California Department of Water Resources 2s of 2022 were traded 61 times.

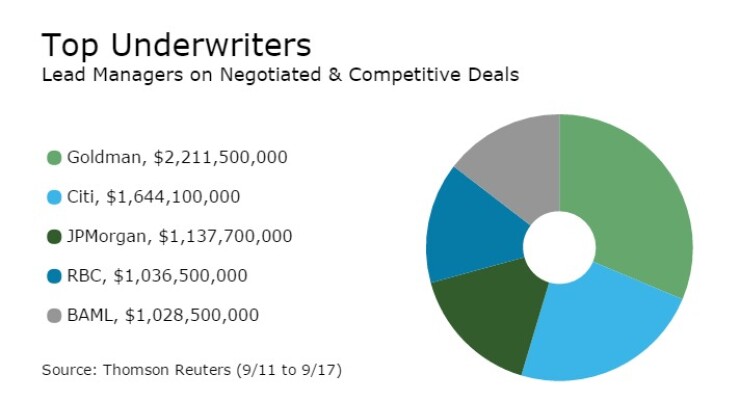

Previous Week's Top Underwriters

The top negotiated and competitive underwriters of last week included Goldman Sachs, Citigroup, JPMorgan Securities, RBC Capital Markets and Bank of America Merrill Lynch, according to Thomson Reuters data. In the week of Sept. 11-Sept. 17, Goldman underwrote $2.21 billion, Citi $1.64 billion, JPMorgan $1.14 billion, RBC $1.04 billion and BAML $1.03 billion.

Primary Market

Ipreo estimates this week's volume at $8.45 billion, down from $11.31 billion last week, according to revised data from Thomson Reuters. The upcoming calendar is composed of $6.29 billion of negotiated deals and $2.16 billion of competitive sales.

Bank of America Merrill Lynch is expected to price the Providence St. Joseph Health Obligated Groups' $700 million of taxable bonds on Monday.

The deal is rated Aa3 by Moody's Investors Service and AA-minus by S&P Global Ratings and Fitch Ratings.

Goldman Sachs is set to price the Pennsylvania Turnpike Commission's $649.89 million of subordinate revenue refunding bonds on Tuesday.

The deal is expected to consist of $391.52 million of Subseries A bonds, $82.17 million of Subseries B taxables and $176.2 million of motor license fund enhanced bonds. The two Subseries are rated A3 by Moody's and A-minus by Fitch, while the enhanced motor license series is rated A2 by Moody's and A-minus by Fitch.

BAML is expected to price the Texas Water Development Board's $575 million of State Water Implementation Revenue Fund for Texas revenue bonds master trust on Tuesday, following a one-day retail order period. The SWIRFT bonds are rated AAA by S&P and Fitch Ratings.

Barclays Capital is expected to price the Georgia Private Colleges and Universities Authority's $328.78 million of Series 20216A&B revenue bonds for Emory University on Tuesday. The deal is rated Aa2 by Moody's, AA by S&P and AA-plus by Fitch.

In the competitive arena, the Dormitory Authority of the State of New York is selling over $1 billion of bonds this week.

DASNY will offer three separate sales on Thursday, consisting of $409.16 million Series 2016A Group A state sales tax revenue bonds; $396.83 million of Series 2016A Group C state sales tax revenue bonds; and $310.94 million of Series 2016A Group B state sales tax revenue bonds.

Another New York issuer is also coming with a large competitive deal this week.

The New York City Municipal Water Finance Authority is scheduled to competitively sell $200 million of water and sewer system second general resolution revenue bonds on Tuesday. The deal is rated AA-plus by Fitch.

Bond Buyer Visible Supply

The Bond Buyer's 30-day visible supply calendar increased $570.5 million to $13.63 billion on Monday. The total is comprised of $4.29 billion of competitive sales and $9.34 billion of negotiated deals.