Municipal bond traders are returning to work after the long holiday weekend, ready to tackle a hefty $11.5 billion new issue slate.

Secondary Market

U.S. Treasuries were weaker on Monday morning. The yield on the two-year rose to 0.98% from 0.90% on Thursday, the 10-year Treasury jumped up to 2.24% from 2.11% and the yield on the 30-year Treasury bond increased to 3.01% from 2.92%.

Top-shelf municipal bonds finished weaker on Thursday. The yield on the 10-year benchmark muni general obligation rose eight basis points to 1.94% from 1.86% on Wednesday, while the yield on the 30-year increased seven basis points to 2.76% from 2.69%, according to the final read of Municipal Market Data's triple-A scale.

The 10-year muni to Treasury ratio was calculated at 91.7% on Thursday compared to 89.9% on Wednesday, while the 30-year muni to Treasury ratio stood at 94.3% versus 93.6%, according to MMD.

MSRB: Previous Session's Activity

The Municipal Securities Rulemaking Board reported 36,183 trades on Thursday on volume of $10.290 billion.

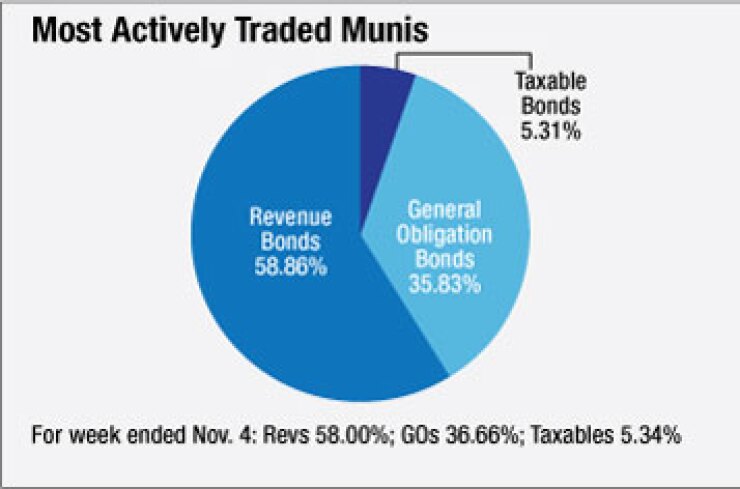

Prior Week's Actively Traded Issues

Revenue bonds comprised 58.86% of new issuance in the week ended Nov. 10, up from 58.00% in the previous week, according to

Some of the most actively traded issues by type were from Puerto Rico, Illinois and Florida. In the GO bond sector, the Puerto Rico Commonwealth 5s of 2041 were traded 21 times. In the revenue bond sector, Chicago O'Hare International Airport 5s of 2041 were traded 42 times. And in the taxable bond sector, the Sumter Landing Community Development District, Fla., 4.172s of 2047 were traded 37 times.

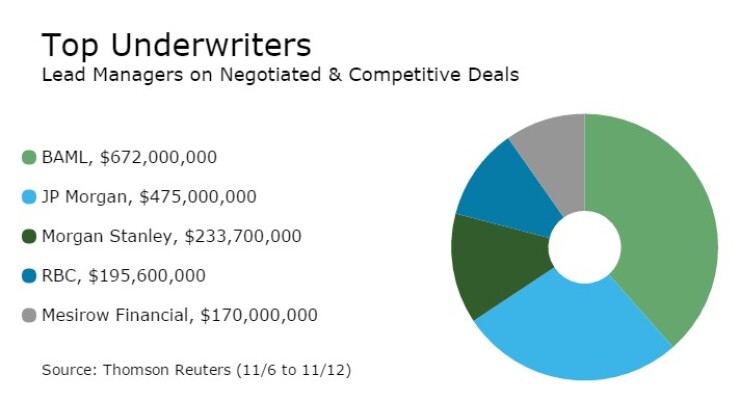

Previous Week's Top Underwriters

The top negotiated and competitive underwriters of last week included Bank of America Merrill Lynch, JPMorgan, Morgan Stanley, RBC Capital Markets and Mesirow Financial, according to Thomson Reuters data. In the week of Nov. 6-Nov. 12, BAML underwrote $672 million, JPM $475 million, Morgan Stanley $233.7 million, RBC $196 million and Mesirow $170 million.

Primary Market

This week's calendar consists of $8.9 billion of negotiated deals and $2.7 billion of competitive sales.

Topping the new issue calendar is the TSASC Inc.'s $1.02 billion tobacco settlement bond deal.

Jefferies is set to price the New York deal for retail investors on Tuesday followed by the institutional pricing on Wednesday.

The issue will consist of $584.39 million of Fiscal 2017 Series A Senior bonds and $440 million of Fiscal 2017 Series B Subordinate bonds. Proceeds will primarily be used to refund TSASC's outstanding bonds.

TSASC is a local development corporation that issues debt secured by tobacco settlement revenues, which cigarette companies pay as part of the 1998 master settlement agreement with 46 states.

According to the preliminary official statement, S&P Global Ratings is expected to assign various ratings for different maturities in the issue, ranging from A and A-minus to BBB-plus for some of the senior bonds and BBB for some maturities of the subordinate bonds.

Morgan Stanley is expected to price the Salt River Agricultural Improvement and Power District, Ariz.'s $719.82 million of Series 2016A refunding revenue bonds for the Salt River Project Electric System on Wednesday.

The deal is rated Aa1 by Moody's Investors Service and AA by S&P.

RBC Capital Markets is set to price the Los Angeles Department of Airports' $661.88 million of Series 2016B subordinate revenue bonds, subject to the alternative minimum tax, Series 2016C taxable senior refunding revenue bonds on Tuesday.

The Series 2016B bonds are rated A1 by Moody's and AA-minus by S&P and Fitch and the Series 2016C bonds are rated Aa3 by Moody's and AA by S&P and Fitch.

Bank of America Merrill Lynch is expected to price the Los Angeles County Metropolitan Transportation Authority's $515 million of Series 2016A Measure R senior sales tax revenue bonds on Tuesday. The deal is rated Aa1 by Moody's.

In the competitive arena, the Washington Suburban Sanitary District, Md., is selling $537.01 million of bonds in two separate offerings on Tuesday.

The deals consist of $381.81 million of consolidated public improvement bonds of 2016, Second Series, and $155.2 million of consolidated public improvement refunding bonds of 2016, Second Series.

Both sales are rated triple-A by Moody's, S&P and Fitch Ratings.

On Thursday, Clark County School District., Nev., is selling $510 million of bonds in three separate offerings.

The deals consist of $405.16 million of Series 2016D limited tax general obligation refunding bonds, $57.7 million of Series 2016E limited tax GO refunding bonds additionally secured by pledged revenues, and $47.99 million of Series 2016F limited tac GO various purpose medium-term bonds.

The deals are rated A1 by Moody's and AA-minus by S&P.

Week's Most Actively Quoted Issues

Minnesota, New Jersey and California issues were among the most actively quoted bonds in the week ended Nov. 10, according to Markit.

On the bid side, the Minneapolis & St. Paul Metropolitan Airports Commission revenue 5s of 2020 were quoted by 593 unique dealers. On the ask side, the New Jersey Transportation Trust Fund Authority taxable 4.1s of 2031 were quoted by 189 unique dealers. And among two-sided quotes, the California taxable 7.3s of 2039 were quoted by 13 unique dealers.

Bond Buyer Visible Supply

The Bond Buyer's 30-day visible supply calendar increased $572.9 million to $15.21 billion on Monday. The total is comprised of $3.68 billion of competitive sales and $11.53 billion of negotiated deals.

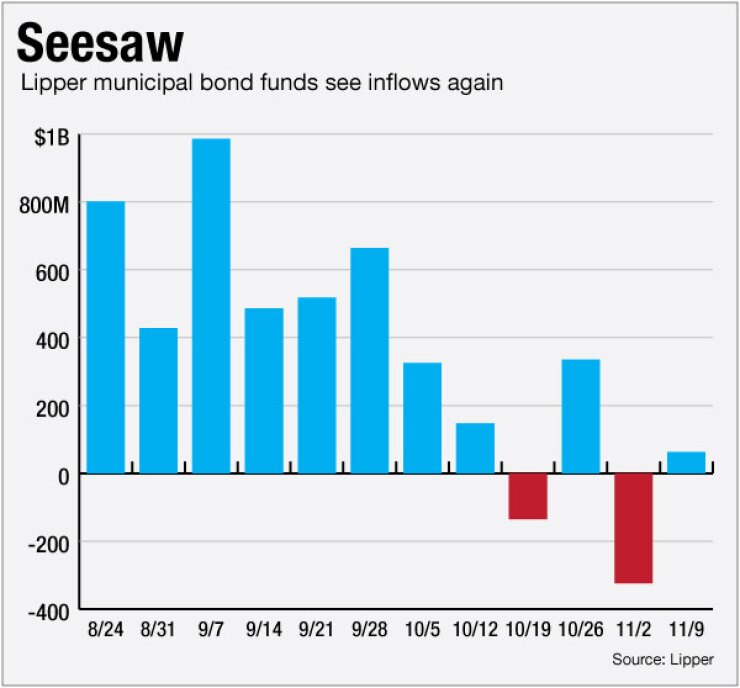

Lipper: Muni Bond Funds See Inflows

Municipal bond funds again saw inflows as investors put cash back into the market, according to Lipper data released late Thursday.

The weekly reporters saw $62.837 million of inflows in the week ended Nov. 9, after outflows of $323.644 million in the previous week.

The four-week moving average turned negative at -$15.457 million after being in the green at $5.662 million in the previous week. A moving average is an analytical tool used to smooth out price changes by filtering out fluctuations.

Long-term muni bond funds experienced inflows, gaining $19.396 million in the latest week after outflows of $297.795 million in the previous week. Intermediate-term funds had inflows of $17.055 million after outflows of $35.461 million in the prior week.

National funds had inflows of $57.695 million after outflows of $264.054 million in the previous week. High-yield muni funds reported outflows of $32.095 million in the latest reporting week, after outflows of $191.896 million the previous week.

Exchange traded funds saw inflows of $25.475 million, after inflows of $14.713 million in the previous week.