Municipal market participants are gearing up for the busiest week in a while, as they prepare to see nearly $10 billion of new issuance.

Secondary market

U.S. Treasuries were mostly unchanged Monday morning. The yield on the two-year Treasury was unchanged from 1.44% on Friday, the 10-year Treasury yield declined to 2.25% from 2.26% and the yield on the 30-year Treasury bond was steady at 2.79%.

Top-shelf municipal bonds finished stronger on Friday. The yield on the 10-year benchmark muni general obligation fell one basis point to 1.92% from 1.93% on Thursday, while the 30-year GO yield dropped two basis points to 2.78% from 2.80%, according to the final read of Municipal Market Data's triple-A scale.

On Friday, the 10-year muni-to-Treasury ratio was calculated at 85.0% compared with 84.8% on Thursday, while the 30-year muni-to-Treasury ratio stood at 99.5% versus 99.9%, according to MMD.

MSRB: Previous session's activity

The Municipal Securities Rulemaking Board reported 28,983 trades on Friday on volume of $6.245 billion.

Prior week's actively traded issues

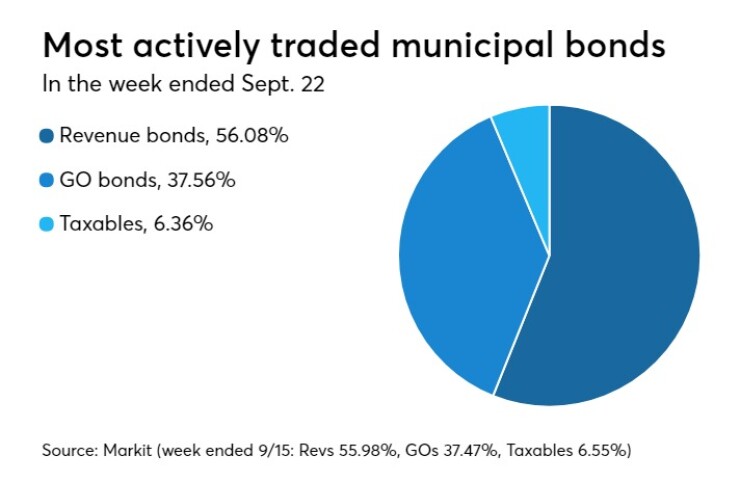

Revenue bonds comprised 56.08% of new issuance in the week ended Sept. 22, up from 55.98% in the previous week, according to

Some of the most actively traded bonds by type were from New York and Virginia issuers, according to Markit.

In the GO bond sector, the New York City 3.25s of 2042 were traded 112 times. In the revenue bond sector, the Erie County, N.Y., 2s of 2018 were traded 65 times. And in the taxable bond sector, the University of Virginia 4.179s of 2017 were traded 29 times.

Primary market

Weekly volume in the primary municipal bond market is expected to almost reach $10 billion in what should be the busiest week in 14 weeks — just in time to close out the third quarter on a good note.

Ipreo estimates volume will soar to $9.92 billion from the revised total of $5.37 billion sold in the past week, according to updated figures from Thomson Reuters. The calendar for the week ahead is composed of $7.15 billion of negotiated deals and $2.77 billion in competitive sales.

The action will commence on Monday for both retail and institutional investors alike.

Raymond James is scheduled to price the New York City Municipal Water Finance Authority’s $380.385 million of water and sewer system second general resolution revenue bonds on Monday. The deal is rated Aa1 by Moody’s Investors Service and AA-plus by S&P Global Ratings and Fitch Ratings.

Bank of America Merrill Lynch is slated to price Oregon’s $578 million of full faith and credit tax anticipation notes for retail investors on Monday, before the institutional pricing period on Tuesday. The TANs are rated MIG 1 by Moody’s, SP-1-plus by S&P and F1-plus by Fitch.

Most of the action takes place on Tuesday, including the biggest deal of the week.

Morgan Stanley is scheduled to price the largest deal of the week — Texas Water Development Board’s $1.06 billion of state water implementation revenue fund for Texas revenue bonds on Tuesday. The deal is the largest in the board’s history and carries ratings of triple-A from S&P and Fitch.

Bank of America Merrill Lynch is expected to price New Jersey Turnpike Authority’s $579 million of revenue SIFMA LIBOR indexed bonds, also on Tuesday. The deal is rated A2 by Moody’s, A-plus by S&P and A by Fitch.

On the competitive side, Washington State is set to sell a total of $528.81 million through three separate sales — including the largest individual competitive sale of $435.025 million on Tuesday. The general obligation various purpose motor vehicle fuel tax and refunding bonds are rated Aa1 by Moody’s and AA-plus by S&P and Fitch.

Bond Buyer reports 30-day visible supply

The Bond Buyer's 30-day visible supply calendar increased $80.9 million to $13.20 billion on Monday. The total is comprised of $5.70 billion of competitive sales and $7.50 billion of negotiated deals.