Municipal bond traders can expected a mostly quiet day ahead the Federal Open Market Committee's announcement on interest rates this afternoon.

The FOMC will announce its decision at 2 p.m., EST, but most policy experts are expecting the Federal Reserve will leave its fed funds target rate unchanged at between 0.25% and 0.50%.

Secondary Market

Treasuries were weaker on the short end and unchanged longer out on the curve on Wednesday. The yield on the two-year Treasury rose to 0.80% from 0.77% on Tuesday, the 10-year Treasury yield was unchanged from 1.69% and the yield on the 30-year Treasury bond was flat at 2.43%.

Top-quality municipal bonds ended unchanged on Tuesday. The yield on the 10-year benchmark muni general obligation finished steady from 1.57% on Monday, while the yield on the 30-year was flat from 2.33%, according to the final read of Municipal Market Data's triple-A scale.

On Tuesday, the 10-year muni to Treasury ratio was calculated at 93.0% compared to 92.7% on Monday, while the 30-year muni to Treasury ratio stood at 95.8% versus 95.3%, according to MMD.

MSRB: Previous Session's Activity

The Municipal Securities Rulemaking Board reported 33,645 trades on Tuesday on volume of $12.65c billion.

Primary Market

Barclays Capital repriced the Georgia Private Colleges and Universities Authority's $350.13 million of Series 2016 A&B revenue bonds for Emory University.

The $127.69 million of Series 2016A bonds were repriced as 4s to yield 2.92% and as 5s to yield 2.61% in a split 2046 maturity. The $222.44 million of Series 2016B bonds were repriced to yield from 0.77% with a 2% coupon in 2017 to 2.82% with a 4% coupon and 2.52% with a 5% coupon in a split 2038 maturity; a 2043 maturity was priced as 3s to yield 3.13%.

The deal is rated Aa2 by Moody's Investors Service, AA by S&P Global Ratings and AA-plus by Fitch Ratings.

No major bond deals are slated to come to market on Wednesday, the day of the FOMC announcement.

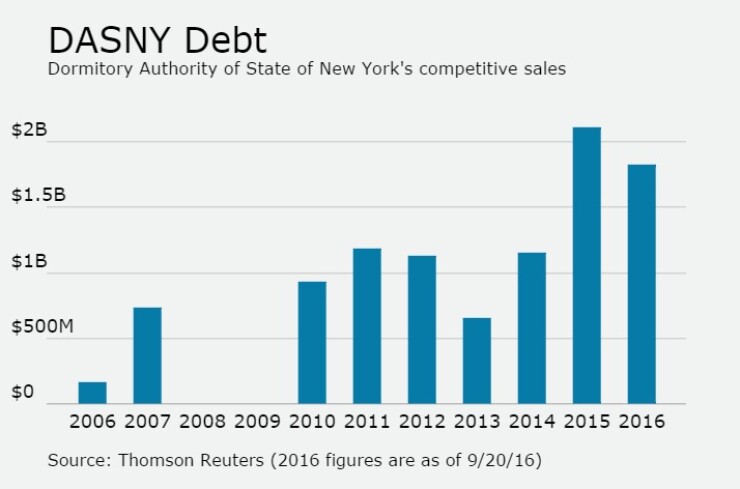

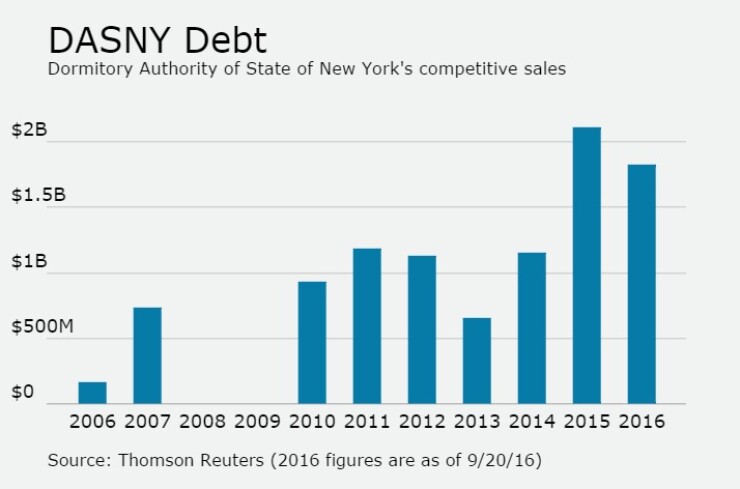

In the competitive arena on Thursday, the Dormitory Authority of the State of New York will sell over $1 billion of bonds in three separate offerings.

The deals consist of $409.16 million Series 2016A Group A state sales tax revenue bonds; $396.83 million of Series 2016A Group C state sales tax revenue bonds; and $310.94 million of Series 2016A Group B state sales tax revenue bonds.

The deals are rated triple-A by S&P.

Since 2006, DASNY has sold over $9 billion of competitive offerings. The most issuance was in 2015 when it put $2.11 billion of bonds out for the bid. It did not competitively sell bonds in 2008 or 2009.

Goldman Sachs plans to price the Pennsylvania Turnpike Commission's $649.89 million of subordinate revenue refunding bonds on Thursday.

The offering is expected to consist of $391.52 million of Subseries A bonds, $82.17 million of Subseries B taxables and $176.2 million of motor license fund enhanced bonds. The two subseries are rated A3 by Moody's and A-minus by Fitch, while the enhanced motor license series is rated A2 by Moody's and A-minus by Fitch.

Also on Thursday, Bank of America Merrill Lynch is set to price the Central Florida Expressway's $425 million of Series 2016B senior lien refunding revenue bonds. The issue is rated A2 by Moody's and A by S&P and Fitch.

Citigroup is expected to price the Turlock Irrigation District, Calif.'s $160 million of Series 2016 first priority subordinated revenue refunding bonds on Thursday. The deal is rated A-plus by Fitch.

RBC Capital Markets is expected to price the Indiana Finance Authority's $284.97 million of Series 2016D state revolving fund program green bonds and Series 2016E state revolving fund program refunding green bonds on Thursday. The deal is rated triple-A by Moody's, S&P and Fitch.

Bond Buyer Visible Supply

The Bond Buyer's 30-day visible supply calendar decreased $1.09 million to $12.32 billion on Thursday. The total is comprised of $3.96 billion of competitive sales and $8.36 billion of negotiated deals.