Municipal bond traders were winding up their week on Friday, after seeing a hefty new issue calendar come to market.

Munis were slightly stronger on Friday morning, as yields were as much as one basis point lower on some maturities, according to traders.

Secondary Market

The yield on the 10-year benchmark muni general obligation was steady from 1.62% on Thursday, while the 30-year muni yield was as much as one basis point lower from 2.56%, according to the first read of the day on Municipal Market Data's triple-A scale.

U.S. Treasuries were stronger on Friday morning. The yield on the two-year Treasury fell to 0.75% from 0.76% on Thursday, while the 10-year Treasury yield decreased to 1.77% from 1.78% and the yield on the 30-year Treasury bond dropped to 2.58% from 2.60%.

The 10-year muni to Treasury ratio was calculated at 91.0% on Thursday compared with 92.0% on Wednesday, while the 30-year muni to Treasury ratio stood at 98.7% versus 99.3%, according to MMD.

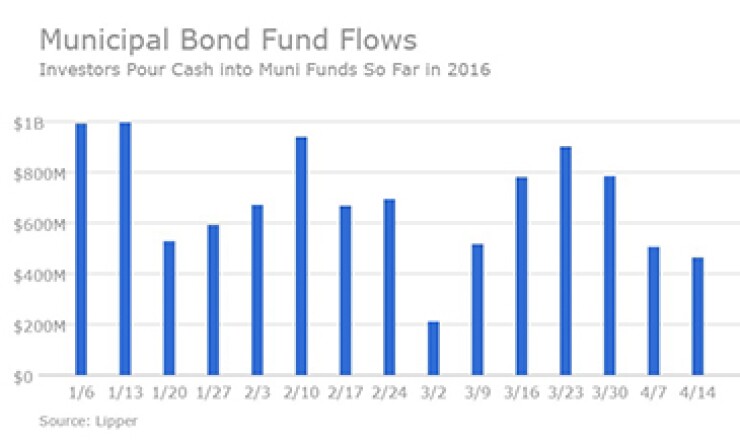

Muni Bond Funds See Inflows for 28th Straight Week

For the 28th week in a row, municipal bond funds reported inflows, according to Lipper data released Thursday.

Weekly reporting funds saw $463.733 million of inflows in the week ended April 13, after inflows of $505.885 million in the previous week, Lipper said. The four-week moving average remained positive at $663.753 million after being in the green at $742.822 million in the previous week. A moving average is an analytical tool used to smooth out price changes by filtering out fluctuations.

Long-term muni bond funds also experienced inflows, gaining $407.212 million in the latest week after inflows of $424.721 million in the previous week. Intermediate-term funds had inflows of $253.410 million after inflows of $205.411 million in the prior week.

National funds had inflows of $342.094 million on top of inflows of $391.385 million in the previous week. High-yield muni funds reported inflows of $160.322 million in the latest reporting week, after inflows of $16.846 million the previous week.

However, exchange traded funds saw outflows of $57.384 million, after outflows of $135.237 million in the previous week.

MSRB Previous Session's Activity

The Municipal Securities Rulemaking Board reported 38,610 trades on Thursday on volume of $11.795 billion.

Bond Buyer Visible Supply

The Bond Buyer's 30-day visible supply calendar rose $945.0 million to $10.95 billion on Friday. The total is comprised of $4.17 billion of competitive sales and $6.78 billion of negotiated deals.

The Week’s Primary Market

It was yet another busy week in the market, with a surprise ending as one issuer significantly upsized the amount of its deal.

Citigroup priced the Massachusetts Water Resources Authority's $750.52 million of general revenue bonds for institutions after holding a one-day retail order period on Wednesday. The deal was originally sized at $514.62 million.

"We got approval from the board of directors for the $100 million new money and $450 million refunding in February," said Thomas Durkin, director of finance and chief financial officer of the MWRA, on Thursday. "We are looking at really low rates, and yesterday the board approved increasing the refunding authorization by $235 million to $685 million, for a new total of $785 million. Although the actual deal size is somewhat smaller. We put the green bond moniker on it and it seems to be working out well, but we have always considered ourselves a green bond issuer."

The deal is rated Aa1 by Moody's Investors Service and AA-plus by Standard and Poor's and Fitch Ratings. All three rating agencies have a stable outlook on the credit.

Raymond James priced the Board of Regents of the University of Texas System’s $133.47 million of Series 2016C revenue financing system refunding bonds.

Goldman Sachs priced the Orange County Health Facilities Authority, Fla.’s $242.68 million of Series 2016A hospital revenue refunding bonds and Series 2016B hospital revenue bonds for the Orlando Health Obligated Group.

JPMorgan Securities priced the Denton Independent School District, Texas’ $118.75 million of Series 2016 unlimited tax refunding bonds.

Piper Jaffray received the written award on the Keller Independent School District, Texas’ $126.94 million of Series 2016 A&B unlimited tax refunding bonds. The issue is backed by the PSF and rated triple-A by Moody’s and S&P.

Ramirez priced the city of Buffalo, N.Y.’s $52.70 million of Series 2016A general improvement bonds with a top yield of 2.17% in 2028 and Series 2016B general obligation refunding bonds with a top yield of 1.62% in 2023. The deal is rated A1 by Moody’s and A-plus by S&P and Fitch.

The NYC TFA competitively sold $750 million of bonds in three separate offerings of tax-exempt and taxable debt.

Bank of America Merrill Lynch won $500 million of Fiscal 2016 Series F Subseries F-3 future tax secured tax-exempt subordinate bonds with a true interest cost of 3.18%.

Citigroup won $198.465 million of Fiscal 2016 Series F Subseries F-1 future tax secured taxable subordinate bonds with a TIC of 2.29%.

Citi won $51.535 million of Fiscal 2016 Series F Subseries F-2 future tax secured taxable subordinate bonds with a TIC of 2.94%.

“Today’s sale of $750 million of new money TFA bonds saw strong demand, with at least nine bidders on each series, and with the winning bidders reporting good going away business,” New York City Comptroller Scott M. Stringer said Tuesday. “We’re proud of these results, which reflect both TFA’s high credit rating and strong support for NYC bonds.”

All three deals are rated Aa1 by Moody’s and triple-A by S&P and Fitch.

Las Vegas, Nev., competitively sold $141.23 million of bonds in three offerings.

BAML won the $42.59 million of Series 2016B limited tax GO various purpose refunding bonds additionally secured by pledged revenues with a TIC of 2.75%.

Morgan Stanley won the $82.46 million of Series 2016A limited tax general obligation performing arts center refunding bonds additionally secured by pledged revenues with a TIC of 2.90%. Citi won the $16.19 million of Series 2016C limited tax GO sewer refunding bonds additionally secured by pledged revenues with a TIC of 1.07%. All three deals are rated Aa2 by Moody’s and AA by S&P.

Back to the negotiated sector, Morgan Stanley priced the California IEDB’s $414.21 million of clean water state revolving fund revenue green bonds for institutions in the afternoon after a morning retail order period Tuesday.

Loop Capital Markets priced the state of Ohio’s $231 million of Series S general obligation highway capital improvement bonds, backed by its full faith and credit and highway user receipts.

The Platte River Power Authority, Colo., competitively sold $154.6 million of Series JJ power revenue bonds.