Municipal bond yields have

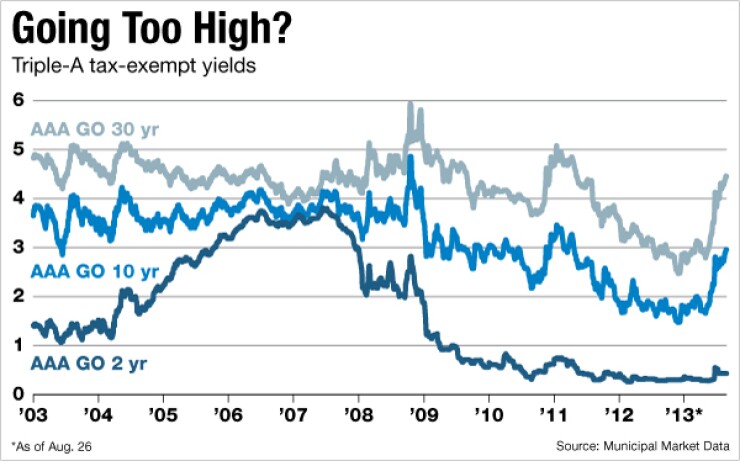

As measured by their value relative to comparable Treasuries, munis across the yield curve are cheaper than their averages since January 2003. The average triple-A yields for bonds maturing in two through 10 years - leading into the intermediate portion of the curve - also remain below their averages for the same period.

Today's 30-year triple-A yield, however, has surged higher than its 10-year average, Municipal Market Data numbers show.

"Rates are still low historically, but ratios are fairly attractive, particularly at the long end of the curve," said Priscilla Hancock, managing director and municipal strategist at JPMorgan Asset Management. "And [municipal] rates versus Treasury rates are pretty attractive on an after-tax basis."

Hancock and other strategists said muni yields have shifted far enough to present opportunities for trades that will attract insurance companies and other institutional buyers as well as individuals into the market.

Muni bond yields are near their 10-year averages at the intermediate and long portions of the curve, MMD numbers show. But they're well below their averages at the short end of the yield curve.

On Aug. 26, the 10-year triple-A yield sat at 2.96%, compared with its 10-year average of 3.18%. The two year, at 0.43% on Aug. 26, lies well below its 10-year average of 1.66%.

But the 30-year, at 4.45% on Aug. 26, surpassed its 10-year average of 4.26%.

For muni ratios to Treasuries, the two-year, 10-year and 30-year ratios on Aug. 26 reached 116%, 106% and 118%, respectively. That compares to 10-year average ratios of 95%, 91% and 100%, MMD numbers show.

But location on the yield curve is important. If investors look at maturities for munis 10 years and shorter, where the market remains historically low in yields, and consider valuation to Treasuries, munis don't appear very attractive, said Phil Condon, head of U.S. fixed income and muni bonds at Deutsche Asset and Wealth Management.

The real value lies at the long part of the market, he said. Investors venturing past 15 years are now seeing interesting numbers.

"The fact that investors can buy A-rated munis at 5.20% out long, tax-free, is a pretty good place to be," Condon said. "Yields on single-A, 30-year paper look good against inflation, look good against history and look good versus Treasuries."

JPMorgan's Hancock sees investors making several trades in the market at today's levels. For starters, retail has proved more willing to buy 15-year paper and lock in a 10% taxable-equivalent yield, she said. And they're not alone.

"When ratios get higher, say 115% is the threshold, or what we see in the 15-year part of the curve today, that's when you start to see crossover buyers come in," Hancock said, "like insurance companies who like the 115%, they know muni credits and want to lock in that ratio to outperform their taxable investments."

There have also been some institutional buyers who find current valuations to Treasuries attractive who sell taxable paper and buy tax-exempts, she said. Some institutions sell Build America Bonds and then buy the same credit in the muni market for the chance to pick up a little yield.

Another trade JPMorgan Asset Management has seen involves individual investors, particularly those who've bought into muni bond funds or purchased muni bonds in the last couple of years and have incurred losses during the recent selloff. They have booked those losses, sold out of the fund and bought individual bonds to lock in the higher yields.

"That trade makes less sense if you had gains," Hancock said, "but it's an interesting trade if you had some losses."