Municipal bond market participants were wrapping up their week and placing the last of the week’s primary supply into their books while they look ahead to next week’s holiday-shortened trading week.

Primary market

With most of the week’s bond supply already having priced, focus turned to the short-term sector.

The South Carolina Association of Governmental Organizations sold $124.021 million of short-term securities.

The deals consisted of $111.826 million of Series 2018D certificates of participation and $12.195 million of Series 2018C taxable COPs.

The financial advisor is Compass Municipal Advisors and the bond counsel is the McNair Law Firm.

Both issues are due March 1, 2019, and rated Aa1 by Moody’s Investors Service.

There are already several big bond issues awaiting buyers on next week’s calendar.

On the East Coast, the New York City Transitional Finance Authority will sell $1.4 billion of future tax secured subordinate Fiscal 2019 bonds.

Next Thursday, Loop Capital Markets will price the TFA’s $900 million of tax-exempt fixed-rate bonds after a two-day retail order period.

Also next Thursday, the TFA is set to sell $500 million of taxable bonds in two competitive sales.

The financial advisors are Public Resources Advisory Group and Acacia Financial Group and the bond counsel are Norton Rose and Bryant Rabbino.

The deals are rated Aa1 by Moody’s and AAA by Fitch Ratings.

Proceeds from the sale will be used to fund capital projects, with the exception of proceeds from approximately $150 million of the tax-exempt fixed rate bonds, which will be used to convert outstanding floating-rate bonds into fixed-rate bonds.

On the West Coast, California is competitively selling over $989 million of general obligation and GO refunding bonds in three sales next Thursday, consisting of $516.035 million of tax-exempt various purpose GO refunding bonds, Bidding Group C, $338.38 million of tax-exempt various purpose GOs, Bidding Group B, and $134.855 million of taxable various purpose GO and refunding bonds, Bidding Group A.

The financial advisor is Public Resources Advisory Group and the bond counsel is Orrick Herrington & Sufcliffe.

The deals are rated Aa3 by Moody’s and AA-minus by S&P Global Ratings and Fitch.

Proceed from the sale will be used to refund certain outstanding debt of the issuer.

Bond Buyer 30-day visible supply at $6.7B

The Bond Buyer's 30-day visible supply calendar decreased $2.2 billion to $6.70 billion for Thursday. The total is comprised of $3.75 billion of competitive sales and $2.95 billion of negotiated deals.

Secondary market

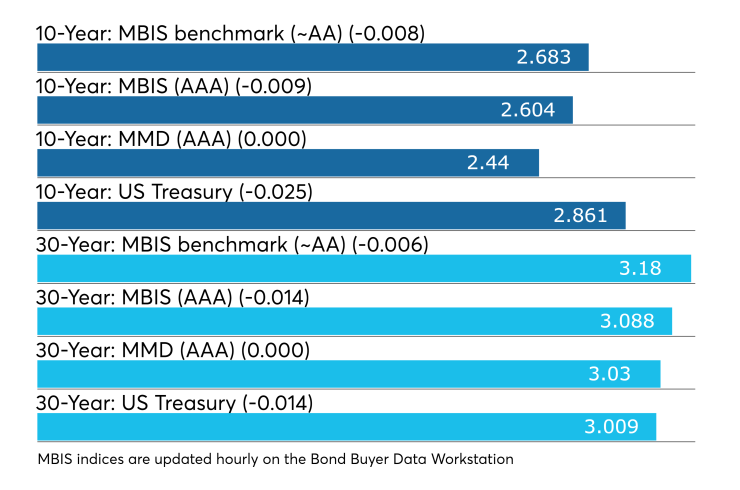

Municipal bonds were mostly stronger on Thursday, according to a midday read of the MBIS benchmark scale. Benchmark muni yields fell less than one basis point in the five- to 30-year maturities and rose four basis points in the one-year maturity and as much as one basis point in the two- to four-year maturities.

High-grade munis were mostly stronger, with yields calculated on MBIS’ AAA scale falling less than one basis point in three- to 30-year maturities and rising six basis points in the one-year and by one basis point in the two-year maturities.

Municipals were steady on Municipal Market Data’s AAA benchmark scale, which showed the yield on both the 10-year muni general obligation and the yield on 30-year muni maturity remaining unchanged.

Treasury bonds were stronger as stock prices traded lower.

On Wednesday, the 10-year muni-to-Treasury ratio was calculated at 84.7% while the 30-year muni-to-Treasury ratio stood at 100.4%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

Previous session's activity

The Municipal Securities Rulemaking Board reported 41,373 trades on Wednesday on volume of $10.17 billion.

California, Texas and New York were the municipalities with the most trades, with Golden State taking 13.206% of the market, the Lone Star State taking 11.552% and the Empire State taking 10.883%.

ICI: Long-term muni funds saw $531M inflow

Long-term tax-exempt municipal bond funds saw an inflow of $531 million in the week ended Aug. 22, the Investment Company Institute reported.

This followed an inflow of $662 million into the tax-exempt mutual funds in the week ended Aug. 15 and inflows of $723 million, $163 million, $600 million, $1.765 billion, $1.028 billion, $356 million, $525 million and $742 million in the eight prior weeks.

Taxable bond funds saw an estimated inflow of $4.067 billion in the latest reporting week, after seeing an inflow of $1.013 billion in the previous week.

ICI said the total estimated inflows to long-term mutual funds and exchange-traded funds were $5.6 billion for the week ended Aug. 22 after inflows of $301 million in the prior week.

Tax-exempt money market funds saw inflows

Tax-exempt money market funds saw inflows of $618.7 million, raising total net assets to $130.11 billion in the week ended Aug. 27, according to The Money Fund Report, a service of iMoneyNet.com. This followed an inflow of $678.6 million to $129.49 billion in the prior week.

The average, seven-day simple yield for the 201 weekly reporting tax-exempt funds rose to 1.08% from 1.06% the previous week.

The total net assets of the 832 weekly reporting taxable money funds rose $7.21 billion to $2.703 trillion in the week ended Aug. 28, after an inflow of $9.0 billion to $2.696 trillion the week before.

The average, seven-day simple yield for the taxable money funds increased to 1.59% from 1.58% from the prior week.

Overall, the combined total net assets of the 1,033 weekly reporting money funds rose $7.83 billion to $2.833 trillion in the week ended Aug. 28, after inflows of $9.68 billion to $2.825 trillion in the prior week.

Treasury announces auction details

The Treasury Department announced these auctions:

- $42 billion of 182-day bills selling on Sept. 4;

- $48 billion of 91-day bills selling on Sept. 4; and

- $55 billion of 28-day bills selling on Sept. 4.

Gary Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.