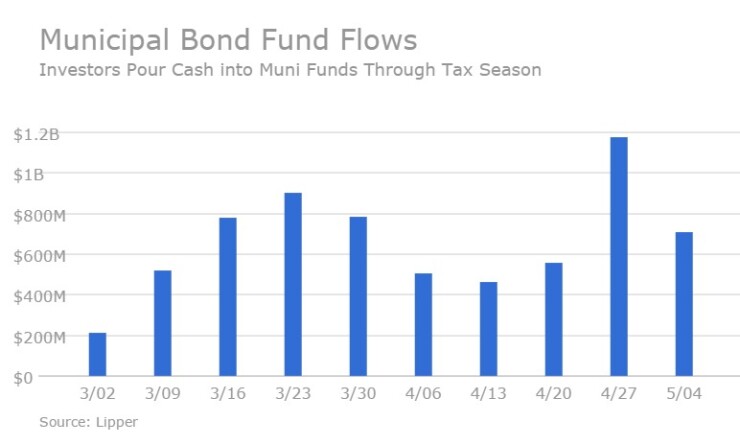

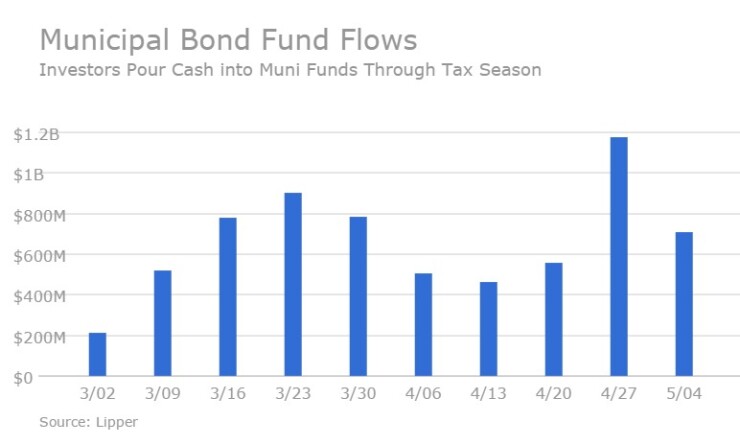

For the 31st week in a row, municipal bond funds reported inflows, according to Lipper data released Thursday. Weekly reporting funds saw $709.727 million of inflows in the week ended May 4, after inflows of $1.173 billion in the previous week, Lipper said.

The four-week moving average remained positive at $725.712 million after being in the green at $674.752 million in the previous week. A moving average is an analytical tool used to smooth out price changes by filtering out fluctuations.

Long-term muni bond funds also experienced inflows, gaining $446.706 million in the latest week after inflows of $1.079 billion in the previous week. Intermediate-term funds had inflows of $213.161 million after inflows of $264.111 million in the prior week.

National funds had inflows of $595.642 million on top of inflows of $1.061 billion in the previous week. High-yield muni funds reported inflows of $131.628 million in the latest reporting week, after inflows of $282.980 million the previous week.

Exchange traded funds saw inflows of $103.057 million, after inflows of $108.132 million in the previous week.