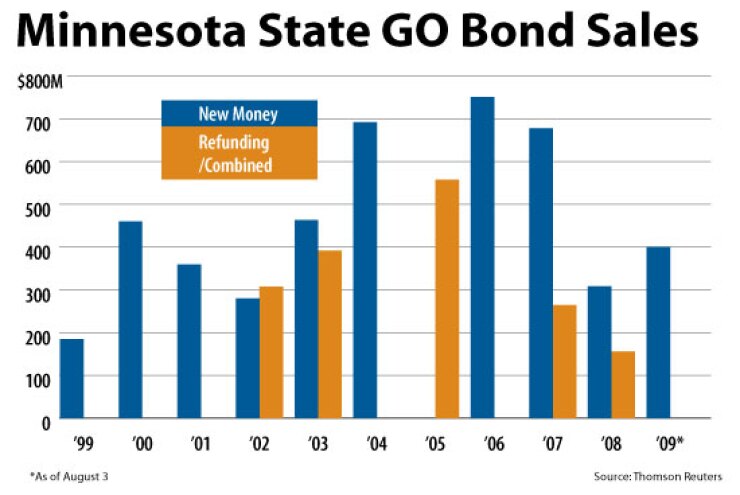

CHICAGO - Minnesota will competitively sell about $600 million of new-money and refunding bonds on Tuesday and return to the market later in the month with $66 million of certificates of participation as finance officials ponder the use of a negotiated sale for the next planned general obligation issue in the fall.

The deal is divided into four series, including a new-money general purpose 20-year tranche for $192 million and a new-money 20-year GO series supported by trunk highway funds for transportation projects for $80 million.

The state will also refund for savings $299 million of general purpose GOs from issues in 1998, 2000 and 2001, and $28.5 million of GO trunk highway bonds issued in 2000 and 2001, though the size of the refunding tranches are subject to change depending on interest rates, according to state debt manager Kathy Kardell.

"We decided to go with the refunding now in our competitive issue rather than wait because interest rates are so good we want to lock them in," Kardell said, adding that the latest review showed at least 8% in net present-value savings. "We wanted to limit the size of the competitive sale to $600 million so we will be back in October with more new money." The state expects to issue at least $460 million in the fall.

Dorsey & Whitney LLP is bond counsel. The state's new financial adviser on its GO sales and any potential cash-flow financings is Public Resources Advisory Group Inc.

Following a request for proposals process, Kardell recently named Minnesota's choices for financial advisory work. Public Financial Management Inc. will serve as financial adviser on the state's lease transaction, COPs, and any new revenue bond programs the Legislature may adopt. Ehlers & Associates was retained as the state's adviser on its 911 call system bond program. The state has $75 million of outstanding 911 bonds and authorization to sell another $153 million.

On Aug. 18, Minnesota intends to competitively sell $66 million of COPs to fund a statewide accounting and tax and procurement system and another $16 million to complete the Department of Revenue's integrated tax reporting system. PFM is advising on the transaction and Briggs & Morgan is bond counsel. The Legislature authorized the borrowing during its spring session.

Kardell's team is reviewing proposals submitted last month by underwriters interested in working on potential negotiated transactions. The state's debt statutes previously required that all GO deals be sold competitively but the Legislature authorized the use of negotiated sales through June 30, 2011, due to the market turmoil of the last year.

The debt manager expects to release the list of underwriters chosen for a senior manager's pool and co-managers' pool later this month.

Kardell has not made a decision on what type of sale method to use on the October deal. "We are still reviewing the underwriting proposals and also really want to see how strong the retail market is," she said. The state has not previously marketed its GOs to retail buyers.

Minnesota has $4.6 billion of outstanding GOs that are rated Aa1 by Moody's Investors Service and AAA by Fitch Ratings and Standard & Poor's. Fitch assigns a negative outlook to the credit. State officials met with rating agency analysts late last week and the latest reviews have not yet been released.

Budget negotiations aimed at achieving a balanced budget for the fiscal biennium that began July 1 came down to the wire between Republican Gov. Tim Pawlenty, who has announced he is not seeking re-election in 2010, and the Democratic-controlled Legislature, but no agreement was reached before a mandated adjournment date in May.

Democrats floated several tax increases but Pawlenty refused to consider them, while Democratic lawmakers rejected the governor's proposal to issue $1 billion of appropriation-backed bonds that would be repaid with tobacco settlement funds.

Lawmakers adjourned after adopting spending bills that lacked sufficient revenue to cover them. Pawlenty responded by slashing or deferring $2.7 billion of funding for local government aid, health and human services, and education in the $57 billion two-year budget.