CHICAGO — The Minneapolis-St. Paul Metropolitan Airports Commission is gearing up to sell about $100 million of general airport revenue bonds in a refunding for savings and to raise funds for expanded car-rental facilities as it advances plans for a $1.5 billion capital improvement program.

The transaction is slated for sale the week of Oct. 22, said the commission’s finance director, Bob Schauer. The MSP commission owns and operates the Minneapolis-St. Paul International Airport.

Piper Jaffray & Co. is the senior manager with Wells Fargo Securities as co-senior manager. Jefferies & Co. is the financial advisor and Kutak Rock LLP is bond counsel.

The new-money piece would raise about $45 million for expanded car rental facilities including service at the airport’s Humphrey Terminal 2. That piece of the deal would be taxable.

The commission recorded a record number of operations and passengers through the Humphrey terminal in 2011, where the focus is on budget carriers such as Southwest Airlines and Sun Country, marking a 12% increase over 2010.

Figures so far this year show a 6.5% increase over 2011 levels with several of the airlines that operate in the terminal expanding service.

Refunding of debt issued in 2003 will make up the remainder of the transaction and generate at least 5% in present-value savings, Schauer said.

The deal comes as the commission staff is pressing ahead with plans to seek board approval for a five-year capital program. Preliminary plans call for spending $1.5 billion in capital improvement and expansion projects.

The agency recently released a preliminary plan that calls for runway improvements, noise mitigation, new gates, concourse improvements, expanded roadways, and increased parking and renovations at the airport’s two terminals — Humphrey and Lindbergh. The projects are needed to relieve congestion and meet future demand, officials contend.

“The $1.5 billion capital improvement program would cover the airport through 2018,” with projects designed to meet demand at the airport through 2020, Schauer said.

The commission board is expected to vote on the CIP plan in December.

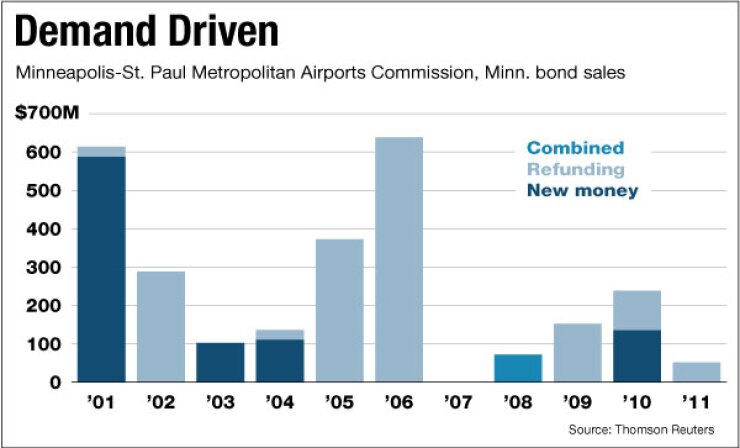

The commission does not need airline approval for projects related to airfield operations, parking and other general airport facilities, but would need airline approval for some of the proposed projects. “The program would be demand-driven,” Schauer said, and only undertaken if supported by growing operations or at the request of the airlines.

Flights are projected to rise to nearly 485,000 by 2020 from 437,075 in 2010. Air traffic peaked in 2004 when the airport handled more than 541,093 flights.

A final financing package has not been developed but likely would include a mix of internal funds, passenger facilities charges, and federal and state grants. The commission has no additional borrowing plans to fund the program at this time. It has begun holding public hearings on the pending plan and has released a draft environmental impact assessment.

“MSP’s terminal and landside facilities do not and/or will not meet current and forecasted demand. MSP is experiencing unacceptable levels of service within Terminal 1-Lindbergh at both landside and terminal facilities: the arrivals curb, parking ramps and international arrivals facility are currently congested,”

“Additionally, the demand for gates at Terminal 2-Humphrey exceeds capacity during the winter period,” the report continues. “As passenger activity grows, the levels of service for landside facilities and regional roadways are expected to deteriorate further.”

The MSP airport launched a nearly $3 billion expansion beginning in 1998 after a 1996 vote by state lawmakers. The Legislature weighed whether to build a new airport or expand the existing one and settled on the latter with projects aimed at meeting demand through 2010.

Ahead of its last sale in 2010, Fitch Ratings and Standard & Poor’s affirmed AA-minus ratings and stable outlooks on the airport’s outstanding senior bonds and A ratings on subordinate bonds.

“Fitch believes that the commission’s current set of financial strengths and favorable cost profile, together with continued importance of [Delta Air Lines] domestic hubbing operations at MSP are the key drivers to maintaining the ratings and stable outlook for the senior- and subordinate-lien bonds,” analysts wrote. “Further traffic losses … that lead to stresses to financial performance could pressure the ratings.”

The airport has maintained a strong financial profile even as it struggled with a decline in passengers in the last decade. During the recession, the commission turned its attention from expansion plans to trimming expenses and managing through the economic downtown and has fared better than comparably sized airports.

The airport served nearly 16 million passengers last year, with originating flights accounting for 54.3% and connecting flights accounting for the remainder, according to financial documents.

The number of passengers was up 1.64% over 2010 which had seen an increase 1.05% over 2009. In 2010, the airport reversed a four-year slide in passenger levels.

The commission closed out 2011 with $1.5 billion of long-term debt on its books, which equates to debt per enplaned passenger of $94.60. The commission benefits from strong liquidity with cash and investments totaling more than $722 million, providing more than 3 times total bonded debt service coverage this year.

The dominance of Delta, which acquired the former Eagan, Minn.-based Northwest Airlines in 2008, has been cited in past rating reports as a credit concern.

The airline accounted for 75% of the landed weight at the airport last year, according to financial filings. The proposed CIP calls for consolidating Delta’s operations.