CHICAGO — With its pricing this week of $15 million of extendible rolling tender variable-rate bonds, Milwaukee will complete a three-tiered plan introducing new floating-rate products to the city’s debt portfolio that don’t require liquidity support.

“It’s about lowering our costs and reducing our third-party risks so we don’t have to worry about what happens with the banks,” said Richard Li, public debt specialist in comptroller Martin Matson’s office.

Downgrades for banks and other issues made such outside liquidity support problematic and expensive during the financial crisis.

The city will sell $15 million of general obligation-backed rolling tender variable-rate securities that operate like seven-day variable-rate demand bonds but can be extended in the event of a failed remarketing. That eliminates the need for bank credit support.

Morgan Stanley is the senior manager and Loop Capital Markets LLC is co-senior.

The city expects to pay a rate in the range of 10 basis points over the Securities Industry and Financial Markets Association index and will pay a remarketing fee of 15 basis points.

The issue follows the city’s sale last week of $15 million of SIFMA index notes that pay a rate of 45 basis points over the SIFMA rate. The notes are reset weekly with a maturity date in January 2016. Bank of America Merrill Lynch was the senior manager and Loop was the co-senior.

Since the spring, Milwaukee has sold a total of $80 million of extendible municipal commercial paper under a new $200 million program that allows for an automatic maturity extension in the event of a failed remarketing.

Robert W. Baird & Co. is adviser on the city’s GO transactions.

Proceeds of the various transactions are funding capital projects, refunding some commercial paper that had required bank support and easing cash flow needs, Li said.

Though the city has opted to tap new short-term products, it still plans to maintain some capacity for bank support. Its letter of credit from State Street Bank dating back to 2005 carries a price tag of 20 basis points. It expires at the end of the year and the city expects the cost to rise to the 50 basis point range, but it will shrink the size to $50 million from $125 million. The city currently has a request for proposals out for a new LOC contract.

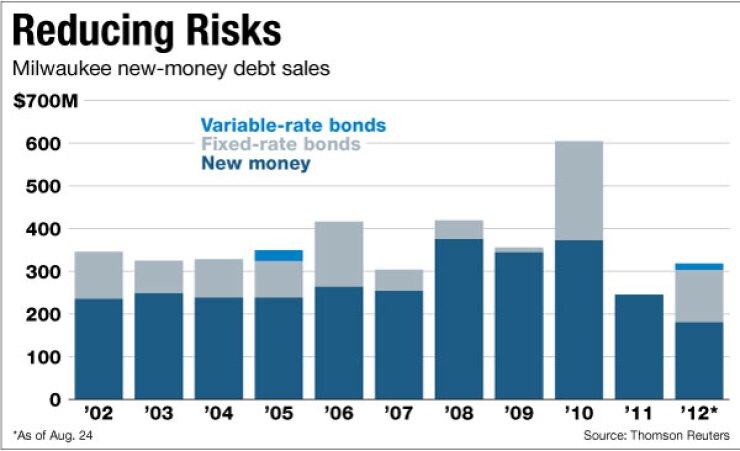

With record low fixed interest rates, the office is keeping the floating-rate deals small and views them as an opportunity to introduce Milwaukee to buyers of such securities. “The idea is to get our name out there for these products, so if fixed rates go up we can ramp up our use of variable-rate products,” Li said.

Ahead of the issues, Moody’s Investors Service affirmed the city’s Aa2 GO rating on $900 million of debt. The agency lowered the rating one notch earlier this year. Standard & Poor’s affirmed its AA. Both assign a stable outlook.

Standard & Poor’s said the city benefits from its status as the economic hub of southeastern Wisconsin, a diverse employment base, strong general fund reserves, and a moderate debt burden. Its above-average unemployment rate, flat state aid, and state imposed levy caps challenge the rating.

Milwaukee’s total general fund balance last year was $54 million, representing 8.5% of expenditures. It also benefits from additional cushion in the form of a public debt amortization fund. Milwaukee balanced its 2012 budget with the use of $14 million of reserves.

Moody’s added as strengths the city’s adequately funded pension plan and a history of strong market access, while annual 5% property valuation declines over the last four years are a challenge.

Matson, who was the deputy director of the city’s Employees Retirement System, took office this spring, replacing longtime Comptroller W. Martin “Wally” Morics, who retired.

Matson initially faced former Milwaukee County supervisor Johnny Thomas Jr. in the April race but Thomas suspended his campaign following the filing of criminal charges against him alleging he accepted a bribe during a sting operation. Thomas was acquitted by a Milwaukee County jury of the bribery and misconduct charges on Friday. The charges had stemmed from a contract involving financial advisory services to the county.