The municipal bond market saw $27.99 billion of volume in May as overall issuance has slowly but surely started increasing as the industry recovers from the coronavirus fallout that began in March.

The 4.2% drop-off in volume compared to the same month in 2019 resulted in the lowest May volume since 2014 when the market saw $27.90 billion.

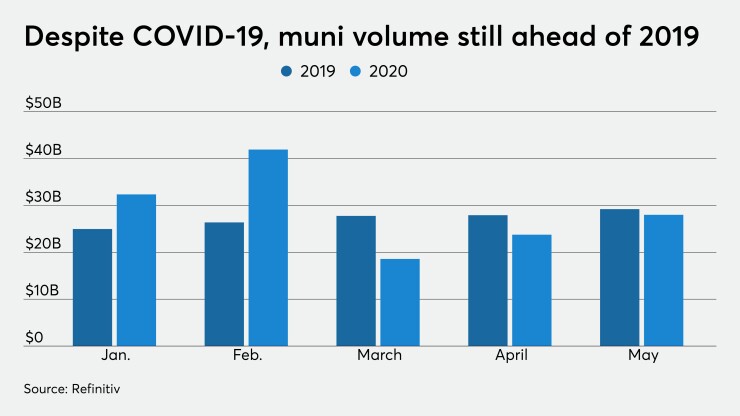

March volume came in at $18.59 billion and April increased slightly to $23.75 billion.

“We expect that there is some pent-up issuance that is likely to continue to hit the market,” said Tom Kozlik, head of municipal strategy and credit at Hilltop Securities. “Overall numbers should reflect typical month-to-month influences. For example, we typically see a bit of a push of issuance to begin the summer. Another market shock would throw a wrench into this pattern, of course.”

Brian Musielak, senior portfolio manager for Commerce Trust Co., said he believes the pattern of monthly volume will continue to move higher over the next few months.

“Especially now that yields have moved significantly lower, increasing refunding activity,” Musielak said. “New-money issues will be slower to recover as issuers tend to their budget deficits.”

The biggest volume month so far this year was February’s $41.91 billion. For comparison, 2019 had three months with greater than $40 billion of issuance and 2018 did not have a single one, as the biggest month that year took place in May when there was $35.15 billion.

So will the second month of the year stand for the most active month this year or will one of the remaining seven months beat it?

“Difficult to pinpoint the potential for one single month of heavy volume, [as] timing of large issues sometimes skew the results for example,” Kozlik said. “But there is definitely the potential for some $30 to $40 billion months of issuance. Overall, we were expecting record issuance in 2020 and we think the landscape is poised to at least come close to that, as a result of some the measures municipal issuers are taking to shore up their finances.”

Musielak thinks that new-issue volume in June has a "great shot" at exceeding February's highs.

“Refunding activity will be strong given the push lower yields and we expect to see lower-rated issues begin to tap the new-issue market,” Musielak said. “Muni high-yield had a strong comeback in May.”

Year-to-date, the market is still on a better pace than last year. So far in 2020 munis have totaled $150.48 billion, compared to $136.55 billion of issuance at this point last year.

“Despite losing some ground in March and April we think supply still has a shot at exceeding last year’s total," Musielak said. “It will depend on yields staying relative low and additional fiscal support from the federal government.”

Refunding volume for the month was up 14.3% to $6.52 billion from $5.70 billion and new-money issuance was down 14.6% to $17.24 billion from $20.18 billion.

“No question the lower new-money volume is tied to the massive budget deficits most all issuers are facing,” Musielak said. “If no further fiscal support is provided from the federal government, this will be a lingering issue for several years much like the Great Recession 2008-09.”

One reason why new money is and has been down is because municipalities may not want to take on new/more debt, especially in the wake of COVID-19.

“This was a dynamic that we saw just after the Great Recession, but it is too early to tell if that dynamic is on the minds of finance officers now,” Kozlik said. “We should revisit this in coming months to see what the trend looks like.”

Taxable bond volume increased 78.7% to $5.32 billion from $2.98 billion in 2019.

“Taxable bonds issue will continue to be strong in our view and with yields back to record lows, taxable bonds offer the only avenue for issuers to advance refund outstanding debt,” Musielak said. “Taxable bonds also offer issuers greater flexibility in the use and timing of how proceeds are deployed.”

Issuance of revenue bonds was 2.4% lower to $16.07 billion, while general obligation bond sales fell to $11.92 billion from $12.75 billion.

“I think that revenue and GO issuers will begin to access the market now that it has returned to a more normalized state,” Kozlik said.

Negotiated deal volume was 14.6% higher to $21.55 billion. Competitive sales decreased 36.2% to $5.89 billion.

Deals wrapped by bond insurance in May increased 59.6% to $2.79 billion in 184 deals from $1.75 billion in 183 transactions the same month last year.

Only three sectors were in the green in May: electric power increased 31% to $1.04 billion from $794 million, environmental facilities issuance grew 47.7% to $299 million from $203 million and general purpose bonds were 30.4% higher to $6.75 billion from $5.18 billion. All the other sectors saw a decline of at least 1.8%.

Three types of issuers increased levels from a year ago, while issuance by the rest of the others declined at least 0.8%. Issuance from state governments rose 38.2% to $2.63 billion from $1.90 billion, colleges and universities saw a 211.2% improvement to $1.79 billion from $575 million and cities and towns improved by 12.3% to $3.87 billion from $3.45 billion.

“Size and credit quality certainly helps,” Musielak said. “State governments and large universities were able to take advantage of strong investor demand for safest, most liquid issues.”

So why did only two types of issuers see year-over-year increases?

“A potential answer is that larger entities have the need and resources to follow-through with these types of financial strategies,” Kozlik said. “Now, still too early to tell if this is going to be an ongoing trend. Let’s revisit this as well.”

California leads all states in terms of long-term muni bonds sold. All issuers in the Golden State have accounted for $20.33 billion. Texas is second with $18.23 billion, New York is third with $16.66 billion, Ohio is fourth with $10.92 billion and Pennsylvania rounds out the top five with $7.12 billion.