The municipal bond market springs to life on Tuesday as several large competitive sales hit the screens, led by issuers in Massachusetts, Virginia and Minnesota.

Secondary market

The MBIS municipal non-callable 5% GO benchmark scale was mixed in early trading.

The 10-year muni benchmark yield fell to 2.256% on Tuesday from the final read of 2.275% on Monday, according to

The MBIS benchmark index is updated hourly on the

Top-rated municipal bonds are weaker on Tuesday. The yield on the 10-year benchmark muni general obligation rose one to three basis points from 2.01% on Monday, while the 30-year GO yield gained one to three basis points from 2.59%, according to a read of MMD’s triple-A scale.

U.S. Treasuries are weaker in early activity. The yield on the two-year Treasury gained to 1.96% on Tuesday from 1.95% on Monday, the 10-year Treasury yield rose to 2.50% from 2.48% and the yield on the 30-year Treasury increased to 2.85% from 2.81%.

On Monday, the 10-year muni-to-Treasury ratio was calculated at 81.0% compared with 81.2% on Friday, while the 30-year muni-to-Treasury ratio stood at 92.1% versus 91.8%, according to MMD.

MSRB: Previous session's activity

The Municipal Securities Rulemaking Board reported 40,823 trades on Monday on volume of $10.11 billion.

Primary market

Primary activity is centered in the competitive sector on Tuesday.

The

Both deals are rated Aa1 by Moody’s Investors Service, AA by S&P Global Ratings and AA-plus by Fitch Ratings.

The last time the state competitively sold comparable bonds was on Oct. 18, 2017, when Bank of America Merrill Lynch won $300 million of consolidated loan of 2017 Series E GOs with a true interest cost of 2.8724%.

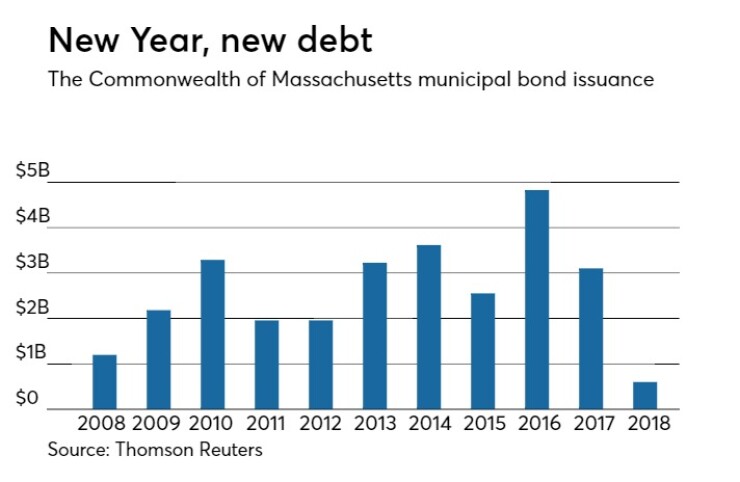

Since 2008 Massachusetts has sold about $28.5 billion of bonds, with the most issuance occurring in 2016 when it sold $4.8 billion. The Bay State saw the least amount in 2008 when it sold $1.19 billion.

Fairfax County, Va., is selling $225.19 million of Series 2018A unlimited tax GO public improvement bonds.

The deal is rated triple-A by Moody’s, S&P and Fitch.

The Roseville Area Schools Independent School District No. 623, Minn., is selling $139.24 million of Series 2018A unlimited tax GO school building bonds.

The deal is being sold under the Minnesota School District Credit Enhancement Program.

On Wednesday, Morgan Stanley is expected to price the Stanford Health Care’s $500 million of Series 2018 corporate CUSIP taxable bonds.

On Thursday, RBC Capital Markets is expected to price the Pennsylvania Commonwealth Financing Authority’s $410 million of Series 2-018A taxable revenue bonds while JPMorgan Securities is set to price the Illinois Finance Authority’s $218.67 million of Series 2018 taxable revenue refunding bonds.

Bond Buyer 30-day visible supply at $6.98B

The Bond Buyer's 30-day visible supply calendar increased $168.5 million to $6.98 billion on Monday. The total is comprised of $3.33 billion of competitive sales and $3.64 billion of negotiated deals.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.