Gilt-edged Maryland sold four competitive offerings of general obligation bonds totaling over $1 billion as municipals remained mostly steady out long while yields dipped 10-years and less on the AAA muni scales.

"The Maryland credit is always a bellwether, and the new issue today showed again how the market is looking at credit," a New York trader said. "When you have yields on a triple-A credit, such as Maryland, coming competitively into this market, all eyes fall onto it and the secondary follows suit."

Trades of Maryland GOs, 4s of 2023, traded at 0.19%. The state's GOs, 5s of 2031, traded at 0.80%. It was priced to yield 1.05% in an early March deal, a testament to how high-grade paper is faring in this new market.

Other highly rated bonds were trading in very large blocks Wednesday. Fairfax County, Virginia, 5s of 2023 were at 0.17%. Loudoun County, Virginia GOs, 5s of 2028, traded at 0.62%. Montgomery County, Maryland GOs, 3s of 2032, were at a 1.19% high.

Going back to the universities, University of Michigan 5s of 2033 traded at 1.01%.

Out longer, we still saw paper trading from out West. Washington GOs, 5s of 2043 were at 1.50% to 1.40% while Texas paper continues to be a place investors are parking money. Alvin, Texas, ISD 3s of 2045 are at a remarkable 1.92%.

"This market is handling the stresses of the virus in somewhat cautious ways but issuers cannot look away from these low rates," the trader said.

Primary market

The Maryland (Aaa/AAA/AAA/NR) deals consisted of both tax-exempt and taxable state and local facilities loan of 2020 bonds.

“As expected Maryland GO provided a liquidity event for front-end buyers and they stepped to the plate to buy 23-24-25 through the current MMD AAA scale,” said Peter Franks, senior market analyst at Refinitiv MMD.

JPMorgan Securities won the $345.76 million of taxable GO refunding bonds Second Series C with a true interest cost of 0.755%.

BofA Securities won the $290.08 million of tax-exempt Bidding Group 1 Second Series A GOs with a TIC of 0.5504%. The bonds were priced with 5% coupons to yield from 0.15% in 2023 to 0.73% in 2030.

“As expected the front end was well bid with 5s 8/2023 at 0.15% -3 bps, 5s 8/2024 at 0.21 -2 bps and 5s 8/2025 at 0.295% -1 bp,” Franks said. “Reports are that these short-end maturities have zero balances. 2026-2030 came as 5's as well at +0bps and carry balances.”

Wells Fargo Securities won the $249.92 million of tax-exempt Bidding Group 2 Second Series A GOs with a TIC of 1.7409%. The bonds were priced with 5% coupons to yield from 0.82% in 2031 to 1.09% in 2035.

MMD said the 5s of 2031 at 0.82% came three basis points above the MMD scale while the 5s of 2032-2035 came at four basis points above.

BofA won the $117.34 million of tax-exempt Second Series B refunding GOs with a TIC of 0.5749%. The bonds were priced with 5% coupons to yield 0.52% in 2027 and 0.59% in 2028.

MMD said both maturities came right on the AAA scale.

Public Resources Advisory Group was the financial advisor. Ballard Spahr along with the State Attorney General were the bound counsel.

BofA priced the City and County of Honolulu, Hawaii’s (Aa1/NR/AA+/NR) $239.025 million of GOs.

The Series 2020C GOs were priced to yield from 0.20% with a 5% coupon in 2021 to 1.70% with a 5% coupon in 2045. The Series 2020D GOs were priced to yield from 0.20% with a 5% coupon in 2021 to 0.82% with a 5% coupon in 2028.

BofA also priced the city and county’s $67.09 million of refunding GOs with 5% coupons to yield 0.25% in 2021 to 1.36% in 2035 and the $41.155 million of taxable GOs at par to yield from 0.42% in 2021 to 2.72% in 2045.

Wells Fargo repriced the Humble Independent School District of Harris County, Texas’ (Aaa/AAA/NR/NR) $181.04 million of unlimited tax school building bonds. The deals is backed by the Permanent School Fund guarantee program.

The bonds were repriced to yield from 0.22% with a 5% coupon in 2023 to 2.10% with a 2% coupon in 2042. A 2045 maturity was priced to yield 1.92% with a 3% coupon, a split 2049 maturity was priced to yield 2.25% with a 2.50% coupon and 2.30% with a 2.25% coupon, and a 2050 maturity was priced to yield 2% with a 3% coupon.

Citigroup priced and repriced Philadelphia, Pa.’s (A1/A+/A+/NR) $202.99 million of water and wastewater revenue bonds and revenue refunding bonds.

The bonds were repriced to yield from 0.27% with a 5% coupon in 2022 to 0.80% with a 5% coupon in 2027 and from 1.54% with a 5% coupon in 2035 to 1.76% with a 5% coupon in 2040. A 2045 maturity was repriced to yield 1.90% with a 5% coupon and a 2050 maturity was repriced to yield 1.95% with a 5% coupon.

Citi also priced the city’s $94.93 million of taxable water and wastewater revenue refunding bonds. The deal was priced at par to yield from 0.693% in 2021 to 2.434% in 2035.

Citi priced and repriced the Fort Worth Independent School District of Tarrant County, Texas’ (Aaa/AAA/NR/NR) $121.725 million of unlimited tax school building bonds. The deal is backed by the PSF.

The bonds were repriced to yield from 0.13% with a 5% coupon in 2021 to 2.05% with a 2% coupon in 2040; a 2045 maturity was priced to yield 2.22% with a 2.25% coupon.

PNC Capital Markets priced Allegheny County, Pa.’s (Aa3/AA-/NR/NR) $112.325 million of Series C-78 GOs.

The bonds were priced to yield from 0.37% with a 3% coupon in 2022 to 1.85% with a 4% coupon in 2040. A 2045 maturity was priced to yield 2.03% with a 4% coupon and a 2049 maturity was priced to yield 2.07% with a 4% coupon.

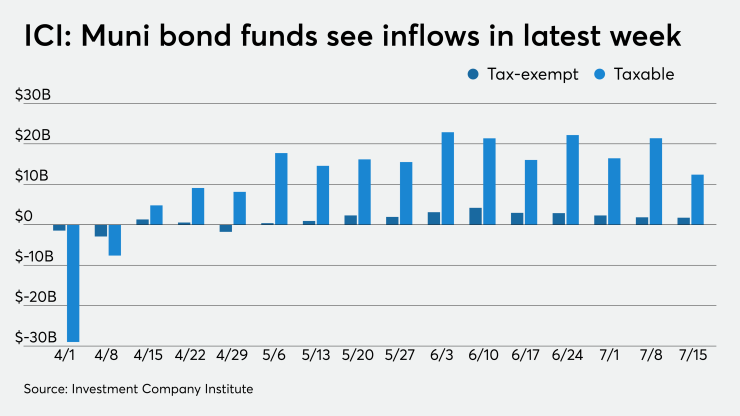

ICI: Muni bond funds see $1.7B inflow

Long-term municipal bond funds and exchange-traded funds saw combined inflows of $1.844 billion in the week ended July 15, the Investment Company Institute reported Wednesday.

It marked the 11th week in a row the funds saw inflows. In the previous week, muni funds saw an inflow of $1.844 billion, ICI said.

Long-term muni funds alone had an inflow of $1.390 billion in the latest reporting week after an inflow of $1.380 billion in the prior week.

ETF muni funds alone saw an inflow of $353 million after an inflow of $465 million in the prior week.

Taxable bond funds saw combined inflows of $12.780 billion in the latest reporting week after revised inflows of $21.391 million, originally reported as a $21.397 billion inflow in the prior week.

ICI said the total combined estimated outflows from all long-term mutual funds and ETFs were $4.957 billion after revised inflows in the prior week of $15.207 billion originally reported as a $14.214 billion inflow.

Secondary market

Municipals strengthened on the short and intermediate ends Wednesday, according to readings on Refinitiv MMD’s AAA benchmark scale.

MMD reported yields on the 2021 and 2023 GO munis were fell two basis points to 0.13% and 0.15%, respectively. The yield on the 10-year GO muni dipped one basis point to 0 0.72% while the 30-year yield was unchanged at 1.45%.

The 10-year muni-to-Treasury ratio was calculated at 121.0% while the 30-year muni-to-Treasury ratio stood at 112.3%, according to MMD.

The ICE AAA municipal yield curve showed short yields dropping one basis point to 0.130% in 2021 and 0.134% in 2022. The 10-year maturity dropped one basis point to 0.696% and the 30-year was steady at 1.476%.

ICE reported the 10-year muni-to-Treasury ratio stood at 126% while the 30-year ratio was at 112%.

The IHS Markit municipal analytics AAA curve showed the 2021 maturity yielding 0.13% and the 2022 maturity at 0.16% while the 10-year muni was at 0.71% and the 30-year stood at 1.44%.

Munis were little changed on the MBIS benchmark and AAA scales.

Treasuries were stronger as stock prices traded mixed.

The three-month Treasury note was yielding 0.123%, the 10-year Treasury was yielding 0.601% and the 30-year Treasury was yielding 1.296%.

The Dow rose 0.32%, the S&P 500 increased 0.27% and the Nasdaq fell 0.08%.