Top-quality municipal bonds were stronger at mid-session, according to traders, as the market took a brief respite ahead of the upcoming week's $5.7 billion new issue slate.

Total volume for the week is estimated by Ipreo at $5.696 billion, down from $12.829 billion in the prior week, according to revised data from Thomson Reuters. The calendar is composed of $3.731 billion of negotiated deals and $1.965 billion of competitive sales.

Secondary Market

The yield on 30-year muni general obligation was three to five basis points weaker on Friday from Thursday's record low level of 2.27%, according to a midday read of Municipal Market Data's triple-A benchmark scale. Thursday was the third day in a row it set a record low.

The yield on 10-year benchmark muni was one to four basis points weaker from 1.56% on Thursday, according to MMD. On Wednesday, it stood nine basis points above its all-time low of 1.47% set in 2012.

Yields on the week were substantially lower. On Friday, June 3, the yield on the 30-year muni stood at 2.40% while the 10-year muni yield was at 1.62%.

U.S. Treasuries were stronger on Friday. The yield on the two-year Treasury dipped to 0.75% on Friday from 0.76% on Thursday, while the 10-year Treasury yield declined to 1.65% from 1.68% and the yield on the 30-year Treasury bond decreased to 2.46% from 2.48%.

The 10-year muni to Treasury ratio was calculated at 93.0% on Thursday compared to 94.0% on Wednesday, while the 30-year muni to Treasury ratio stood at 91.5% versus 93.2%, according to MMD.

MSRB: Previous Session's Activity

The Municipal Securities Rulemaking Board reported 40,511 trades on Thursday on volume of $17.12 billion.

The Week's Most Actively Traded Issues

Some of the most actively traded issues by type in the week ended June 10 were from California, New York and Indiana issuers, according to Markit.

In the GO bond sector, the Los Angeles County, Calif. 3s of 2017 were traded 74 times. In the revenue bond sector, the New York Transportation Development Corp. 5s of 2031 were traded 105 times. And in the taxable bond sector, the Indiana State Financing Authority 3.624s of 2036 were traded 28 times.

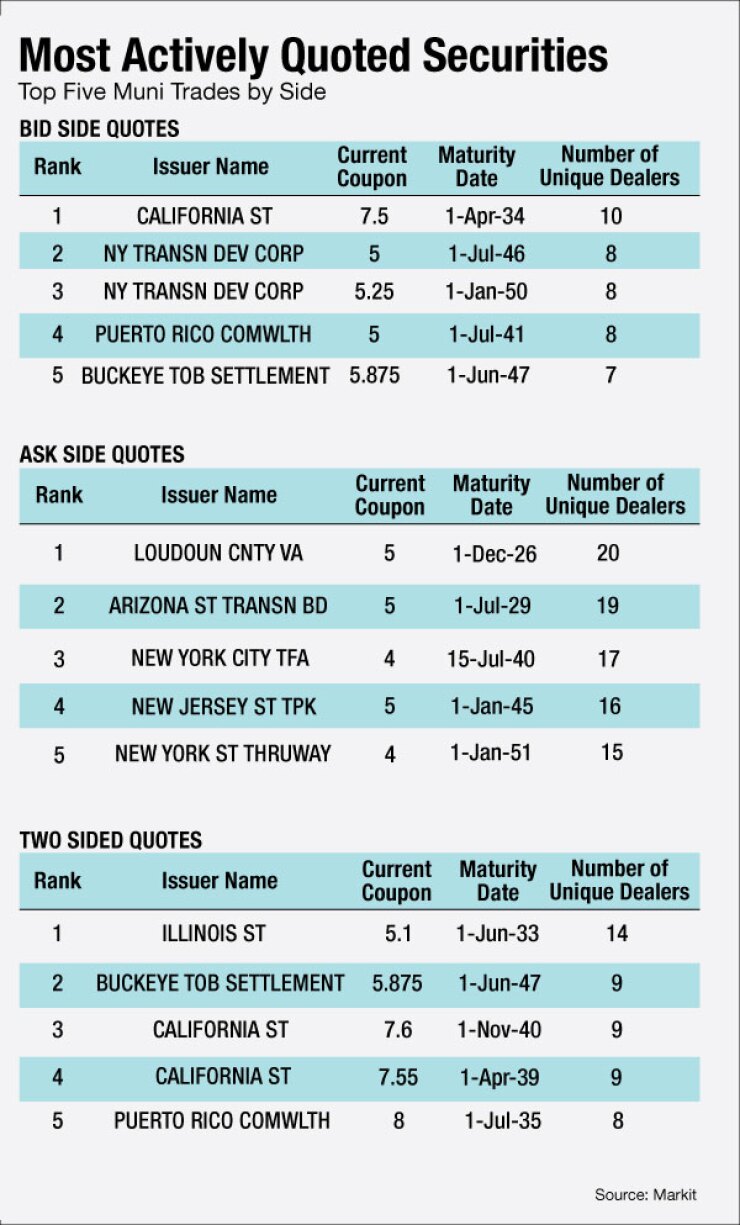

The Week's Most Actively Quoted Issues

California, Virginia and Illinois issues were among the most actively quoted names in the week ended June 10, according to Markit.

On the bid side, the California taxable 7.5s of 2034 were quoted by 10 unique dealers. On the ask side, the Loudoun County, Va. 5s of 2026 were quoted by 20 unique dealers. And among two-sided quotes, the Illinois taxable 5.1s of 2033 were quoted by 14 dealers.

Primary Market

The primary market saw the busiest new issue week of the year, with a record amount of competitive sales being offered along with a hefty negotiated slate.

Bank of America Merrill Lynch won the state of Maryland's $1.04 billion of general obligation state and local facilities loan of 2016, First Series bonds with a true interest cost of 2.17%. Traders said the deal met with a warm reception from buyers. The deal is rated triple-A by Moody's Investors Service, S&P Global Ratings and Fitch Ratings.

In the competitive arena on Tuesday, Georgia sold about $1.37 billion of bonds in five separate offerings.

Citigroup won the $382.19 million of Series 2016C-1 and Series 2016C-2 general obligation refunding bonds with a TIC of 1.49%. JPMorgan Securities won the $361.64 million of Series 2016A Tranche 1 GOs with a TIC of 1.24%. JPMorgan also won the $355.66 million of Series 2016A Tranche 2 GOs with a TIC of 2.69%. And JPMorgan won the $199.87 million of Series 2016B taxable GOs with a TIC of 2.57%. Morgan Stanley won the $67.99 million of Series 2016D taxable refunding GOs with a TIC of 1.78%. All five sales are rated triple-A by Moody's, S&P and Fitch.

Massachusetts competitively sold $500 million of GOs in two separate competitive sales. JPMorgan Securities won the $450 million of Consolidated Loan of 2016 Series E GOs with a TIC of 3.29%. JPMorgan also won the $50 million of Consolidated Loan of 2016 Series D GOs with a TIC of 1.46%. The deals are rated Aa1 by Moody's and AA-plus by S&P and Fitch.

Prince George's County, Md., competitively sold $174.15 million of GOs in two separate offerings. BAML won the $115.8 million of Series 2016A GO consolidated public improvement bonds with a TIC of 2.197%. BAML also won the $58.35 million of Series 2016B GO consolidated public improvement refunding bonds with a TIC of 1.577%. Both deals are rated triple-A by Moody's, S&P and Fitch.

South Broward Hospital District, Fla., sold $168.03 million of Series 2016 hospital refunding revenue bonds. PNC Capital Markets won the bonds with a TIC of 2.89%. The deal is rated Aa3 by Moody's and AA by S&P.

Seattle, Wash., sold $164.95 million of Series 2016 drainage and wastewater system improvement and refunding revenue bonds. Morgan Stanley won the bonds with a TIC of 2.92%. The deal is rated Aa1 by Moody's and AA-plus by S&P.

The Fayetteville Public Work Commission, N.C., sold $114.41 million of Series 2016 revenue bonds. Wells Fargo Securities won the bonds with a TIC of 2.49%. The deal is rated Aa2 by Moody's and AA by S&P and Fitch.

Clark County, Nev., competitively sold $107.35 million of Series 2016 highway revenue motor vehicle fuel tax refunding bonds. Raymond James won the bonds with a TIC of 1.38%.The deal is rated Aa3 by Moody's and AA-minus by S&P.

In the negotiated sector, Citi priced the New York Transportation Corp.'s $844.21 million of Series 2016 special facilities revenue refunding bonds for the American Airlines John F. Kennedy International Airport project. The deal, which is subject to the alternative minimum tax, is rated BB-minus by S&P and BB by Fitch.

Loop Capital Markets priced Harris County, Texas' $513.92 million of Series 2016A toll road senior lien revenue refunding bonds. The deal is rated Aa2 by Moody's and AA by Fitch.

JPMorgan priced the District of Columbia's $431.82 million of Series 2016A GO bonds. The deal is rated Aa1 by Moody's and AA by S&P and Fitch.

Piper Jaffray priced the Pennsylvania Turnpike Commission's $408.11 million of Series 2016 A1 and A2 turnpike revenue bonds. The deal is rated A1 by Moody's and A-plus by S&P.

JPMorgan Securities priced the New York City Housing Development Corp.'s $377.01 million of multi-family housing revenue sustainable neighborhood bonds. The bonds are rated Aa2 by Moody's and AA-plus by S&P.

Barclays Capital priced the Pennsylvania State University's $351.08 million of Series 2016A bonds and Series 2016B refunding bonds. The deal is rated Aa1 by Moody's and AA by S&P.

Citigroup priced the San Diego County Water Authority's $296.51 million of Series 2016A and B water revenue refunding bonds. The bonds are rated Aa2 by Moody's, triple-A by S&P and AA-plus by Fitch. Morgan Stanley priced the SDCWA's $87.69 million of Series 2016S-1 subordinate lien water revenue refunding bonds. That deal was rated Aa3 by Moody's, AA-plus by S&P and AA by Fitch.

Goldman Sachs priced the Massachusetts Development Finance Agency's $233.20 million of Series 2016N revenue bonds for the Dana-Farber Cancer Institute. The deal is rated A1 by Moody's and A by S&P.

Ramirez & Co. priced the Los Angeles Department of Water and Power's $225 million of Series 2016B power system revenue bonds. The deal is rated Aa2 by Moody's and AA-minus by S&P and Fitch.

BAML priced the California Statewide Communities Development Authority's $219.91 million of Series 2016 revenue bonds for John Muir Health. The deal is rated A1 by Moody's and A-plus by S&P.

Citi priced the Board of Regents of the University of Texas System's $213.19 million of Series 2016D revenue financing system bonds. The deal is rated triple-A by Moody's, S&P and Fitch.

Barclays Capital priced the Lower Colorado River Authority, Texas' $188.39 million of Series 2016 transmission contract refunding revenue bonds for the LCRA Transmission Service Corp. project. The deal is rated A by S&P and A-plus Fitch.

Goldman Sachs priced the California Educational Facilities Authority's $170.35 million of Series U7 revenue bonds for Stanford University. The deal is rated triple-A by Moody's, S&P and Fitch.

JPMorgan Securities priced the McAllister Academic Village LLC's $119.4 million of Series 2016 revenue refunding bonds for the Arizona State University's Hassayampa Academic Village project. The deal is rated A1 by Moody's and AA-minus by S&P.

Wells Fargo priced Los Angeles County, Calif.'s $800 million of 2016-17 tax and revenue anticipation notes. The TRANs are rated MIG1 by Moody's, SP1-plus by S&P and F1-plus by Fitch.

Piper Jaffray priced the state of Idaho's $500 million of Series 2016 tax anticipation notes. The TANs are rated MIG1 by Moody's, SP1-plus by S&P and F1-plus by Fitch.

Bond Buyer Visible Supply

The Bond Buyer's 30-day visible supply calendar increased $1.60 billion to $10.23 billion on Friday. The total is comprised of $4.08 billion of competitive sales and $6.16 billion of negotiated deals.

Muni Bond Funds See Inflows for 36th Week in a Row

For the 36th straight week, municipal bond funds reported inflows, according to Lipper data released Thursday.

Weekly reporting funds saw $852.457 million of inflows in the week ended June 8, after inflows of $473.159 million in the previous week, Lipper said.

The four-week moving average remained positive at $880.275 million after being in the green at $970.242 million in the previous week. A moving average is an analytical tool used to smooth out price changes by filtering out fluctuations.

Long-term muni bond funds also experienced inflows, gaining $700.430 million in the latest week after inflows of $291.408 million in the previous week. Intermediate-term funds had inflows of $212.204 million after inflows of $104.528 million in the prior week.

National funds had inflows of $718.562 million on top of inflows of $448.237 million in the previous week. High-yield muni funds reported inflows of $470.952 million in the latest reporting week, after inflows of $178.633 million the previous week.

Exchange traded funds saw inflows of $134.964 million, after inflows of $92.783 million in the previous week.