The week got off to a fast start on Monday and will pick up right where it left off on Tuesday, as issuers are doing what they can to get deals done and in the books before yearend. Tuesday is expected to be one of the last busiest primary days of the year.

Secondary market

The MBIS municipal non-callable 5% GO benchmark scale was stronger in early trading on Tuesday morning.

The 10-year muni benchmark yield dipped to 2.295% from Monday’s final read of 2.296%, according to

The MBIS benchmark index, which is comprised of investment-grade municipal securities, is updated hourly on the

Top-rated municipal bonds were weaker on Tuesday morning. The yield on the 10-year benchmark muni general obligation was as many as two basis points higher from 2.03% on Monday, while the 30-year GO was also up by as many as two basis points from 2.62%, according to a read of MMD’s triple-A scale.

U.S. Treasuries were weaker on Tuesday morning. The yield on the two-year Treasury inched up to 1.84% from 1.83%, the 10-year Treasury yield climbed to 2.43% from 2.39% and the yield on the 30-year Treasury rose to 2.78% from 2.74%.

On Monday, the 10-year muni-to-Treasury ratio was calculated at 84.9% compared with 84.5% on Friday, while the 30-year muni-to-Treasury ratio stood at 96.6% versus 96.0%, according to MMD.

Primary market

Barclays Capital is expected to price Houston’s $1.007 billion of pension general obligation taxable bonds on Tuesday. The deal is rated Aa3 by Moody’s Investors Service and AA by S&P Global Ratings.

Morgan Stanley is scheduled to price California Health Facilities Financing Authority’s $461.98 million of refunding revenue bonds for Stanford Healthcare.

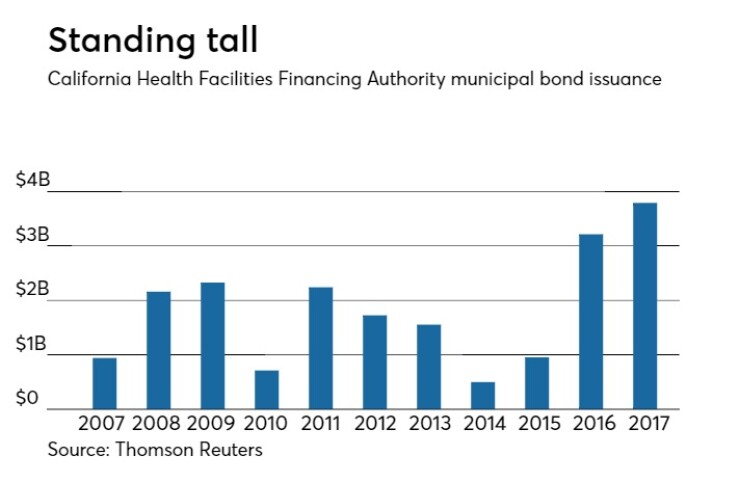

Since 2007, the California HFFA has issued roughly $20.21 billion of bonds, with the most issuance before this year occurring in 2016 when it sold $3.21 billion of bonds. The authority saw a low year of issuance in 2014 when it issued $500 million.

Goldman Sachs is slated to price the Riverside County, Calif., Transportation Commission’s $393.44 million of sales tax revenue refunding limited tax bonds. The deal is rated AA-plus by S&P and AA by Fitch Ratings.

Wells Fargo is expected to price the New Jersey Economic Development Authority’s $286.26 million of special facility revenue and refunding bonds for the Port Newark Container Terminal Project. The deal is rated Ba1 by Moody’s.

MSRB: Previous session's activity

The Municipal Securities Rulemaking Board reported 45,574 trades on Monday on volume of $12.545 billion.

Bond Buyer 30-day visible supply

The Bond Buyer's 30-day visible supply calendar decreased $1.60 billion to $12.36 billion on Tuesday. The total is comprised of $704 million of competitive sales and $11.66 billion of negotiated deals.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.