DALLAS — The Louisiana State Bond Commission named Citi as senior managing underwriter for a negotiated sale of $400 million of state gasoline and fuels-tax revenue refunding bonds.

The sale is expected in early May.

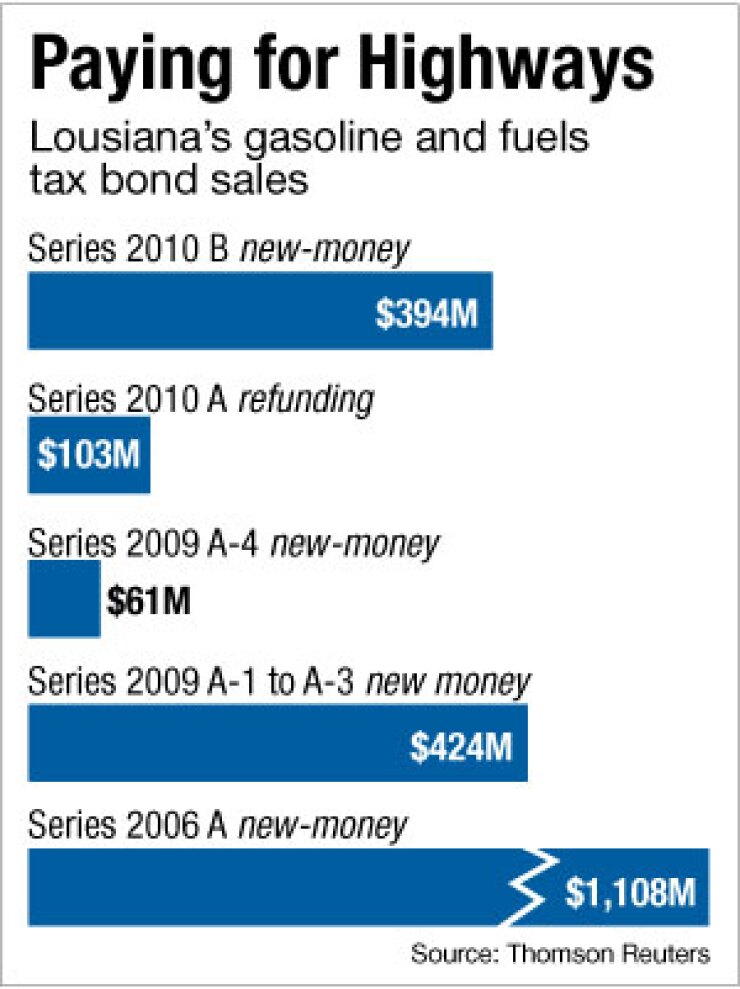

The fuels tax bonds were issued in 2002, 2005 and 2006 to provide funds to the Department of Transportation and Development’s highway construction and maintenance efforts.

The commission issued a request for underwriting proposals on the refunding issue in January and received 18 bids.

Commission director Whit Kling Jr. said 12 firms sought the position as senior underwriter with six interested only in co-manager status within the underwriting syndicate.

Co-managers selected at Thursday’s commission meeting include Jefferies & Co., Morgan Keegan & Co., Loop Capital Markets LLC, Stephens Inc. and Dorsey & Co. Foley & Judell LLP is bond counsel and Lamont Financial Services is the state’s financial advisor.

Louisiana’s revenue-supported gas and fuel debt is rated AA-minus by Fitch Ratings and Standard & Poor’s, and Aa1 by Moody’s Investors Service. The state’s GO debt is rated Aa2 by Moody’s and AA by Fitch and Standard & Poor’s.

The commission authorized a committee of Kling, the financial advisor and bond counsel to negotiate with four firms to renew or replace interest-rate swap agreements on five gas and fuels-tax bond issues that as of Jan. 31 carried termination fees of almost $200 million to the state.

Louisiana Treasurer John Kennedy said if interest rates go up, as he expects to happen, the termination penalties will ease and could eventually evaporate.

The bonds will not reach final maturity until 2043.

The swap agreements involve Morgan Keegan Financial Products, Merrill Lynch Capital Services Inc., Citibank NA and JPMorgan Chase Bank NA.

The variable-rate issues covered by the agreements include 2009 tranches of $200 million, $121.3 million and $60.6 million, and a $103.1 million issue in 2010.

Agreements on $203 million of the bonds include a variable rate of SIFMA plus 75 basis points, and a variable rate on the swaps of 70% of the one-month London Interbank Offered Rate average. The other $182 million of bonds have a variable rate of Libor plus 250 basis points and a swap rate of 70% of the one-month Libor average.

The Bond Commission also wants to renegotiate the mandatory swap termination dates of May 1 and July 1 for the agreements with Citibank and Merrill Lynch.

The measure the commission adopted stipulates that the interest rate paid by the state under the renegotiated agreement should not be more than 1% higher than the current rate.

The agency also approved $60 million of revenue bonds to be issued by Louisiana Public Facilities Authority for renovations and expansions at Lafayette General Medical Center.