Top-quality municipal bonds finished stronger on Friday, as the yield on Municipal Market Data's 30-year muni general obligation fell to its fourth straight record low.

In the primary, traders took a brief respite ahead of the upcoming week's more manageable new issue slate. Total volume for the new week is estimated by Ipreo at $5.7 billion, down from $12.8 billion, according to revised data from Thomson Reuters.

Secondary Market

The yield on 30-year muni general obligation dropped five basis points on Friday to 2.22% from 2.27% on Thursday, according to the final read of MMD's triple-A benchmark scale. It was the fourth day in a row it set a record low.

The yield on 10-year benchmark muni fell four basis points to 1.52% from 1.56% on Thursday, according to MMD. It now stands only five basis points above its all-time low of 1.47% set back in 2012.

Yields on the week were substantially lower, falling between 10 and 18 basis points. On Friday, June 3, the yield on the 30-year muni stood at 2.40% while the 10-year muni yield was at 1.62%.

U.S. Treasuries were stronger on Friday. The yield on the two-year Treasury dropped to 0.73% on Friday from 0.76% on Thursday, while the 10-year Treasury yield declined to 1.63% from 1.68% and the yield on the 30-year Treasury bond decreased to 2.44% from 2.48%.

The 10-year muni to Treasury ratio was calculated at 92.9% on Friday compared to 93.0% on Thursday, while the 30-year muni to Treasury ratio stood at 90.7% versus 91.5%, according to MMD.

The Federal Open Market Committee is set to gather in Washington to decide the course of monetary policy. Most observers think it'll be a washout, with the Fed not making any move to raise interest rates at the conclusion of its two-day meeting on Wednesday.

Primary Market

Issuance slows down a bit in the upcoming week after traders saw the busiest new issue calendar of the year, where a record amount of competitive sales were served up along with a hefty sized negotiated slate.

The new calendar is composed of about $3.7 billion of negotiated deals and $2.0 billion of competitive sales, according to Ipreo. This is down from the $7.5 billion of negotiated sold in the previous week and the $5.4 billion of competitives offered, according to revised data from Thomson Reuters.

"With the June 9 release of the Federal Reserve flow of funds, we see the continued growth of foreign interest in municipal bonds. This 'crossover' interest, plus robust June redemptions, is likely to keep demand high," said Natalie Cohen, Managing Director of Municipal Securities Research at Wells Fargo Securities. "With lower supply in the coming week, we expect pricing to be tight and perhaps spill over into more secondary market trading."

The upcoming week's headline issuer is fresh off a ratings downgrade amid a bitter budget conflict.

The state of Illinois is competitively selling $550 million of its Series 2016 general obligation bonds on Thursday.

The bonds are rated Baa2 by Moody's Investors Service and BBB-plus by S&P Global Ratings and Fitch Ratings. All three raters have negative outlooks on the credit.

"Given the relatively light calendar, focus will be on Illinois, with back story of two downgrades and an 11 1/2 month budget gridlock," said Janney Municipal Strategist Alan Schankel. "Despite downgrades, I expect demand to be strong. It's pretty amazing to me that this state GO is trading at comparable or even higher yields than the week's American Airlines JFK deal, which was S&P BB-minus rated and is subject" to the alternative minimum tax.

Illinois last competitively sold GOs on Jan. 14, when Bank of America Merrill Lynch won $480 million Series of January 2016 GOs with a true interest cost of 3.9989%. It was the state's first sale after a 20-monthj hiatus with the proceeds going mostly to transportation projects. That issue was priced with a top yield of 4.27% in 2041, which at the time was 161 basis points over the comparable maturity on MMD's triple-A scale.

Also on tap is the New York State Environmental Facilities Corp.'s $500.64 million of Series 2016A state clean water and drinking water revolving funds revenue bonds.

Goldman Sachs is expected to price the NYS EFC's issue, the New York City Municipal Water Finance Authority Projects Second Resolution bonds, on Tuesday after a retail order period on Monday. The bonds are rated triple-A by Moody's and S&P and AA-plus by Fitch.

BAML is expected to price the Dutchess County Local Development Corp., N.Y.'s $378.01 million of Series 2016B revenue and revenue refunding bonds for Health Quest Systems on Thursday. The deal consists of $28.01 million of Series 2016A revenue refunding bonds and $350 million of Series 2016B revenue bonds. The issue is rated A3 by Moody's and A-minus by S&P.

JPMorgan Securities is expected to price the Metropolitan Washington Airports Authority's $375 million of Series 2016A AMT and Series 2016B non-AMT airport system revenue refunding bonds on Tuesday. The deal is rated A1 by Moody's and AA-minus by S&P and Fitch.

JPMorgan is also set to price the Maryland Economic development Corp.'s $333.06 million of private activity revenue bonds for the Purple Line Light Rail project on Monday. The deal consists of Series 2016A RSA bonds, Series 2016B FCP bonds, Series 2016C SLP bonds and Series 2016D AP bonds. The bonds are rated BBB-plus by S&P and Fitch.

Barclays Capital is set to price Cook County, Ill.'s $300 million of Series 2016A GO refunding bonds on Tuesday. The deal is rated A2 by Moody's, AA-minus by S&P and A-plus by Fitch.

In the short-term competitive arena, the New York Metropolitan Transportation Authority is selling $700 million of bond anticipation notes in two separate sales on Thursday. The deals consist of $350 million of Series 2016A Subseries 2016A-1 dedicated tax BANs and $350 million of Series 2016A Subseries 2016A-2 dedicated tax BANs.

Week's Most Actively Traded Issues

Some of the most actively traded issues by type in the week ended June 10 were from California, New York and Indiana issuers, according to

In the GO bond sector, the Los Angeles County, Calif. 3s of 2017 were traded 74 times. In the revenue bond sector, the New York Transportation Development Corp. 5s of 2031 were traded 105 times. And in the taxable bond sector, the Indiana State Financing Authority 3.624s of 2036 were traded 28 times.

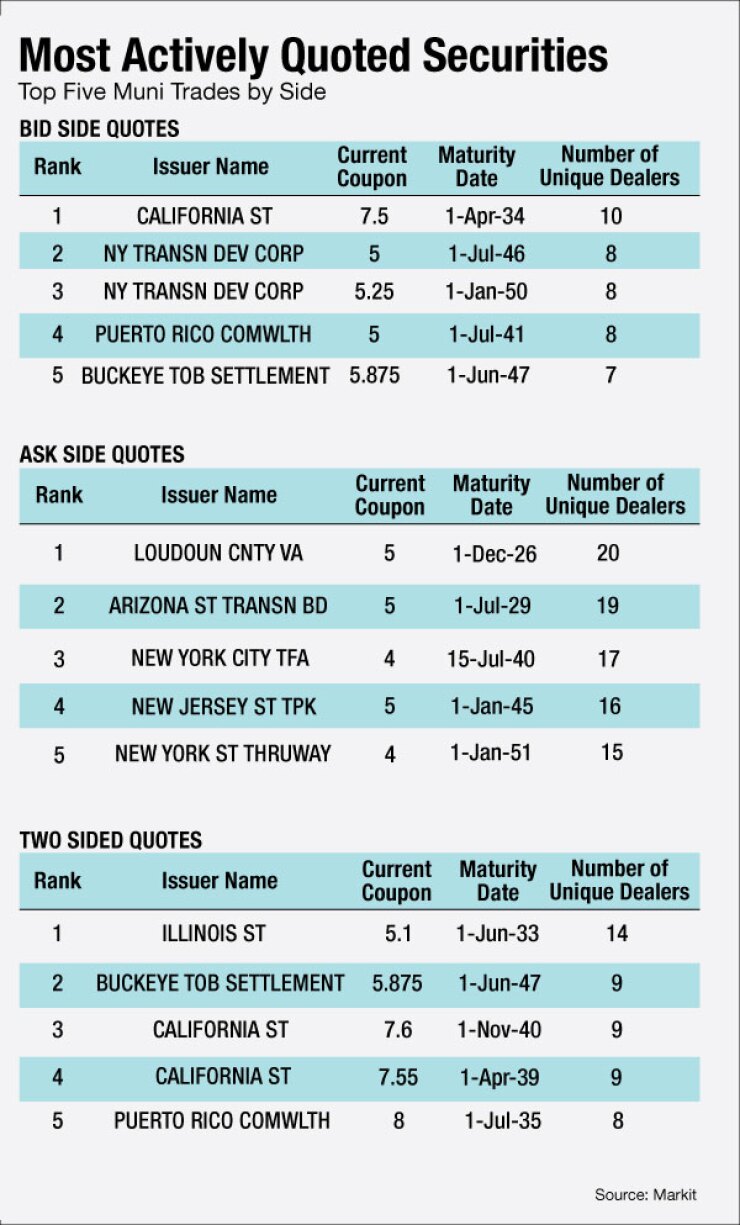

Week's Most Actively Quoted Issues

California, Virginia and Illinois issues were among the most actively quoted names in the week ended June 10, according to Markit.

On the bid side, the California taxable 7.5s of 2034 were quoted by 10 unique dealers. On the ask side, the Loudoun County, Va. 5s of 2026 were quoted by 20 unique dealers. And among two-sided quotes, the Illinois taxable 5.1s of 2033 were quoted by 14 dealers.

Muni Bond Funds Again See Inflows

For the 36th straight week, municipal bond funds reported inflows, according to Lipper data released Thursday. Weekly reporting funds saw $852.457 million of inflows in the week ended June 8, after inflows of $473.159 million in the previous week, Lipper said.

The four-week moving average remained positive at $880.275 million after being in the green at $970.242 million in the previous week. A moving average is an analytical tool used to smooth out price changes by filtering out fluctuations.

Long-term muni bond funds also experienced inflows, gaining $700.430 million in the latest week after inflows of $291.408 million in the previous week. Intermediate-term funds had inflows of $212.204 million after inflows of $104.528 million in the prior week.

National funds had inflows of $718.562 million on top of inflows of $448.237 million in the previous week. High-yield muni funds reported inflows of $470.952 million in the latest reporting week, after inflows of $178.633 million the previous week.

Exchange traded funds saw inflows of $134.964 million, after inflows of $92.783 million in the previous week.