CHICAGO — Borrowing by Midwest issuers during the first half of 2014 slid 13.2% from the same period of 2013, according to Thomson Reuters data.

On the other hand, borrowing fueled by Chicago and other Illinois issuers helped boost new- money issuance by 16.8%.

Total volume in the Midwest for the first half of the year dropped to nearly $30 billion in 1,813 transactions from $34.6 billion in 2,264 deals for the first half of 2013, according to Thomson Reuters.

Borrowing slipped by 16.2% for the first quarter from the year before and then 11.4% in the second.

The sharp decline in refundings drove the slippage with new-money demand easing the drop. New-money volume rose 16.8% to $16.9 billion while refunding fell 36.1% to $8.7 billion. Combined transactions dropped 43% to $4.4 billion. The only other region to see a rise new-money bonding was the Southwest.

"There's an abundance of infrastructure needs in the Midwest but I don't see a lot of governments looking at expansion projects. They are more focused on repairs and maintenance," said Richard Ciccarone, president of Merritt Research Services.

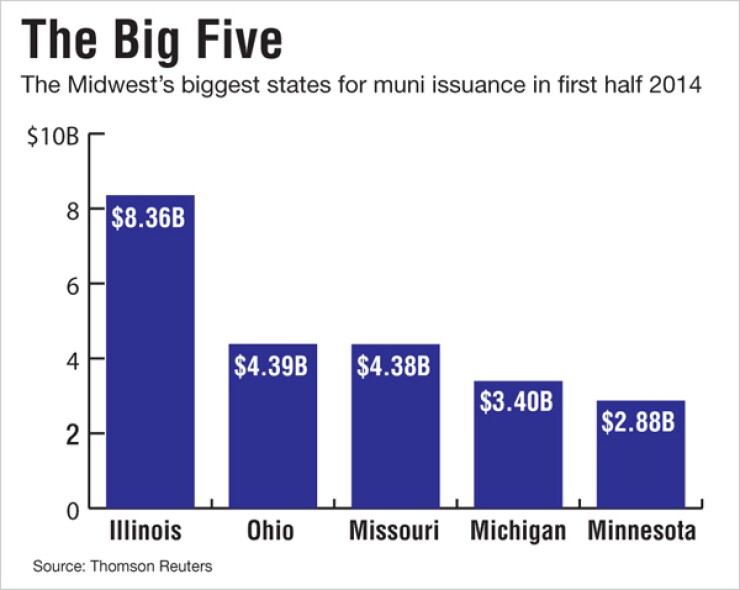

Illinois-based issuers far outpaced borrowing in the region's other 10 states, accounting for $8.4 billion of the region's volume. Issuance rose 9.2% in Illinois. Ohio and Missouri borrowers followed with each state accounting for another $4.4 billion of issuance. Those numbers represented a 36% increase for Missouri but a sharp decline of 39.5% for Ohio.

Borrowing also slid in Indiana, Iowa, Michigan, South Dakota and Wisconsin while rising in Minnesota, Nebraska and North Dakota. The rise in North Dakota, which is enjoying the largest oil boom in its history and one of the healthiest economies in the nation, was led by the state's housing agency. It was the state's top issuer for the first half.

Issuance dropped 12% in Michigan to $3.4 billion but Detroit's high-profile bankruptcy, now in its 13th month, did not seem to affect local issuance, unlike last year when the Chapter 9 filing virtually halted all local borrowing for several weeks.

Issuance by Michigan's cities and towns was up 13% compared to the same period in 2013, which was before Detroit's bankruptcy, and issuance by counties and parishes was up by nearly 52%. Michigan's local authorities issued 247% more debt during the first six months of 2014 than in 2013, according to Thomson Reuters.

Around the Midwest, state agencies led the pack with $7.1 billion of borrowing, down 31.5%, followed by district issuance of $6.7 billion, down 9.7%.

Local borrowing showed some strength with city and town issuance rising 24.7% to $5.7 billion and local authorities rising 36.2% to $3.2 billion, although county borrowing saw a 56.4% drop to $1.6 billion.

State government bonding rose slightly by 3.7% to $4.3 billion.

Among sectors, education led the pack with $8.8 billion of borrowing, down 26%, followed by general purpose issuance of $5.8 billion, down 22.5%.

Health care volume in the Midwest fell 19% compared to the same period last year with total issuance of $3.7 billion in 66 transactions.

Nonprofit providers continue to hold off on major capital plans as they monitor the impact of the Affordable Care Act, now six months old, according to health care experts.

Anemic patient volume and other weaknesses are also stalling many borrowing plans, experts said. Two of the three major rating agencies have negative outlooks on the sector.

"The coverage expansion is making some difference but I don't expect to see that curve where the slope of the line of declining hospital admissions is going to turn upward," said Allan Baumgarten, a Midwest-based health care analyst and consultant.

Many health-care providers have shifted their capital plans to incorporate less costly outpatient service projects from more traditional and expensive projects such as new inpatient towers, Baumgarten added.

"There's still a pretty healthy volume of capital investment going forward, but there's a greater emphasis on outpatient and ambulatory services," he said.

The trend of mergers and acquisitions has also shifted, he said. More providers are looking for joint ventures and other partnerships that stop short of full mergers.

Mayo Clinic, the Cleveland Clinic and Ascension are examples of major credits that have entering into partnerships with smaller providers that share services but are not outright acquisitions.

More health care providers are also turning to direct loans and lending as well.

Transportation saw a whopping 170% increase, pushing borrowing up to nearly $5 billion in 81 deals.

The Missouri Highways and Transportation Commission, the Illinois State Toll Highway Authority and the Chicago Transit Authority all came to market as did Chicago with a new-money and refunding sale for its Midway Airport.

Taxable borrowing dropped 61% to $2.5 billion.

Revenue-backed bonds accounted for $15.3 billion of the region's volume while general obligation bonds accounted for $14.7 billion.

Fixed-rate structures represented $27.8 billion of issuance.

More issuers showed a proclivity to use insurance but the total remained sparse with $1.3 billion of bonds over 118 deals insured for a 125% increase.

The state of Illinois took the top seat among Midwestern borrowers, selling $2.4 billion of bonds.

The state government also accounted for the region's largest transaction, a $1 billion new-money sale in February led by Citi.

That offering was followed by a $400 million issue in March and then a $750 million deal and a $250 million sale in April.

Illinois has no new issuance planned for the remainder of the year.

Chicago followed on the ranking of biggest issuers with $1.9 billion of borrowing as it took care of its new-money needs in a general obligation new-money and refunding sale for $884 million in March in its first GO issue in two years, and then $770 million of new-money and refunding and restructuring bonds for Midway Airport.

The Missouri Highways and Transportation Commission followed in third place, all through its $900 million refunding.

The Illinois toll authority was the fourth-top borrower with $878 million and Wisconsin followed with $846 million.

Other top offerings in the region for the first half included the Illinois state toll agency and CTA's sales. Minnesota's $462 million sale for the new Minnesota Vikings' National Football League stadium was also among the region's top 10 bond sales.

Volume for the remainder of the year could be difficult to assess and could be influenced by interest rates, according to Ciccarone. A rise in rates may prompt some issuers to move more quickly on borrowings. Even if interest rates hold steady at current low levels, Midwest refundings may have hit a "saturation level" and would require a drop to bring more to market, Ciccarone said.

The rankings competition among senior managers was fierce. Citi took the top spot among senior managers but just barely. It was credited with $2.63 billion, followed by Wells Fargo Securities with $2.61 billion.

Morgan Stanley ranked third senior managing $2.5 billion, followed by Bank of America Merrill Lynch with nearly $2.5 billion, and JPMorgan with $2.2 billion.

Stifel, Nicolaus & Co., RBC Capital Markets, Barclays Capital, Robert W. Baird & Co. and Piper Jaffray rounded out the top 10.

Public Financial Management Inc. ran away with the top ranking among financial advisory firms credited with advising on $4.9 billion of borrowing, followed by Baird which advised on $1.2 billion, Ehlers with $1.1 billion, Acacia Financial with nearly $1.1 billion,and Stauder Barch with almost $1.1 billion.

Peralta Garcia Solutions, Public Resources Advisory Group, Columbia Capital Management, Frasca & Associates, ad PRISM Municipal Advisors LLC rounded out the top 10.

Chicago-based Chapman and Cutler LLP led among bond counsel, credited with $3.3 billion of the region's financings. It was followed by Missouri-based Gilmore & Bell PC with $2.4 billion.

Squire Patton Boggs, which was formed by the merger this year of Squire Sanders and Patton Boggs, followed with $1.4 billion.

Wisconsin-based Quarles & Brady LLP followed with $1.3 billion, and Miller Canfield Paddock with $1.2 billion. Mayer Brown LLP, Bricker & Eckler LLP, Kutak Rock LLP, Sanchez Daniels & Hoffman LLP rounded out the top 10.