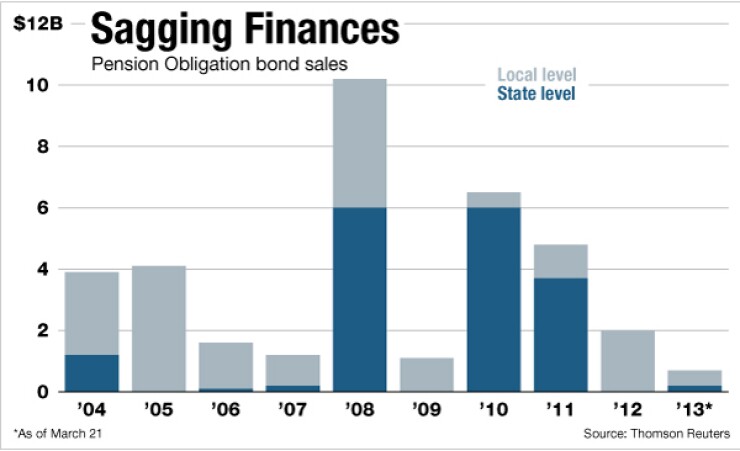

DALLAS — Kansas lawmakers will consider a bill next week authorizing up to $1.5 billion of taxable state pension bonds to bolster the sagging finances of the main state employee pension plan.

The measure was narrowly approved, 7-6, by the House pension and benefits committee March 21.

The bill authorizes Kansas Development Finance Authority to issue one of more series of up to $1.5 billion of the taxable bonds. The measure stipulates that the proceeds would be deposited to Kansas Public Employee Retirement System to finance “a portion of the unfunded actuarial pension liability.”

House Bill 2403 was moved to the House floor with support of one Democrat and six Republicans on the committee, with four Republicans and two Democrats voting no. The pension bond bill was filed March 18 by the House Appropriations Committee.

The bonds, which would be supported by annual general fund appropriations by the Legislature, could only be issued with approval by the State Finance Council. The interest rate on the bonds is capped at 5% by the enabling legislation.

Debt service on the 30-year bonds is estimated by the Division of the Budget at $86.3 million a year.

Alan D. Conroy, executive director of KPERS, said the infusion of bond proceeds into KPER’s $13.1 billion investment portfolio would allow the retirement system to whittle down its unfunded liabilities, currently estimated at $9.3 billion through 2033.

“It would represent a meaningful effort,” he said. “Our board is certainly in favor of the pension bond plan.”

If the pension bonds are authorized, Conroy said, the $1.5 billion of debt would probably be issued in three $500 million tranches over several years.

“One of the board members noted that $1.5 billion is more than could be prudently invested in one fell swoop,” he said.

Contributions into the retirement system by state and local school districts would be almost $3.7 billion less over the next two decades if the pension bonds are issued, state budget analysts said.

The legislative fiscal report on HB 2034 said employer contributions from fiscal 2013 through 2034 would total $20.9 billion under current law. The report predicted a drop in employer contributions to $17.3 billion If the $1.5 billion of pension bonds are issued.

The peak employer contribution rate would fall to 14.1% of an employee’s annual salary from a projected 17.3% under current provisions.

Selling the bonds at 5% or less and investing the proceeds to obtain a return of 8% is projected to allow KPERS to close the funding gap from the current 53% of obligations to 61% by 2015. The funded level then would rise faster than it would without the infusion.

Conroy said the $500 million of state pension bonds issued for KPERS in early 2004 has been a good investment. The Kansas pension bonds are rated Aa2 by Moody’s Investors Service and AA by Standard & Poor’s.

“The 2004 bonds gave us $440 million of proceeds,” he said. “We earned a return of 6.4% on those funds in fiscal 2012 and paid 5.4% in interest.”