SAN FRANCISCO — Stockton, Calif.’s

“I think this has been brewing for a while and I don’t think it is going to set off a wave or panic situation yet,” said Howard Cure, director of municipal research at Evercore Wealth Management.

As of Monday morning, investors appeared to still be digesting the developments from a city that has been plagued for years with financial troubles.

“We have seen a couple of trades at the distressed levels. It is really hard to tell today — we are seeing so many Stockton bonds up for bid,” said a trader in Southern California. “There are some prices at really distressed levels and some that have traded down from where they were on Friday.”

As an example of the distress, an investor sold city redevelopment revenue bonds for 85% of par with a 6.17% yield on Monday after the same bonds sold for 96% of par with 5.24% yield on Friday. The initial offering price of the 2004 bonds maturing in 2036 was 105% with a 5% coupon.

Investors may be waiting for the City Council to make a final decision Tuesday on whether to accept city manager Bob Deis’s recommendation to halt general fund payments toward debt service on seven bonds through June 30, which would save the government $2 million as it tries to close a $15 million budget gap.

The move would cause a technical default on the bonds, though investors would still be paid either through bond reserves, previous payments to bond trustees, or bond insurance, according to a city staff report signed by Deis.

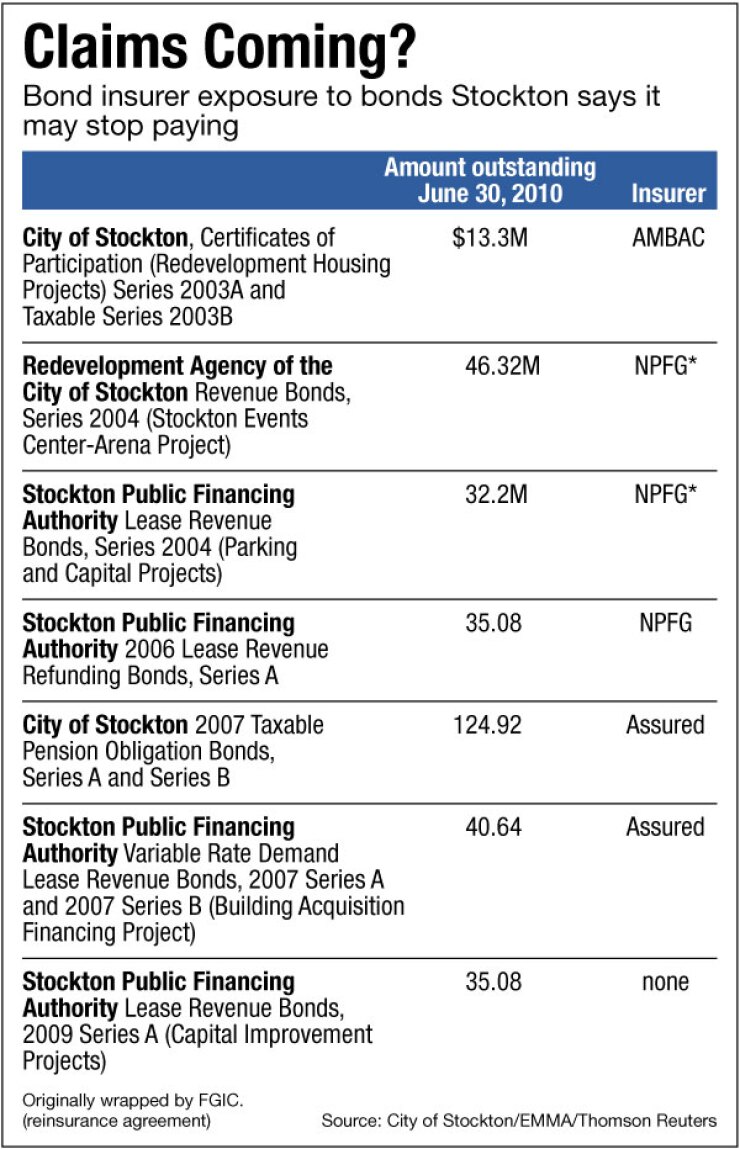

The bonds were issued by Stockton, its redevelopment agency and its public financing authority.

The city’s plan would stop payments tied to $327 million of lease revenue and pension obligation bonds. All of the bonds except about $35 million are insured by National Public Finance Guarantee Corp., Assured Guaranty and Ambac, according the city’s most recent comprehensive audited financial report filed for the fiscal year ending June 30, 2010.

“In the event that debt service payments by the city are interrupted, National will ensure that its policyholders will receive all of their principal and interest payments on time and in full,” Kevin Brown, spokesman for National, said in statement.

Brown said National had $224 million of insured exposure to Stockton debt, $89 million of which is backed by its general fund.

A spokesperson for Assured said the company could not comment, but noted that the insurer is exposed to the tune of more than $150 million net par.

Ambac insures $13 million of the bonds linked to the potential default, according to officials.

There were more than $702 million in bonds issued by Stockton, including the city government, the redevelopment agency, as well as water, sewer and parking enterprises outstanding as of June 30, 2010, according to the CAFR.

The bond insurers would be brought into negotiations if Stockton’s city leaders also decide on Tuesday to accept Deis’ recommendation for mediation with stakeholders to avoid bankruptcy.

The talks are required before a bankruptcy filing, after the adoption last year by the California Legislature of AB 506. The new law requires a majority of a municipality’s elected body to either vote during a public hearing to declare a fiscal emergency or take part in a 60-day evaluation process by an independent third party before proceeding to declare bankruptcy.

Stockton has declared fiscal emergencies the last two years and its mayor even mentioned bankruptcy in May. City leaders have been trying for years to reduce employee costs locked into contracts that continued to rise amid the downturn. The city has cut more than a quarter of its workforce since 2009.

But Stockton’s plan to curtail bond payments did appear to take rating agencies by surprise. The news Friday led to “super-downgrades” of California’s 13th-largest city by Moody’s Investors Service and Standard & Poor’s to junk status. On Friday, Moody’s cut Stockton’s rating to Ba2 from Baa1 shortly after.

S&P distributed a news release Monday, saying they had dropped the city's issuer rating to BB from A-minus late on Friday. Both agencies kept the credit on watch for another downgrade.

Fitch Ratings doesn’t rate the city.

Moody’s also downgraded the city’s water enterprise bond rating to A3 from Aa3 out of concern that if the city council adopts the resolution Tuesday it could also trigger default on the bonds. It said it may trigger the bank backing the bonds with a letter of credit to buy the bonds and demand reimbursement.

The city said in a staff report that restricted funds wouldn’t be impacted by the decision.

Located in the Central Valley, the housing bust crushed the city of 290,000 residents during the recession. The city’s assessed property values dropped 19% in fiscal 2010 and then 5% in fiscal 2011.

As of the end of the year, Stockton unemployment rate stood at 15.9%, one of the highest in the nation, according to the U.S. Department of Labor.