New York and Illinois deals top Tuesday’s new issue slate as municipal bond traders get ready to gobble up some deals in the primary.

Secondary market

U.S. Treasuries were little changed on Tuesday. The yield on the two-year Treasury was unchanged from 1.69%, the 10-year Treasury yield was flat from 2.40% and the yield on the 30-year Treasury decreased to 2.86% from 2.87%.

Top-quality municipal bonds finished weaker on Monday. The yield on the 10-year benchmark muni general obligation rose one basis point to 1.99% from 1.98% on Friday, while the 30-year GO yield gained one basis point to 2.69% from 2.68%, according to the final read of Municipal Market Data's triple-A scale.

On Monday, the 10-year muni-to-Treasury ratio was calculated at 80.6% compared with 82.6% on Friday, while the 30-year muni-to-Treasury ratio stood at 92.6% versus 93.1%, according to MMD.

AP-MBIS 10-year muni at 2.292%, 30-year at 2.805%

The Associated Press-MBIS municipal non-callable 5% GO benchmark scale was mixed in early trading.

The 10-year muni benchmark yield rose to 2.292% on Tuesday from the final read of 2.290% on Monday, according to

The AP-MBIS benchmark index is a yield curve built on market data aggregated from MBIS member firms and is updated hourly on the

MSRB: Previous session's activity

The Municipal Securities Rulemaking Board reported 34,488 trades on Monday on volume of $7.62 billion.

Primary market

Ipreo estimates bond volume for the week at $9.897 billion, which consists of $6.644 billion of negotiated deals and $3.253 billion of competitive sales.

Barclays Capital is set to price the New York City Municipal Water Finance Authority’s $398.12 million of Fiscal 2018 Series CC water and sewer system second general resolution revenue bonds for institutions on Tuesday after holding a one-day retail order period.

The $338.44 million of Subseries CC-1 bonds were priced for retail as 3s to yield approximately 3.103% in 2037. A triple-split 2048 maturity was priced as 4s to yield 3.14% and as 5s to yield 2.86%; the last tranche was not offered to retail.

The $59.68 million of Subseries CC-2 bonds were priced for retail as 5s to yield 1.53% in a split 2024 maturity and 1.63% in a split 2025 maturity. The other halves of the 2034 and 2025 maturities were not offered to retail.

Proceeds from the sale will be used to fund capital projects and refund outstanding debt, the NYC MWFA said.

The deal is rated Aa1 by Moody’s Investors Service and AA-plus by S&P Global Ratings and Fitch Ratings.

On Tuesday, Citigroup is slated to price the Metropolitan Pier and Exposition Authority’s $475 million of McCormick Place expansion project and refunding bonds.

The issue is composed of Series 2017A bonds and Series 2017B and 2018A refunding bonds. The deal is rated BB-plus by S&P and BBB-minus by Fitch.

JPMorgan Securities is expected to price Norfolk, Va.’s $153.2 million of Series 2017A capital improvement bonds and Series 2017B taxable GO refunding bonds on Tuesday. The deal is rated Aa2 by Moody’s and AA-plus by S&P and Fitch.

Siebert Cisneros Shank is set to price Tallahassee, Fla.’s $115.17 million of Series 2017 consolidated utility systems refunding bonds on Tuesday. The deal is rated AA by S&P and AA-plus by Fitch.

In the competitive arena, Washington state will sell $505.81 million of Series R-2018C various purpose general obligation refunding bonds on Tuesday. The deal is rated Aa1 by Moody’s and AA-plus by S&P and Fitch.

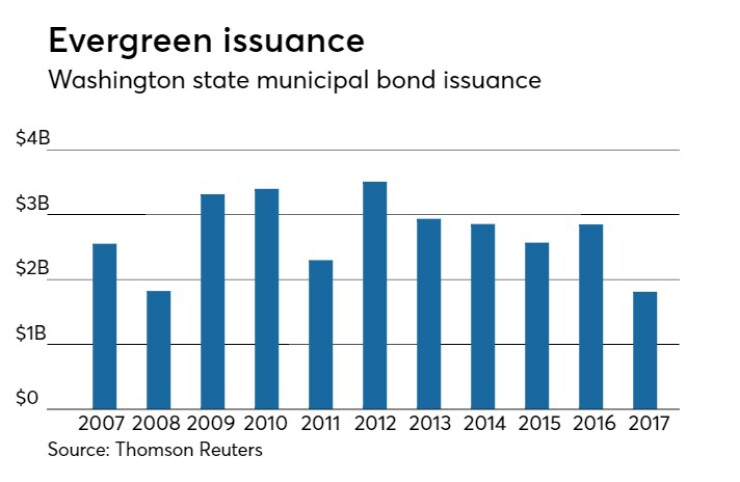

Since 2007, the Evergreen State has issued almost $30 billion of bonds, with the most issuance occurring in 2012 when it sold $3.51 billion of debt. Prior to this year, the state sold the least amount of bonds in 2008, when it issued $1.83 billion.

Also on Tuesday, Wisconsin is set to sell $277.71 million of Series 2017B GOs. The deal is rated AA by S&P and AA-plus by Fitch.

Bond Buyer reports 30-day visible supply

The Bond Buyer`s 30-day visible supply calendar increased $978.0 million to $10.38 billion on Tuesday. The total is comprised of $3.52 billion of competitive sales and $6.85 billion of negotiated deals.