The impact of eliminating tax deductions, adjusting individual tax brackets, and maintaining the tax-exemption for municipal bonds are all on the radar screen for buyside analysts these days.

President Trump's proposal to reduce the number of income tax brackets to three ranks high on their watch list, even though only a broad overview of the plan, with few specific details or a deadline, was released. The proposal included limiting personal income tax brackets to 35%, 25%, and 10%, but didn't specify the incomes associated with those brackets. And it didn't specify whether the loopholes being closed to pay for lower tax rates rates would include the tax exemption on municipal bond interest.

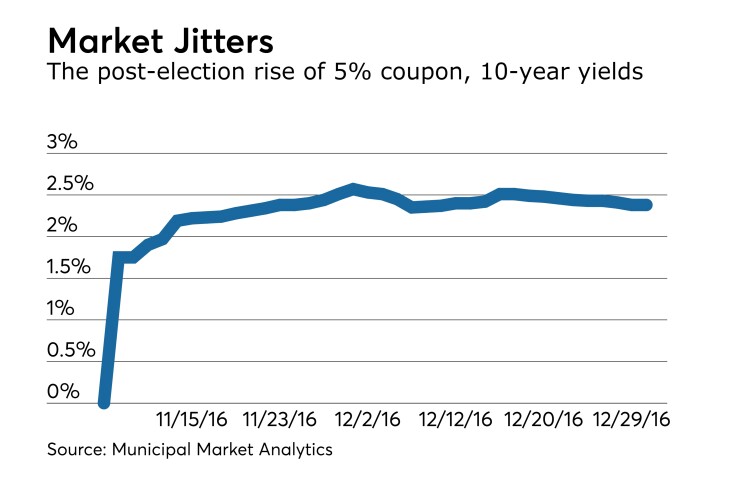

The muni market had slumped on tax reform concerns after Trump's unexpected election in November. Last week, some analysts were saying tax reform could be a positive.

“The fact that the top rate may only be going down to 35% — and that is accompanied by either a cap or elimination of certain deductions — you could see it be a net positive for munis,” speculated Dan Heckman, senior fixed income strategist at U.S. Bank Wealth Management.

With proposals calling for the elimination of many current and prior years’ tax deductions, “I think it makes the tax-exempt status of municipals more attractive,” Heckman said in a May 1 interview.

After Trump announced what he called the largest tax reform and reuduction in U.S. history, Heckman said the municipal market was behaving well, as it finished steady on April 27 — a day after the proposal was announced.

The yield on the 10-year benchmark general obligation bond was unchanged from 2.13% the previous day, while the 30-year GO yield was steady from 3.01%, according to the final read of Municipal Market Data's triple-A scale.

The 10-year muni to Treasury ratio was calculated at 92.8% on April 27, compared with 92.2% on Wednesday, while the 30-year muni to Treasury ratio stood at 101.4%, versus 101.3%, according to MMD.

In addition to modifying the income tax bracket structure, the tax reform proposal also calls for the doubling of the standard individual tax deduction, allowing individual filers to deduct their first $12,700 in income from their taxes, as opposed to the current $6,350 for individuals. Joint filers would be able to deduct the first $25,400 in income under the proposal.

“Maybe tax reform is not going to be as much of a negative for the municipal bond market as many people thought,” Heckman said.

John Mousseau, managing director at Cumberland Advisors in Vineland, N.J., said tax reform should simplify taxes, without radically changing the municipal landscape at all.

“We think that drop in marginal rates from 39.6% to 35% only takes you back to where we were under George W. Bush and before marginal tax rates were raised at the end of 2012,” he said in an April 26 interview.

“The elimination of some loopholes and deductions — like removing deductions for mortgage interest on second homes — will leave munis as the only game in town,” he added.

Mousseau recalled that the average tax rate for all municipal bond holders is 25%, so he said tax reform, overall, is a plus for municipals in the long term.

Mousseau said he expects municipal demand to pick up “with less obfuscation over things like AMT and the elimination of the other loopholes.”

Still, maintaining the tax-exemption of municipal bonds is a monumental concern for municipalities, bond holders, and the market, analysts said.

“With the exemption for municipals maintained [municipal bonds] would become more favorable,” Heckman said. “Any cap on muni interest comes at high income levels and depending on what type of cap and what levels it might not be as much of a negative as some people were expecting.”

He said municipalities “have come out strong against” eliminating tax-exemption, and will continue to put up a fight if that ends up becoming an issue under future proposals.

“They are not going to sit too comfortably with tinkering with that status and driving up their overall interest cost,” Heckman said of municipalities.

“They will have to pay higher interest to attract the same level of buyer, so I think there’ll be very strong opposition, as there was in previous years,” he said. “It’s very challenging from a political standpoint. Anything that would cause the cost of borrowing to go up, I don’t think has any political wind behind it.”

Other observers, including George Friedlander, a managing partner at Court Street Group Research LLC, believe there could be negative impacts from some of the tax reform proposal, even if the full value of municipals’ tax-exemption is maintained.

The proposed reduction of the maximum marginal tax rate for corporations by 60%, from 35% to 15%, as well as cutting the tax rate for individuals who receive their income as part of a pass-through business by nearly two-thirds, down to the same 15%, is concerning, he said in a weekly municipal perspective published on April 28 by the Brooklyn-based research and consulting firm.

Tax-exemption “would be worth far less under a tax regime in which corporations are only taxed at a federal rate of 15% on bond interest, and individuals are only taxed at a rate of no more than 16.5%,” Friedlander wrote. “Even if the tax-exemption is protected, a sharp reduction in the maximum tax rate on interest income would largely erode demand for municipal bonds, except at yields very close to corporate bond yields,” or those slightly higher than corporates on the long end when call and liquidity considerations are factor in, he said.

For instance, 10-year double-A muni general obligation yields would move from roughly 2.30% currently to more than 3.45% or as much as 115 basis points, according to Friedlander.

Also included in the proposed tax reform is the possible repeal of the alternative minimum tax, which Heckman said could also be viewed as positive.

This tax requires some people who have large numbers of deductions to calculate their income tax under the normal tax rate and the alternative and pay the higher amount.

While AMT brings relief to those who have deductions, with its possible removal included in Trump’s latest proposal, Heckman said tax payers “would not have any triggers for AMT. I see that as a wash out versus being an absolute negative for the municipal market.”

Mousseau said the elimination of the AMT will have those bonds “gapping up” as they no longer will be a preference item. “An ill-conceived rule devised by Congress 30 years ago will be given an appropriate burial,” he said of the AMT repeal.

Friedlander added that in the low likelihood that a proposal similar to the first draft gets enacted, the elimination of the AMT would also reduce tax collections by hundreds of billions of dollars.

However, Peter Block, managing director at Ramirez & Co., has been advocating AMT bonds.

Once the AMT is repealed, the bonds formerly subject to the AMT become standard tax-exempt bonds and will benefit from an instant price appreciation, he said.

“Currently any investor subject to the AMT must pay tax on interest received from AMT municipal bonds and the price on that bond reflects that fact,” Block explained. “If the AMT no longer exists, that investor — or any investor that subsequently buys that bond — will no longer owe tax on the interest on that bond’s interest payments.”

Since Treasury Secretary Steven Mnuchin and National Economic Council Director Gary Cohn announced the proposal to repeal the AMT as part of the broader tax reform plan, there has been evidence of modest spread tightening on the AMT market versus non-AMT paper, analysts at Court Street Group Research said in its weekly municipal report.

“If the minimum tax were to be eliminated, existing private activity bonds subject to the AMT would trade at the same yield levels as comparable non-AMT paper,” the report said.

At the same time, another important component of the proposed tax reform – and a major concern — calls for the elimination of state and local tax deductions, which can heavily impact municipalities, analysts said.

But the repeal of the AMT could possibly be fully or partially offset by the non-tax deductability of state and local taxes, Block suggested.

“If that happens, municipals issued in high-tax states, like New York, Connecticut, and New Jersey will be in even higher demand than they are now,” Block said.

Others, like Peter Delahunt, managing director of the municipal bond department at Raymond James & Associates, speculated that specialty states with higher taxes, such as New York and California, should trade at larger premiums — if state taxes are no longer deductible from federal taxes.

“You could see an increase in migration from New York to Florida and/or California to Washington or Texas,” Delahunt added.

Mousseau said the higher the marginal state tax rate the more onerous the tax on non-state exempt bonds’ income will be.

“At the margin this should slow the growth in state and local income taxes as they feel the full brunt of the tax and not 60% or 65%, which is currently the case when those taxes are deducted,” Mousseau said.

Friedlander said the issue is that the effective tax rate on taxable income at the state and local level would go from the “net” rate, after deducting on the Federal return, to the full level of the tax rate, if deductibility were

eliminated.

The change, according to Friedlander, would make residence in high-tax states that much more unattractive – particularly for high-income decision makers.

If talk of potential tax reform has impacted the municipal market in a notable way, it has been in limiting new issuance, according to Heckman.

It’s been "a little head wind for issuers coming to market not knowing what the final rules will be, and issuance has been down,” he said. “To some degree it’s made issuers kind of hesitant because of the outcome and uncertainty of some of these proposals,” Heckman said.

At the same time, he said, it's raised the pressure on municipalities to get issuance done ahead of any finalization of tax cuts and reform.

“As every day ticks by it’s less and less likely that personal income tax reform might become an event in 2017— but it might be an event in 2018,” Heckman said.

He believes uncertainty adds to the challenges of the proposal. “The devil is in the details,” he said.

Friedlander agreed, saying that the first draft of the proposal should hardly be used as a guideline for the future.

“We wouldn’t be focusing on the specifics of this bare-bones tax cut plan as a projection as to what tax reform will actually look like, when and if it occurs,” Friedlander wrote. “Without being able to measure this one-page tax ‘plan’ against actual revenue estimates, tax cuts this massive on both corporations and pass-through entities would inevitably raise dramatically lower amounts of tax revenues than the current tax system.”