DALLAS - The San Jacinto Community College District is coming to market today with the second tranche of a $295 million bond package voters overwhelmingly approved last year.

The Houston-area community college plans to offer $150 million of unlimited-tax bonds in a negotiated sale with Coastal Securities Inc. as lead manager. The underwriting syndicate includes Estrada Hinojosa & Co., Fidelity Capital Markets, Southwest Securities Inc., and Wells Fargo Brokerage Services LLC.

RBC Capital Markets Corp. is the district's financial adviser and Vinson & Elkins LLP is bond counsel.

David Tiffin, vice president at RBC, said favorable construction costs prompted officials to increase the size of this week's issue.

"The college decided to escalate the second phase of its expansion to take advantage of the recent declines in construction costs," he said. "So they're doing a little more in this phase and shoving the final issuance for the last phase of construction into early 2011."

Voters approved a $295 million bond referendum in May 2008. Tiffin said the final tranche from the bond package was initially expected to come to market sometime next year.

"There's certainly no reason for them not to revise and increase this bond sale. They're a good solid credit and these proceeds will allow for the completion of three allied health buildings," Tiffin said.

Moody's Investors Service assigned its Aa3 rating to the sale, citing the district's tax base composition, increased student enrollment, and strong financial performance.

Analysts expect the college district to "continue to generate positive financial performance as officials prudently trim expenditures to offset revenue shortfalls."

The district has increased its unrestricted net assets annually the past four years to $78.5 million at the end of 2008 from $42.4 million at the end of fiscal 2005, according to Moody's.

Standard & Poor's assigned a AA rating to this week's issue. Analysts said the district's credit strengths include participation in the Houston metropolitan area, a low tax rate, and sound financial position.

The district's taxable assessed value has climbed 37% the past four years to $39 billion for fiscal 2009, although officials project a 2% decline for next year, according to Standard & Poor's.

The Series 2009 bonds are structured as serials maturing in 2011 through 2039. A decision on bond insurance will be made just before pricing, according to Tiffin.

"We're going to take one last look at insurance Monday and make a decision," he said. "Although with the price of insurance being what it is right now, we may go out without it."

Proceeds from this offering will fund several projects outlined in the approved bond package, including new allied health and science buildings at each of the district's three campuses.

Teri Fowle, associate vice chancellor of marketing, said the college is looking to expand its allied health offerings, specifically surgical and vision-care technology classes. Additional bond funding will be used to upgrade libraries and renovate classrooms and laboratories at each campus.

Fowle said enrollment continues to climb as more and more students look to enhance their professional skills and technical training during the current tough job market.

The student population at the district's three schools was about 25,600 in the fall of 2008, which is 13.3% higher than five years earlier and excludes continuing education students.

"And the summer head count of 11,146 is 10.1% higher than last summer," Fowle said.

Tiffin said he has continually seen an uptick in enrollment at community colleges in times of a recession during his more than 40 years in public finance.

"There's an elevated interest in community colleges with the economy being what it is," he said. "People tend to look to increase their education and skills to prepare themselves better when the economy turns around, and community colleges fit that niche."

Earlier this month, the National Association for College Admission Counseling reported that 37% of high schools surveyed "indicated an increase in the number of students planning to enroll in community colleges versus four-year colleges."

"The potential effects of the economy loomed large over this admission cycle," according to Joyce Smith, the chief executive officer of the Arlington, Va.-based organization.

"It appears that students and families were more concerned about cost, and plans about whether or where to enroll were changed as a result. The colleges' experience this year is more difficult to generalize, though budget cuts and declining yield rates are indicative of a tougher year at many institutions," Smith said in a press release.

San Jacinto Community College provides classes required for students interested in continuing their education at a four-year university but focuses on technical and scientific training for large industries in the Houston area. The district offers more than 140 technical programs from nursing to aerospace to petrochemicals.

The three campuses are all in southeastern Harris County close to NASA's Johnson Space Center, the Texas Medical Center, and numerous petrochemical and maritime companies along the Houston Ship Channel.

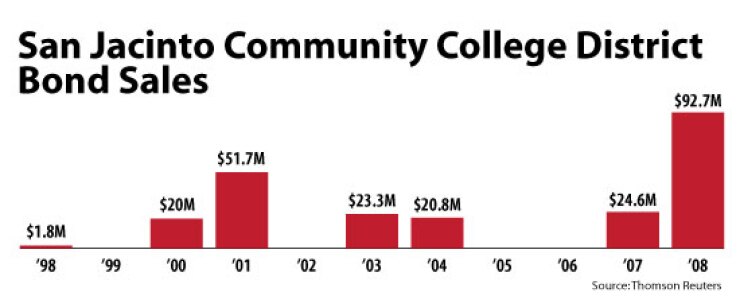

The district was established in 1961 with a single campus. Bonds were sold in 1972 to build the second campus and again in 1976 to build the third one. Voters approved a $91 million bond package for the district in 1999, proceeds of which financed construction of six buildings and major infrastructure projects.