Individual investors haven’t been themselves lately. The retail crowd has been scaling back direct ownership of municipal bonds amid growth of managed product alternatives in recent years, a trend that's been exacerbated by market volatility.

“Household sector holdings — direct retail and separately-managed accounts (SMAs) — for the most part are shown by the Fed to have quite literally collapsed,” George Friedlander, managing partner at Court Street Group Research LLC, wrote in a March 16 weekly municipal perspective.

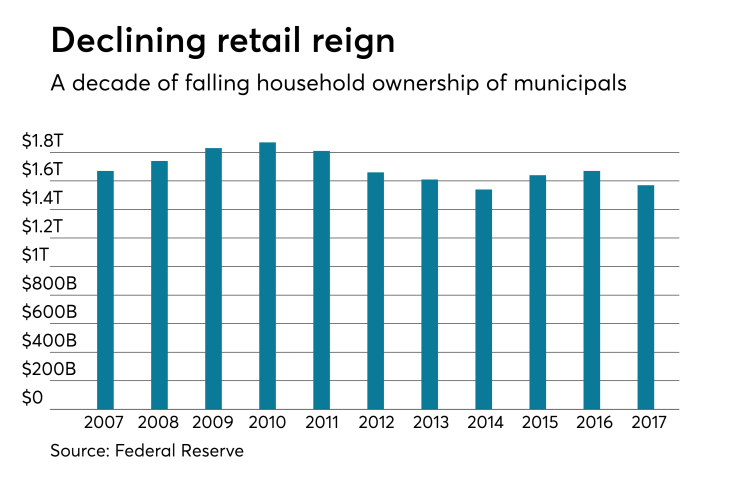

Friedlander cited the year-end Fed Flow of Funds report, released March 8, that showed household ownership fell by $103 billion to $1.570 trillion at the end of 2017, from $1.673 trillion at the end of 2016. According to the Fed’s latest figures, households own 40.7% of the outstanding debt in the $3.8 trillion municipal market.

Declining volume and rising interest rates, as well as low yields and tbe overhaul of tax laws that just took effect have kept retail investors largely on the sidelines for most of 2018.

But analysts said they noticed the pullback long before 2017.

“Since the financial crisis, the percentage of individual buyers of municipals has dwindled and has given way to more professionally-managed retail buyers institutionally,” said Howard Mackey, managing director of NW Financial Group said.

The collapse of the triple-A bond insurance market following the financial crisis added to the fall, he noted.

“Without insurance a lot of individuals were reluctant to make purchase decisions” over nearly the last decade, he said.

“Now that you don’t have that credit assurance in the market a lot of individual buyers have turned over their credit decisions and purchases to professionals through SMAs and private wealth management groups,” Mackey said.

Rethinking Rates

Since many of the retail crowd’s investment choices are dictated by current and future interest rates, their direct ownership of municipals fluctuates, analysts said.

In his report, Friedlander questioned whether the household category’s reign as the most dominant holder of municipal debt is slowly disappearing -- or already over -- largely due to recent ongoing market uncertainty and interest rate volatility.

He said of particular concern currently is the anticipated continued increase in short term rates.

“While we do not expect Fed funds to have to be pushed up too sharply from the current 1.25% to 1.50% level, the market consensus has priced in roughly four more hikes, or up to the 2.25% to 2.50% range,” he wrote.

“We expect retail investors to be wary of lengthening maturities while this pattern is ongoing, even as they get paid somewhat better for staying relatively short,” Friedlander's report continued. “We are also concerned that chaotic economic policy in Washington, such as the risk of a trade war, could keep retail investors relatively short in average maturity for a while.”

Friedlander suggests direct retail buyers will continue to prefer bonds in the short to intermediate range — when and if they do buy.

“We have seen no evidence, as yet, that individuals are willing to move out along the yield curve, for the most part staying inside 10 years, plus a smaller amount of long ‘yield’ paper,” he wrote.

Low yields may have triggered this pattern, according to Friedlander, and the trend has solidified because of concerns over Fed tightening. “If those concerns subside, we may see some more longer direct retail buying,” he wrote.

In the meantime, he believes their distance from direct ownership of munis has not only led to a drastic decrease in household ownership over the last year, but also a decade long decline from historically higher levels.

Household ownership has been noticeably declining since 2010, Friedlander pointed out, when it was as high as $1.871 trillion. He believes the $302 billion decrease is hard to ignore.

The Fed itself outlined a decade long decline in direct household holdings of municipals in a separate 2017 report.

The Central Bank data indicated that direct retail holdings by households declined over a 10-year period to $1.5 trillion in 2016 from $1.6 trillion in 2006. The household category includes individual holdings of municipal bonds, as well as hedge fund holdings of municipal securities, which are not separated by the Federal Reserve in its calculations, that report said.

“This decline may reflect the move to ownership of municipal securities through mutual funds and exchange-traded funds, and may also reflect a decrease in demand for individual securities caused by a prolonged period of low interest rates,” the 2017 Fed report said.

Friedlander believes the year-over-year -- and decade long -- data indicates that retail has lost its footing as the top holder of municipal bonds.

Scarce Supply

Other analysts, meanwhile, believe overall retail demand for individual municipal bonds is still inherently strong, but has been hard to recognize lately due to uncertain market conditions, such as low supply and a lengthy period of rate volatility, among other concerns.

While it’s true that retail demand has been somewhat muted lately, retail participation is being largely curtailed by the low volume, according to Pete Stare, managing director at Hilltop Securities Inc. in Dallas.

“Professional retail, like SMAs and trust departments, are being choosy, but buying,” he said, pointing to their participation in a few select large issues that surfaced in the last two weeks.

“The biggest problem with the market is we have had such little volume we really haven’t had enough to test the impact of the new tax reform on investors,” Stare said in an interview.

The lowering of the top tax bracket to 37% from 39.6% has decreased the attractiveness of municipal bonds and dampened demand among high-net-worth investors, other analysts said.

With volume so spotty lately — such as the less than $3 billion in new issues that arrive in the week of March 19 — there is little for the buy side to focus on, Stare added.

Institutional demand isn’t necessarily dominating the market either, he noted.

“It’s really a combination” of retail and institutional activity in the market, but it’s sporadic depending on supply, Stare said. “It’s more or less buy by appointment -- depending on transaction,” he continued.

Contributing Factors

Friedlander and other analysts said there are still many reasons that direct retail ownership tumbled from its historic highs — and may continue to decline.

Besides the direction of interest rates, other circumstances, like low reinvestments and low yields, are also contributing to the decline, they said.

“A large portion of the reduction isn’t from the sale of munis, but from the fact that a large proportion of retail holdings are old paper with imminent calls, or relatively short maturities,” Friedlander said in his report. “These holdings continue to roll off to bond calls and maturities.” However, the roll-offs are not being replaced as they historically were, and that restrains new demand, according to Friedlander.

Direct retail investment in municipals may be continuing to fall faster than total household sector flows suggest, due to the transition of many financial advisors away from giving advice on individual securities and toward encouraging investors to move assets into SMAs, Friedlander said in his report.

“SMA data is difficult to aggregate,” he wrote, “but we continue to believe that a portion of total household sector assets is moving toward them.”

“Given the SMA tendency to use laddered maturities that end no longer than 10 years, increased use of SMAs does not support the longer intermediate range, where demand remains spotty,” he added.

Besides an aversion to interest rate risk, the use of fixed income assets in retirement accounts as a part of a total portfolio, and, to a degree the boom in equity prices, are also impacting the decline of direct household ownership, according to Friedlander.

Potential increase in demand

While analysts agree direct ownership by households has been lackluster lately — some say the households are still a major holder of tax-exempt debt — and could be poised to increase ownership under certain future improving market, legislative, and rate conditions.

For instance, pending legislative developments could boost demand for municipals, Peter Block, managing director of credit research at Ramirez & Co. suggested in his weekly municipal report on March 19.

As part of a broader banking bill, the Senate recently voted 67 to 31 to include municipals as “level 2B” high-quality liquid assets — HQLA — toward a bank’s liquidity coverage ratio, or LCR.

“Should the House pass the Senate bill, or at least the muni HQLA provision, this is clearly a positive demand-side catalyst for the muni market,” Block wrote.

He described banks as collectively the “distant number two” holder of municipals at $571 billion, or 15% of all bonds outstanding as of Dec. 31, with individuals holding approximately 41%, and the remainder by other investor categories.

Stare of Hilltop said increased volume and investor-friendly credits should be positives for the market.

For example, new essential service revenue bonds have recently appealed to conservative investors for their strong credit quality, while airport offerings are of more interest to total return buyers because they provide more incremental yield.

“More supply will bring better participation from all sectors of the market,” Stare said.

Despite the recent obstacles potentially reducing direct retail ownership of municipals, Friedlander believes their reign could resurface if rates moved “appreciably higher.”

“But for now," he wrote, "this isn’t your grandfather’s retail-dominated investment space."